Market News

NEW YORK, Oct 23 - U.S. asset manager Vanguard is bullish on longer-dated Treasuries after this year's brutal selloff, betting that the Federal Reserve is at the end of its rate hiking cycle and that the economy will slow next year.

An economic slowdown, in theory, would force the Fed to cut borrowing costs, pushing down prices of shorter-dated Treasuries as they are more sensitive to interest rates and heightening the appeal of longer-dated bonds. Expectations that the Fed will cut interest rates to boost an economy hit by much higher borrowing costs have been pushed out several times this year, as economic activity has remained surprisingly resilient to the interest rate hikes delivered so far by the U.S. central bank as it seeks to curb inflation.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Vanguard bets on long-term US Treasuries after 'cruel summer' for bond investorsU.S. asset manager Vanguard is bullish on longer-dated Treasuries after this year's brutal selloff, betting that the Federal Reserve is at the end of its...

Vanguard bets on long-term US Treasuries after 'cruel summer' for bond investorsU.S. asset manager Vanguard is bullish on longer-dated Treasuries after this year's brutal selloff, betting that the Federal Reserve is at the end of its...

Read more »

Vanguard bets on long-term US Treasuries after 'cruel summer' for bond investorsExplore stories from Atlantic Canada.

Vanguard bets on long-term US Treasuries after 'cruel summer' for bond investorsExplore stories from Atlantic Canada.

Read more »

Stock market today: Wall Street drifts lower as pressure rises from the bond marketNEW YORK (AP) — Wall Street is drifting lower in early trading as pressure from the bond market continues to build. The S&P 500 was down 0.5% early Monday. The Dow lost 171 points, and the Nasdaq composite was off 0.6%.

Stock market today: Wall Street drifts lower as pressure rises from the bond marketNEW YORK (AP) — Wall Street is drifting lower in early trading as pressure from the bond market continues to build. The S&P 500 was down 0.5% early Monday. The Dow lost 171 points, and the Nasdaq composite was off 0.6%.

Read more »

Leveraged funds' record short Treasuries bets surge againMarket News

Leveraged funds' record short Treasuries bets surge againMarket News

Read more »

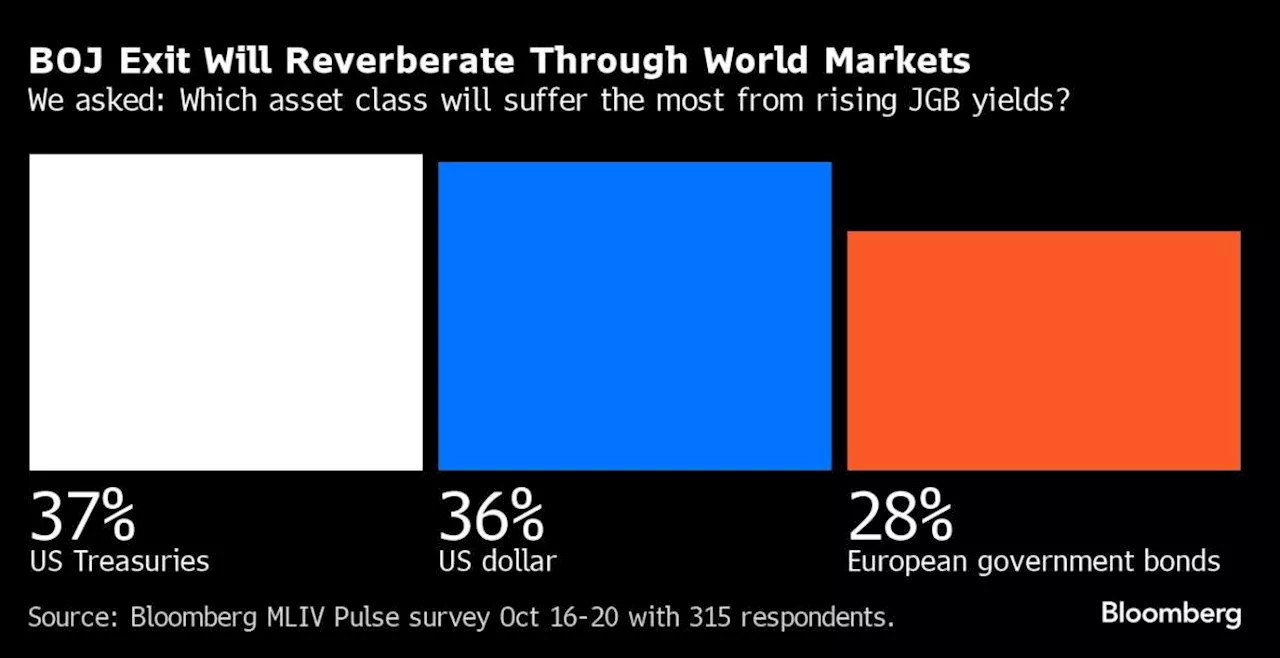

When Japan Ends Negative Rate Policy, Treasuries Will Suffer(Bloomberg) -- Japan’s era of negative interest rates will end in coming months, and the implications for world markets will be enormous, with US Treasuries ...

When Japan Ends Negative Rate Policy, Treasuries Will Suffer(Bloomberg) -- Japan’s era of negative interest rates will end in coming months, and the implications for world markets will be enormous, with US Treasuries ...

Read more »

Column-Leveraged funds' record short Treasuries bets surge again: McGeeverExplore stories from Atlantic Canada.

Column-Leveraged funds' record short Treasuries bets surge again: McGeeverExplore stories from Atlantic Canada.

Read more »