Victorias Milling Co. Inc. (VMC) saw its net income increase by 13.6% in its first fiscal quarter, reaching P368 million, despite a 13% drop in consolidated revenues. The company attributed the revenue decline to a delayed milling season, but noted that increased revenue share from ethanol and power generation, along with higher sugar and ethanol prices, partially offset the decrease.

Victorias Milling Co. Inc. ( VMC ) reported a 13.6 percent surge in net income for its fiscal first quarter ending November 30, 2024, reaching P368 million compared to P323.8 million in the same period last year. Despite this positive performance, the company experienced a 13 percent decline in consolidated revenues to P2.51 billion from P2.89 billion a year earlier. VMC attributed this revenue drop to the delayed start of the milling season, which resulted in a lower quantity of sugar sold.

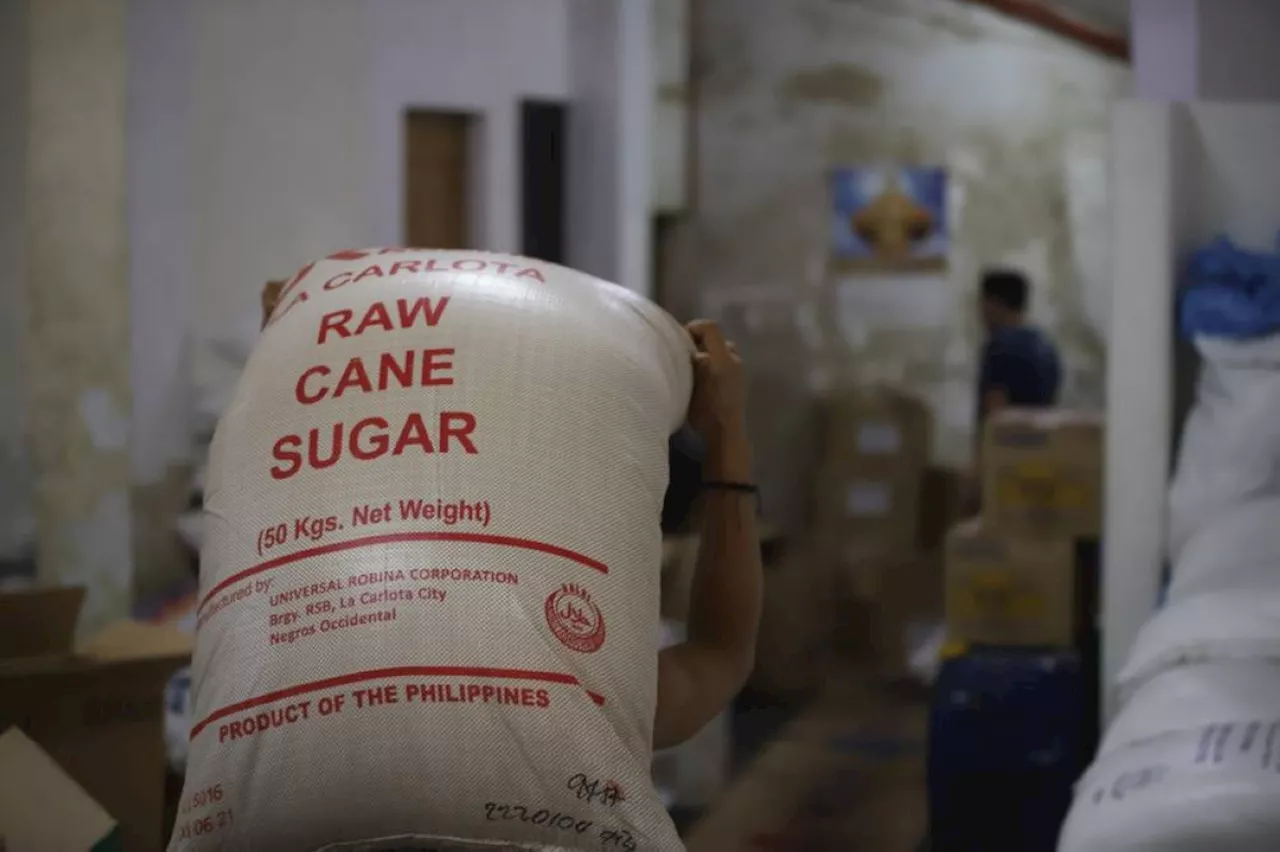

However, the company noted that the decrease in revenue was partially offset by an increase in revenue share from ethanol and power generation, along with a slight increase in sugar and ethanol prices compared to the previous year. VMC highlighted that the increase in other income was primarily driven by factors such as power feed-in tariff rate differentials, storage, handling, and insurance fees generated from the previous crop year's production, and foreign currency gains.Breaking down the performance by segment, net income from sugar milling operations decreased by 14.96 percent to P182.96 million from P210.3 million, while revenues dropped 25.3 percent to P1.82 billion from P2.44 billion. Net income from distillery operations also fell to P102.04 million from P134.98 million a year earlier. Conversely, VMC's power generation segment reported a swing to a net income of P113.19 million, reversing the net loss of P1.94 million the previous year. Other income also turned positive with a profit of P65.75 million compared to a net loss of P23.13 million in the same period last year. VMC attributed the positive performance in the quarter to sales of raw sugar, ethanol, power, and molasses. Raw sugar sales reached P1.17 billion from P1.21 billion, while ethanol sales rose to P498.34 million from P439.56 million. Power sales surged to P170.94 million from P81,000 a year earlier. However, this was offset by a significant drop in refined sugar sales to P49.26 million from P326.3 million. Sales of molasses and other products contributed P2.65 million and P23.25 million, respectively. Services income slumped to P170.94 million from P900.79 million. VMC shares last traded at P2.00 each on Tuesday

