U.S. asset manager Vanguard is bullish on longer-dated Treasuries after this year's brutal selloff, betting that the Federal Reserve is at the end of its...

FILE PHOTO: The logo for Vanguard is displayed on a screen on the floor of the NYSE in New YorkNEW YORK - U.S. asset manager Vanguard is bullish on longer-dated Treasuries after this year's brutal selloff, betting that the Federal Reserve is at the end of its rate hiking cycle and that the economy will slow next year.

An economic slowdown, in theory, would force the Fed to cut borrowing costs, pushing down prices of shorter-dated Treasuries as they are more sensitive to interest rates and heightening the appeal of longer-dated bonds. Expectations that the Fed will cut interest rates to boost an economy hit by much higher borrowing costs have been pushed out several times this year, as economic activity has remained surprisingly resilient to the interest rate hikes delivered so far by the U.S. central bank as it seeks to curb inflation.

On the credit side, Vanguard is optimistic on highly rated companies as it believes they continue to have strong fundamentals after they managed to either not borrow or to borrow short-term debt, avoiding higher funding costs for long.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

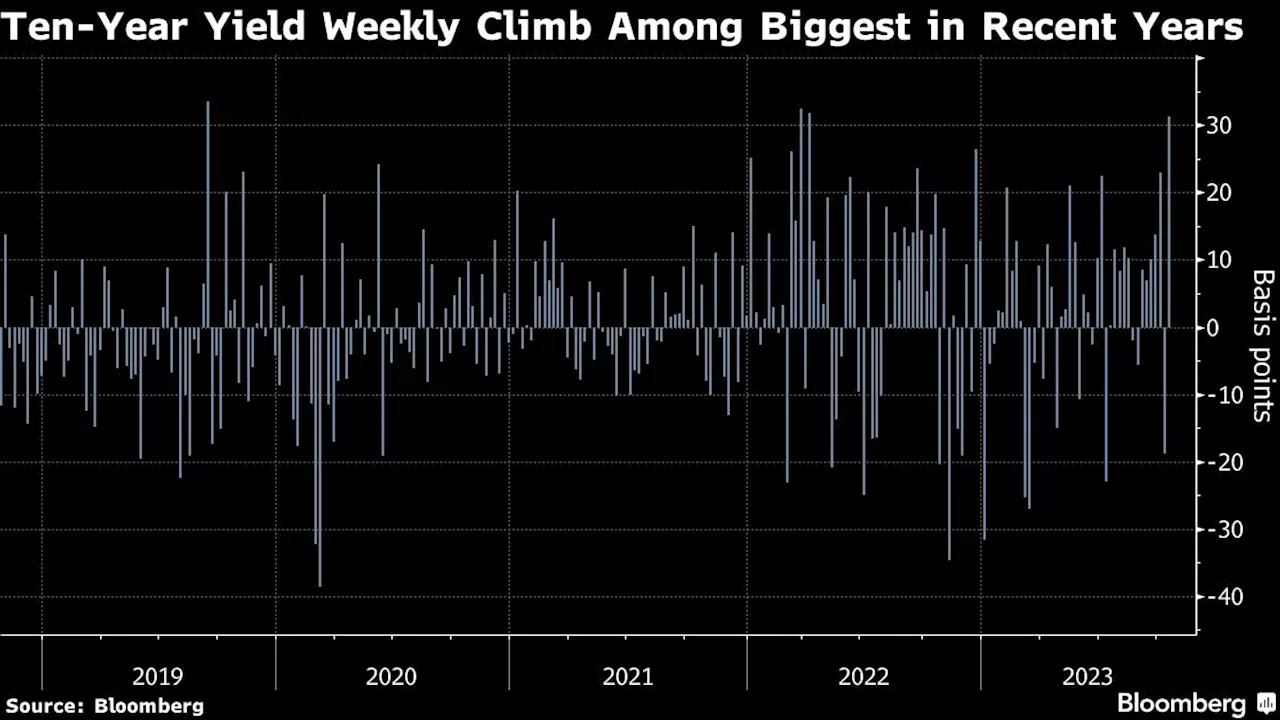

Wild Treasury Swings Just Starting as Bond Traders ‘Buckle Up’(Bloomberg) -- A surprisingly strong US economy and mixed signals from the Federal Reserve have fueled some of the wildest swings in Treasuries in recent...

Wild Treasury Swings Just Starting as Bond Traders ‘Buckle Up’(Bloomberg) -- A surprisingly strong US economy and mixed signals from the Federal Reserve have fueled some of the wildest swings in Treasuries in recent...

