Chastened Economists Hopeful for US Soft Landing, Fed Rate CutsZimbabwe Rescues All 15 Trapped Miners Alive: Mines MinisterCanada job gains miss forecast, jobless rate steady at 5.8%Expect 2024 downturn followed by a rate-cut rebound: economistsU.S

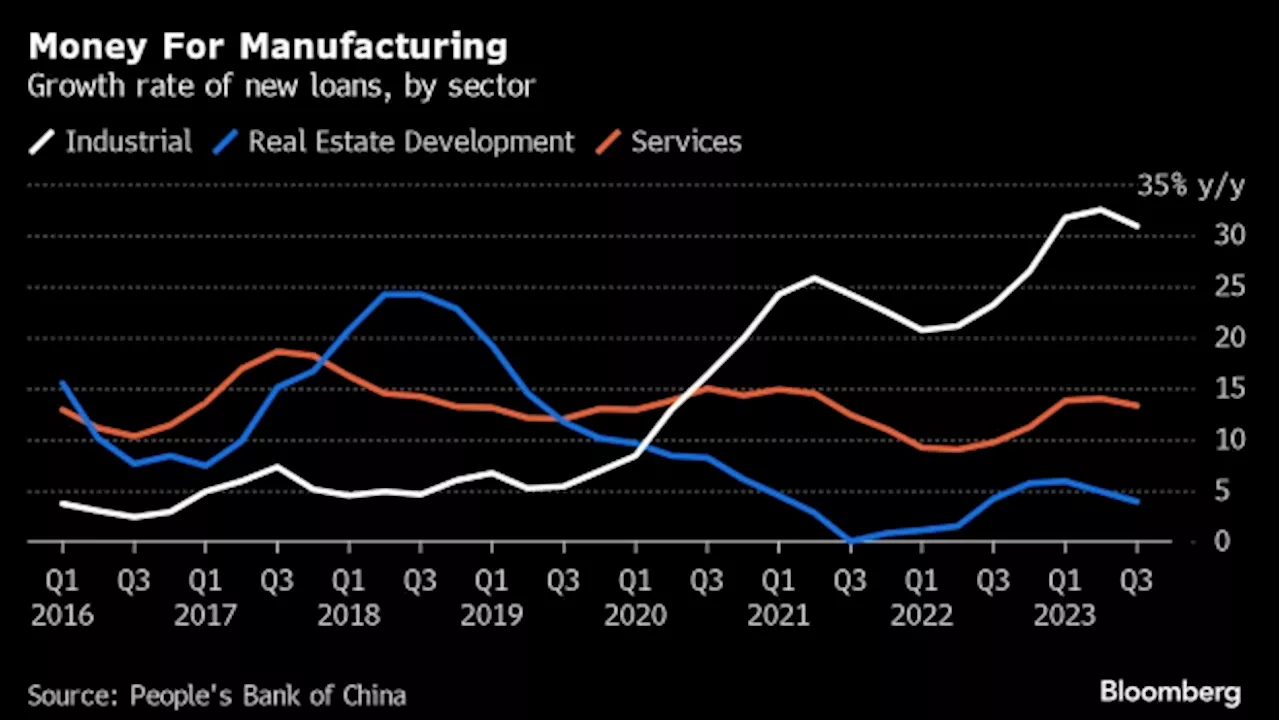

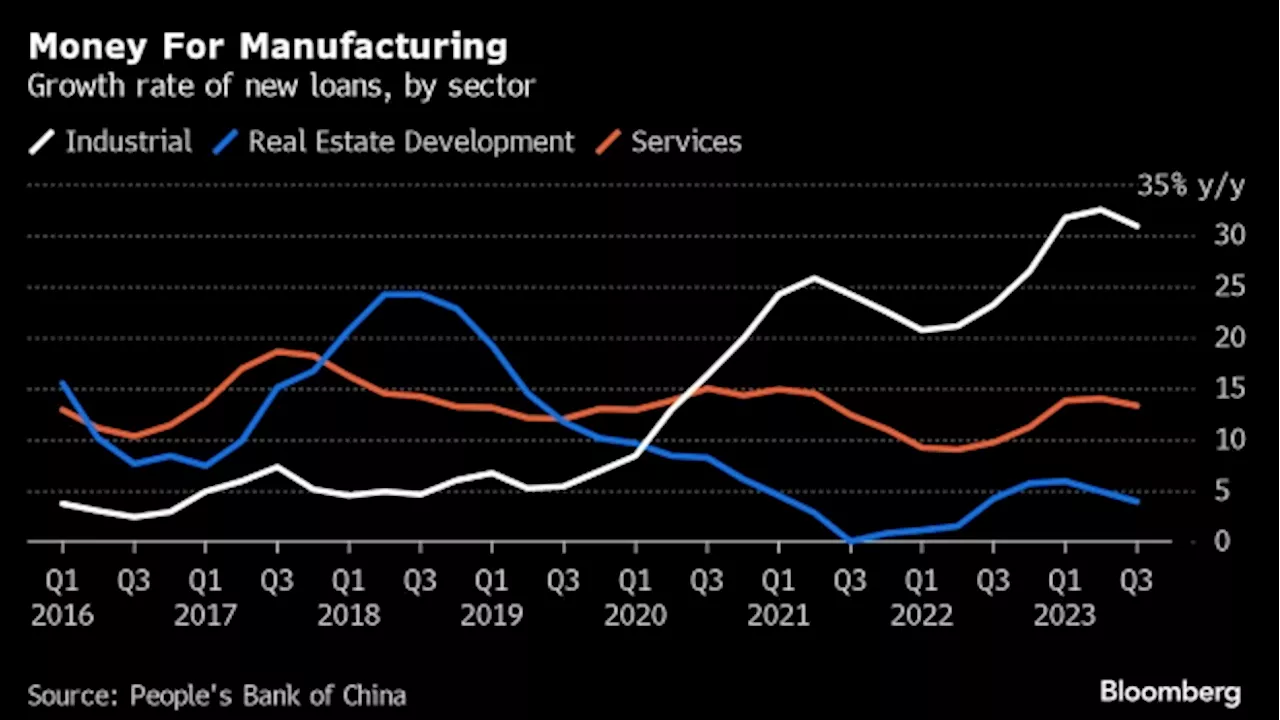

Xi’s Solution for China ’s Economy Risks Triggering New Trade War Chastened Economists Hopeful for US Soft Landing , Fed Rate Cuts Zimbabwe Rescues All 15 Trapped Miners Alive: Mines Minister Canada job gains miss forecast, jobless rate steady at 5.

8%Expect 2024 downturn followed by a rate-cut rebound: economistsU.S

Xi China Trade War Economists US Soft Landing Fed Rate Cuts Zimbabwe Miners Canada Job Gains Jobless Rate 2024 Downturn Rate-Cut Rebound

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Canada's Economy Shows No Growth in OctoberCanada's GDP remained unchanged at 0.0% in October, disappointing analysts' expectations of 0.2% growth. The economy has been stagnant for three consecutive months, and advance estimates for November show a slight increase of 0.1%. However, experts predict that the economy will continue to struggle and may even enter a mild recession.

Canada's Economy Shows No Growth in OctoberCanada's GDP remained unchanged at 0.0% in October, disappointing analysts' expectations of 0.2% growth. The economy has been stagnant for three consecutive months, and advance estimates for November show a slight increase of 0.1%. However, experts predict that the economy will continue to struggle and may even enter a mild recession.

Read more »

