Daily roundup of research and analysis from The Globe and Mail’s market strategist Scott Barlow

Retail sales data is arguably the most important for the Canadian economy as it will provide the initial indicator that higher interest rates are starting to bite consumers. The most recent results announced Wednesday were much weaker than expected as CIBC economist Katherine Judge reports,

“Canadian consumers ended the second quarter on a cautious note, and unlike their American cousins, don’t seem to be rushing to the stores at the start of Q3. Retail sales rose by only 0.1% in June, and that modest increase was entirely driven by autos, some of which might have been ordered months ago, as non-auto sales were down by 0.8%. That compared to the consensus expectation of 0.0% and 0.3% for total and ex. auto sales, respectively.

“During the last 30 years, meanwhile, globalization has prompted many businesses to shift investment from their home to cheaper overseas locations. As a result, the net borrowings of US nonfinancial corporations, which averaged 3.44 per cent of GDP from 1970 to 1985, have dropped to an average of just 0.74 per cent of GDP since then.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

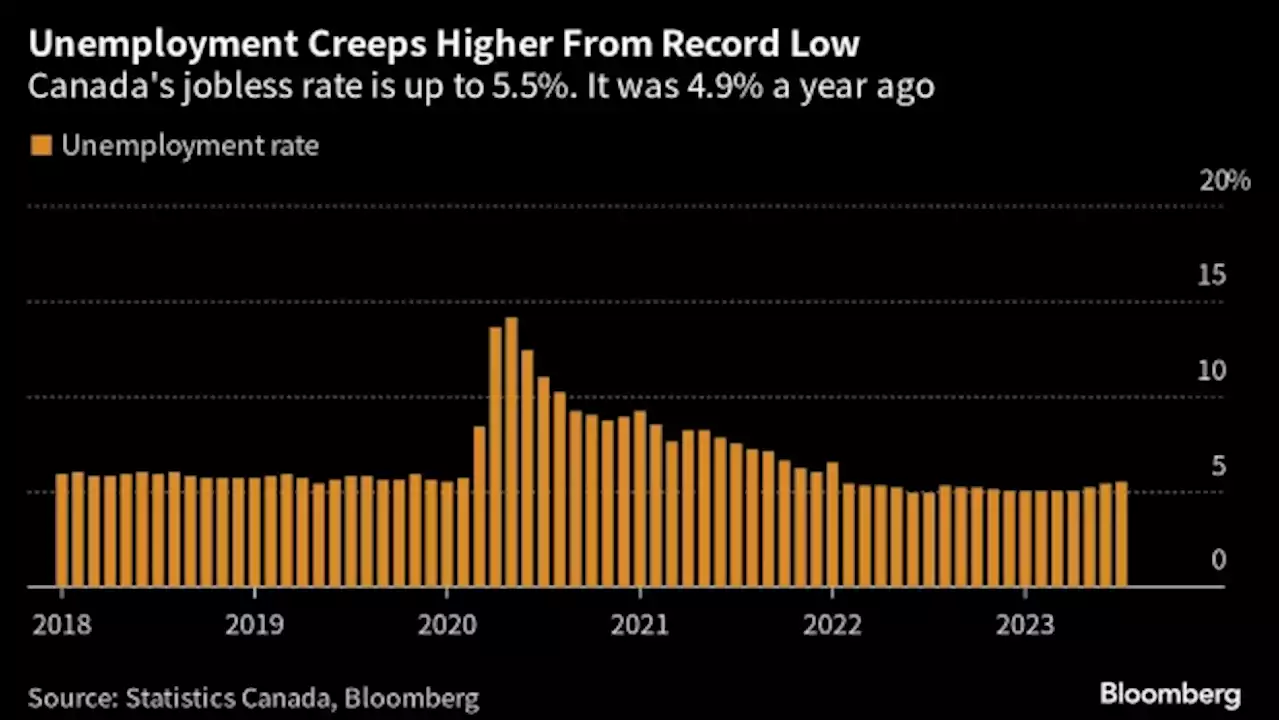

Labour market key for Bank of Canada interest rate decisions: CIBCIndicators, including unemployment, job vacancy rates and wage growth, could show whether the job market is in excess demand or supply.

Labour market key for Bank of Canada interest rate decisions: CIBCIndicators, including unemployment, job vacancy rates and wage growth, could show whether the job market is in excess demand or supply.

Read more »

Softer Jobs Data Points to Lower Interest Rates in Early 2024, CIBC SaysThe Bank of Canada is likely to place more weight on the weakening state of the labor market in its coming rate decisions, opening the door to cuts early next year, according to economists at CIBC.

Softer Jobs Data Points to Lower Interest Rates in Early 2024, CIBC SaysThe Bank of Canada is likely to place more weight on the weakening state of the labor market in its coming rate decisions, opening the door to cuts early next year, according to economists at CIBC.

Read more »

David Rosenberg: The Canadian economy is mired in weak fundamentals and investors are taking noteAnother BoC rate hike would be beyond nutty given an economy heading into a deep freeze

David Rosenberg: The Canadian economy is mired in weak fundamentals and investors are taking noteAnother BoC rate hike would be beyond nutty given an economy heading into a deep freeze

Read more »

Premarket: Weak European data hits euro, lifts bondsMarkets await Nvidia results, Fed chair Jerome Powell’s Jackson Hole speech

Premarket: Weak European data hits euro, lifts bondsMarkets await Nvidia results, Fed chair Jerome Powell’s Jackson Hole speech

Read more »

Canada June retail rise a notch on autos but trend is weakBy Steve Scherer and Dale Smith OTTAWA (Reuters) - Canadian June retail sales grew by 0.1% from the previous month driven mostly by car sales, data ...

Canada June retail rise a notch on autos but trend is weakBy Steve Scherer and Dale Smith OTTAWA (Reuters) - Canadian June retail sales grew by 0.1% from the previous month driven mostly by car sales, data ...

Read more »

Yen’s Too Weak and Benefits Are Waning, Japan Bourse Chief SaysThe yen is too weak and its benefits for Japanese stocks are diminishing while negative economic side effects are starting to show, according to the chief of the nation’s stock exchanges.

Yen’s Too Weak and Benefits Are Waning, Japan Bourse Chief SaysThe yen is too weak and its benefits for Japanese stocks are diminishing while negative economic side effects are starting to show, according to the chief of the nation’s stock exchanges.

Read more »