Markets await Nvidia results, Fed chair Jerome Powell’s Jackson Hole speech

Weak European economic data sent the euro lower and sparked a bounce in bond and share markets on Wednesday, as investors also awaited results from tech darling Nvidia later to see if the sector’s lofty valuations still look justified.

“There’s many indicators that suggest that we could have had the last hike but if you just look at inflation, which is the key mandate... that is not a done deal,” he added. Its shares hit an all-time high of $481.87 on Wall Street on Tuesday, with options data showing traders are expecting a larger-than-usual swing in shares after the quarterly results which will be published later.

Data there showed factory activity shrank for a third straight month in August, offering the first glimpse into the health of global manufacturing this month. The United States will also report its flash PMI readings on Wednesday, which is likely to show the factory sector remained in contraction. Wall Street futures also pointed to a bounce having been pressured on Tuesday by higher bond yields, which hit 16-year highs. The Dow Jones fell 0.5%, the S&P 500 lost 0.3% and the Nasdaq Composite added 0.1%.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Premarket: Global stocks extend comeback, U.S. yields hit new peaksU.S. dollar pulls back from recent 10-week highs

Premarket: Global stocks extend comeback, U.S. yields hit new peaksU.S. dollar pulls back from recent 10-week highs

Read more »

South Africa’s Thungela Sees 69% Profit Drop on Weak Coal PricesSouth African coal exporter Thungela Resources Ltd. saw profits plunge by 69% in the first half of the year on weaker coal prices and logistical constraints.

South Africa’s Thungela Sees 69% Profit Drop on Weak Coal PricesSouth African coal exporter Thungela Resources Ltd. saw profits plunge by 69% in the first half of the year on weaker coal prices and logistical constraints.

Read more »

David Rosenberg: The Canadian economy is mired in weak fundamentals and investors are taking noteAnother BoC rate hike would be beyond nutty given an economy heading into a deep freeze

David Rosenberg: The Canadian economy is mired in weak fundamentals and investors are taking noteAnother BoC rate hike would be beyond nutty given an economy heading into a deep freeze

Read more »

‘The Good, the Bad and the Implications’ for the Canadian housing marketsDaily roundup of research and analysis from The Globe and Mail’s market strategist Scott Barlow

‘The Good, the Bad and the Implications’ for the Canadian housing marketsDaily roundup of research and analysis from The Globe and Mail’s market strategist Scott Barlow

Read more »

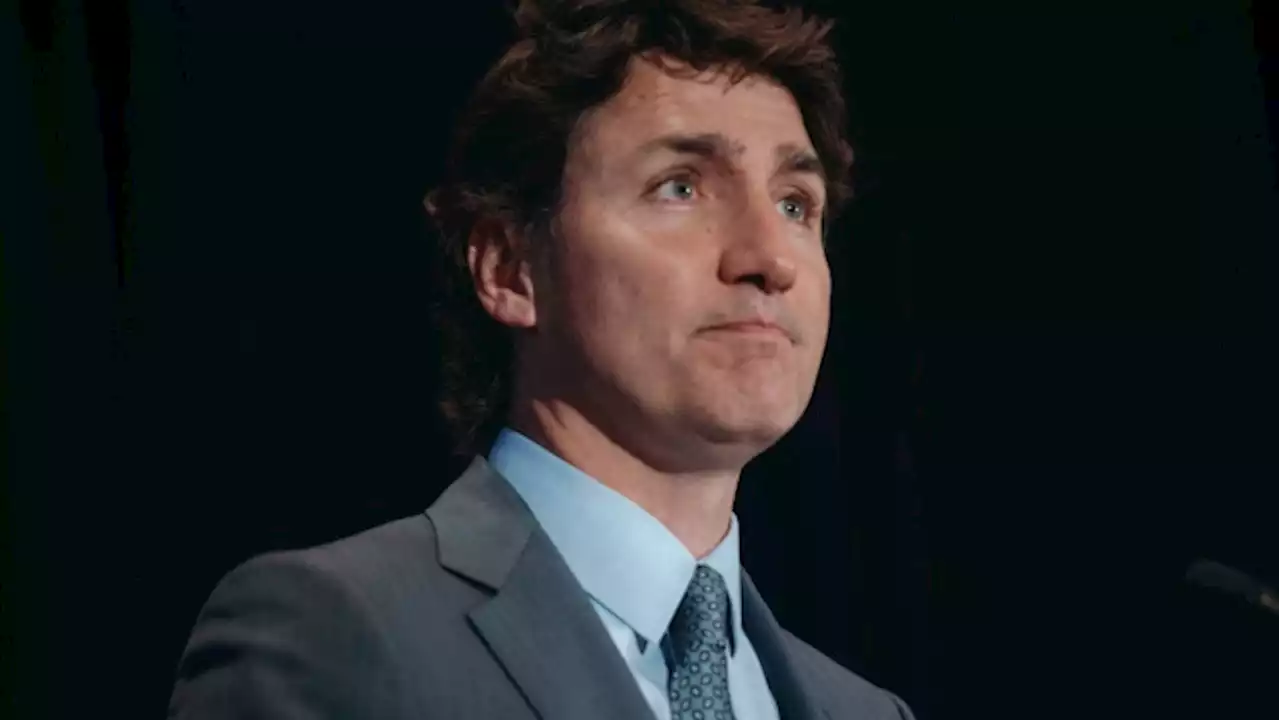

The Daily Chase: Markets point to positive open, Trudeau faces inflation outrageHere are five things you need to know today.

The Daily Chase: Markets point to positive open, Trudeau faces inflation outrageHere are five things you need to know today.

Read more »

Goldman Sees GDP, Markets Weathering Likely Government ShutdownGoldman Sachs Group Inc. sees a short-term hit to the US economy, with a subsequent rebound, in the likely event of a federal government shutdown sometime after appropriations run out Sept. 30.

Goldman Sees GDP, Markets Weathering Likely Government ShutdownGoldman Sachs Group Inc. sees a short-term hit to the US economy, with a subsequent rebound, in the likely event of a federal government shutdown sometime after appropriations run out Sept. 30.

Read more »