Stocks Largely Unchanged Amid Shortened Trading WeekStocks were largely unchanged on Wednesday amid a shortened week of trading and few major catalysts to drive market action. The S&P 500 neared an all-time high record close of 4,796 on Wednesday. The benchmark average and the tech-heavy Nasdaq Composite were barely in positive territory. Meanwhile, the Dow Jones Industrial Average (DJIA) closed slightly lower. For the year, all three major averages are up double digits. The S&P 500 has risen more than 24% while the Dow Jones is up over 13%. The Nasdaq has led gains, adding about 44% thus far this year. As of Wednesday afternoon, the S&P 500 is headed for its ninth straight week of increases, which would mark its best run since 2004. The major average has gained nearly 13% since Nov. 1. The surge higher in stocks over the past two months has come as investors have increased bets that the Federal Reserve will cut interest rates in March and inflation falls closer to the central bank's 2% target with few signs that the US economy is set for a full-on slowdown.

Stocks Largely Unchanged Amid Shortened Trading WeekStocks were largely unchanged on Wednesday amid a shortened week of trading and few major catalysts to drive market action. The S&P 500 neared an all-time high record close of 4,796 on Wednesday. The benchmark average and the tech-heavy Nasdaq Composite were barely in positive territory. Meanwhile, the Dow Jones Industrial Average (DJIA) closed slightly lower. For the year, all three major averages are up double digits. The S&P 500 has risen more than 24% while the Dow Jones is up over 13%. The Nasdaq has led gains, adding about 44% thus far this year. As of Wednesday afternoon, the S&P 500 is headed for its ninth straight week of increases, which would mark its best run since 2004. The major average has gained nearly 13% since Nov. 1. The surge higher in stocks over the past two months has come as investors have increased bets that the Federal Reserve will cut interest rates in March and inflation falls closer to the central bank's 2% target with few signs that the US economy is set for a full-on slowdown.