Read more »

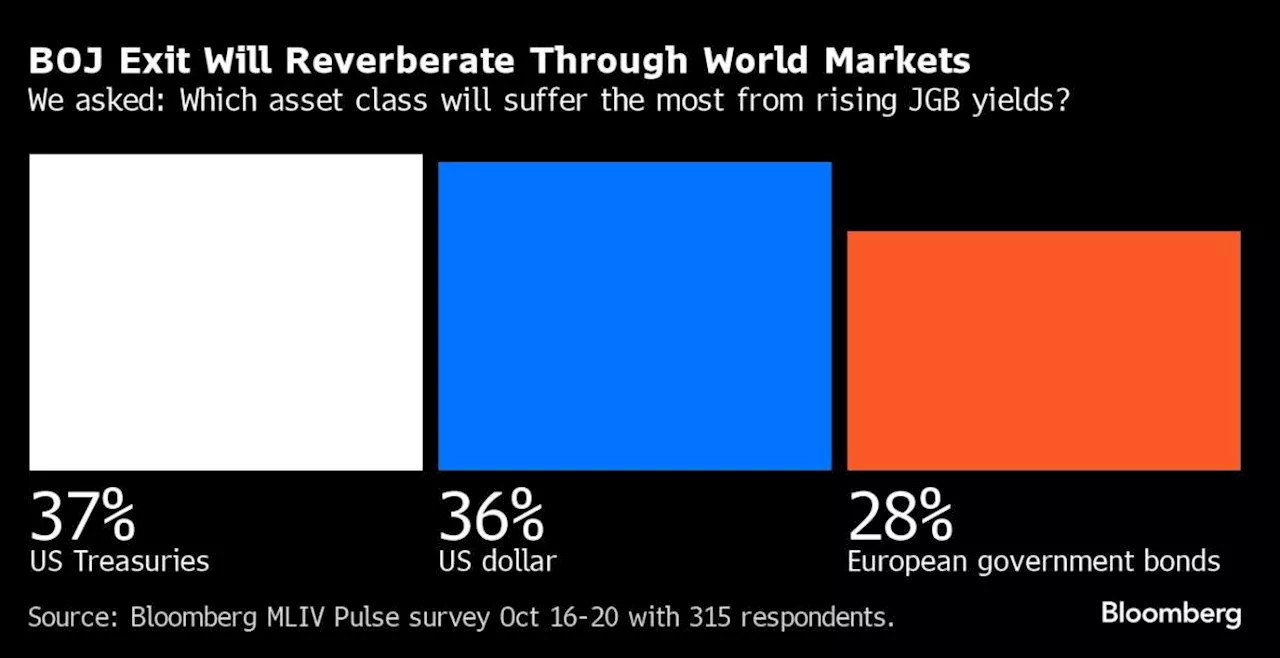

When Japan Ends Negative Rate Policy, Treasuries Will Suffer(Bloomberg) -- Japan’s era of negative interest rates will end in coming months, and the implications for world markets will be enormous, with US Treasuries ...

When Japan Ends Negative Rate Policy, Treasuries Will Suffer(Bloomberg) -- Japan’s era of negative interest rates will end in coming months, and the implications for world markets will be enormous, with US Treasuries ...

Read more »

Column-Leveraged funds' record short Treasuries bets surge again: McGeeverExplore stories from Atlantic Canada.

Column-Leveraged funds' record short Treasuries bets surge again: McGeeverExplore stories from Atlantic Canada.

Read more »

Leveraged funds' record short Treasuries bets surge againMarket News

Leveraged funds' record short Treasuries bets surge againMarket News

Read more »

Bill Ackman Says He Covered His Short Bet on US TreasuriesBillionaire investor Bill Ackman said he covered his short bet on US Treasuries, saying “there is too much risk in the world to remain short bonds at current long-term rates.”

Bill Ackman Says He Covered His Short Bet on US TreasuriesBillionaire investor Bill Ackman said he covered his short bet on US Treasuries, saying “there is too much risk in the world to remain short bonds at current long-term rates.”

Read more »

South African Reserve Bank Deputy Governor Kuben Naidoo ResignsKuben Naidoo, a deputy governor at the South African Reserve Bank, has resigned.

South African Reserve Bank Deputy Governor Kuben Naidoo ResignsKuben Naidoo, a deputy governor at the South African Reserve Bank, has resigned.

Read more »