VMC Victorias Milling Co. Inc. Net Income Revenue Sugar Ethanol Power Generation Philippines

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

SMC Tollways Net Income Rises 13% in First 9 Months of 2024SMC Tollways Corp. reported a 13% increase in net income for the first nine months of 2024, driven by higher vehicle traffic. Revenue also grew by 5% compared to the same period in 2023.

SMC Tollways Net Income Rises 13% in First 9 Months of 2024SMC Tollways Corp. reported a 13% increase in net income for the first nine months of 2024, driven by higher vehicle traffic. Revenue also grew by 5% compared to the same period in 2023.

Read more »

SMC Tollways Net Income Up 13% in First Nine Months of 2024SMC Tollways Corp. reported a 13% increase in net income during the first nine months of 2024, attributed to higher vehicle traffic across its expressway network.

SMC Tollways Net Income Up 13% in First Nine Months of 2024SMC Tollways Corp. reported a 13% increase in net income during the first nine months of 2024, attributed to higher vehicle traffic across its expressway network.

Read more »

PTFC Redevelopment Corp. Reports 14.89% Rise in Net IncomePTFC Redevelopment Corp., a listed leasing firm, experienced a 14.89% increase in net income during the first quarter of its fiscal year. This growth was driven by higher occupancy and average lease rates, leading to a 16% rise in revenues.

PTFC Redevelopment Corp. Reports 14.89% Rise in Net IncomePTFC Redevelopment Corp., a listed leasing firm, experienced a 14.89% increase in net income during the first quarter of its fiscal year. This growth was driven by higher occupancy and average lease rates, leading to a 16% rise in revenues.

Read more »

Philippines Posts $2.3 Billion Balance of Payments Deficit in November 2024The Philippines recorded a $2.3 billion balance of payments (BOP) deficit in November 2024, a significant jump from the $216 million deficit in the same month last year. The Bangko Sentral ng Pilipinas (BSP) attributed the deficit to the national government's foreign currency withdrawals to settle debt obligations and expenditures, as well as the BSP's net foreign exchange operations. Despite the November deficit, the cumulative BOP position from January to November 2024 still showed a surplus of $2.1 billion. Lower net receipts from trade in services and government net foreign borrowing contributed to the decline in the cumulative surplus. However, this was partially offset by continued net inflows from personal remittances, foreign portfolio investments, and direct investments. The BOP position resulted in a decrease in the gross international reserves (GIR) to $108.5 billion as of end-November 2024, from $111.1 billion at the end of October 2024. Despite the decrease, the GIR still provides a more than adequate external liquidity buffer equivalent to 7.7 months' worth of imports and payments of services and primary income.

Philippines Posts $2.3 Billion Balance of Payments Deficit in November 2024The Philippines recorded a $2.3 billion balance of payments (BOP) deficit in November 2024, a significant jump from the $216 million deficit in the same month last year. The Bangko Sentral ng Pilipinas (BSP) attributed the deficit to the national government's foreign currency withdrawals to settle debt obligations and expenditures, as well as the BSP's net foreign exchange operations. Despite the November deficit, the cumulative BOP position from January to November 2024 still showed a surplus of $2.1 billion. Lower net receipts from trade in services and government net foreign borrowing contributed to the decline in the cumulative surplus. However, this was partially offset by continued net inflows from personal remittances, foreign portfolio investments, and direct investments. The BOP position resulted in a decrease in the gross international reserves (GIR) to $108.5 billion as of end-November 2024, from $111.1 billion at the end of October 2024. Despite the decrease, the GIR still provides a more than adequate external liquidity buffer equivalent to 7.7 months' worth of imports and payments of services and primary income.

Read more »

Ariana Grande posts new photo with Ethan Slater, Jeff GoldblumLatest Philippine news from GMA News and 24 Oras. News, weather updates and livestreaming on Philippine politics, regions, showbiz, lifestyle, science and tech.

Ariana Grande posts new photo with Ethan Slater, Jeff GoldblumLatest Philippine news from GMA News and 24 Oras. News, weather updates and livestreaming on Philippine politics, regions, showbiz, lifestyle, science and tech.

Read more »

Philippine Government Refines Aid Program for Low-Income EarnersThe Philippine government is taking steps to improve the Ayuda Para sa Kapos ang Kita Program (AKAP) to provide more targeted assistance to those most affected by inflation.

Philippine Government Refines Aid Program for Low-Income EarnersThe Philippine government is taking steps to improve the Ayuda Para sa Kapos ang Kita Program (AKAP) to provide more targeted assistance to those most affected by inflation.

Read more »