Read more »

Menopause Advocacy Gains Momentum in CanadaAdvocates in Canada are hopeful that the increasing mainstream attention on menopause could drive progress in health care and workplaces to better support women in this difficult stage of life.

Menopause Advocacy Gains Momentum in CanadaAdvocates in Canada are hopeful that the increasing mainstream attention on menopause could drive progress in health care and workplaces to better support women in this difficult stage of life.

Read more »

S&P 500 Calls for 2024 Reflect Limited Increase for StocksMany strategists' S&P 500 calls for 2024 already reflect a limited increase for stocks next year. The median target among the 20 Wall Street strategists tracked by Bloomberg shows the benchmark index finishing 2024 at 4,850, less than 2% higher than where the benchmark closed 2023. Strategists at Goldman Sachs already boosted their 2024 target to reflect the recent run-up in stocks and the shift to a more dovish Fed., with year-end targets of 5,200 for the S&P 500, reflecting about 9% upside from the 2023 close. Meanwhile, the lowest call on the Street for 2024 isthat the S&P will sink to 4,200, which would mark a 12% decline for the benchmark index in 2024.Those that either see the economy not entering a recession at all, or believe that outcome has been talked about so much it won't entail much impact for stocks, predict the S&P 500 hits at least 5,000 in 2024. That camp includes firms like Oppenheimer, Fundstrat, Goldman Sachs, Deutsche Bank, and Bank of America. and causes mass hysteria over it

S&P 500 Calls for 2024 Reflect Limited Increase for StocksMany strategists' S&P 500 calls for 2024 already reflect a limited increase for stocks next year. The median target among the 20 Wall Street strategists tracked by Bloomberg shows the benchmark index finishing 2024 at 4,850, less than 2% higher than where the benchmark closed 2023. Strategists at Goldman Sachs already boosted their 2024 target to reflect the recent run-up in stocks and the shift to a more dovish Fed., with year-end targets of 5,200 for the S&P 500, reflecting about 9% upside from the 2023 close. Meanwhile, the lowest call on the Street for 2024 isthat the S&P will sink to 4,200, which would mark a 12% decline for the benchmark index in 2024.Those that either see the economy not entering a recession at all, or believe that outcome has been talked about so much it won't entail much impact for stocks, predict the S&P 500 hits at least 5,000 in 2024. That camp includes firms like Oppenheimer, Fundstrat, Goldman Sachs, Deutsche Bank, and Bank of America. and causes mass hysteria over it

Read more »

Gold Prices Slightly Higher, Silver Prices Slightly Lower in Midday TradingGold prices are slightly higher and silver prices slightly lower in midday U.S. trading Tuesday. Quieter, post-holiday trading is featured. Bullish charts are prompting some mild speculator buying interest in both precious metals. The key outside markets were also bullish for the metals today, as the U.S. dollar index was modestly weaker and crude oil prices were solidly higher. Some profit-taking from the shorter-term futures traders did limit gains in gold and silver today. February gold was last up $1.70 at $2,070.60. March silver was last down $0.07 at $24.50. Asian and European stock markets were mixed overnight. U.S.

Gold Prices Slightly Higher, Silver Prices Slightly Lower in Midday TradingGold prices are slightly higher and silver prices slightly lower in midday U.S. trading Tuesday. Quieter, post-holiday trading is featured. Bullish charts are prompting some mild speculator buying interest in both precious metals. The key outside markets were also bullish for the metals today, as the U.S. dollar index was modestly weaker and crude oil prices were solidly higher. Some profit-taking from the shorter-term futures traders did limit gains in gold and silver today. February gold was last up $1.70 at $2,070.60. March silver was last down $0.07 at $24.50. Asian and European stock markets were mixed overnight. U.S.

Read more »

Xi’s Solution for China’s Economy Risks Triggering New Trade WarChastened Economists Hopeful for US Soft Landing, Fed Rate CutsZimbabwe Rescues All 15 Trapped Miners Alive: Mines MinisterCanada job gains miss forecast, jobless rate steady at 5.8%Expect 2024 downturn followed by a rate-cut rebound: economistsU.S

Xi’s Solution for China’s Economy Risks Triggering New Trade WarChastened Economists Hopeful for US Soft Landing, Fed Rate CutsZimbabwe Rescues All 15 Trapped Miners Alive: Mines MinisterCanada job gains miss forecast, jobless rate steady at 5.8%Expect 2024 downturn followed by a rate-cut rebound: economistsU.S

Read more »