When the controversial Maharlika Investment Fund was proposed and debated in Congress, the point was made that Filipino taxpayers do not have extra funds to potentially lose in a sovereign investment fund. But the BBM administration was insistent.

They presented the fund as a way of expanding the financial resources of the government given the tight fiscal space inherited from the Duterte administration.

According to Bilyonaryo, some of the investment decisions and proposals of the GSIS head have met stiff scrutiny at the board level. One example is the P1.4 billion worth of preferred shares of Alternergy Holdings that GSIS bought via a private placement. It is about half of the P3-billion equity capital raised by former Energy secretary Vince Perez for his new company. The GSIS GM unilaterally decided to invest because anything under P1.5 billion need not have the board’s approval.

That’s not as bad as a supposed proposal to bail out a Duterte crony from a bad investment in an ambitious property development project. After EDSA, politics also intruded in the investment decisions of the government managed pension funds. This resulted in the overpriced investment in Equitable-PCIB shares of stocks for which SSS lost P8 billion, according to a paper published in the Philippine Management Review by a UP professor of accounting.

CNBC reports that Deputy Prime Minister and Finance Minister Lawrence Wong commented: “What happened with FTX therefore has not only caused financial loss to Temasek but also reputational damage.” Because bringing power plants online from scratch takes at least five years, our current problems with low grid reserves resulting in yellow and red alerts can be blamed on a failure during the Duterte era. But the...

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

BCDA, Maharlika fund manager sign deal to explore investment projectsDefining the News

BCDA, Maharlika fund manager sign deal to explore investment projectsDefining the News

Read more »

Maharlika, BCDA ink MOU for possible investment opportunitiesThe Bases Conversion and Development Authority (BCDA) and the Maharlika Investment Corp. (MIC) on Monday inked a memorandum of understanding for the two agencies to explore potential collaboration opportunities.

Maharlika, BCDA ink MOU for possible investment opportunitiesThe Bases Conversion and Development Authority (BCDA) and the Maharlika Investment Corp. (MIC) on Monday inked a memorandum of understanding for the two agencies to explore potential collaboration opportunities.

Read more »

Maharlika Investment Corporation unveils official logoThe state-owned company that manages the Philippines’ very first sovereign wealth fund has unveiled its official logo.

Maharlika Investment Corporation unveils official logoThe state-owned company that manages the Philippines’ very first sovereign wealth fund has unveiled its official logo.

Read more »

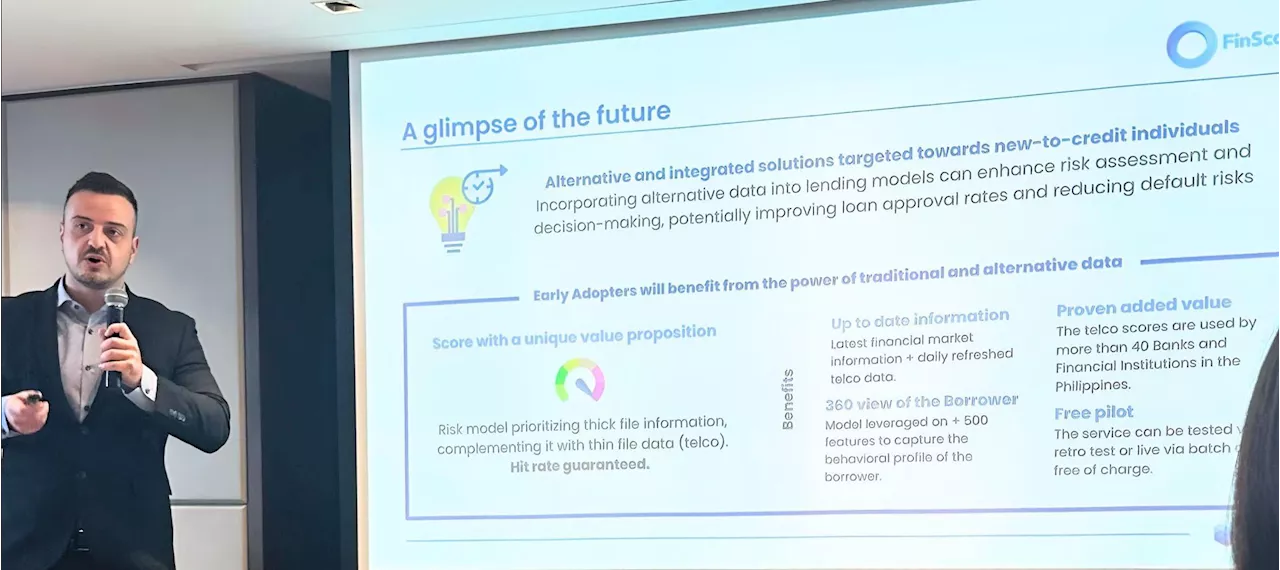

Master the art of risk analysis: FinScore opens Credit Risk AcademyDefining the News

Master the art of risk analysis: FinScore opens Credit Risk AcademyDefining the News

Read more »

Master the art of risk analysis: FinScore opens Credit Risk AcademyOn May 29, FinScore will launch Credit Risk Academy. This comprehensive six-week online course is designed to help professionals working in banks and financial institutions to interpret and create better scoring models.

Master the art of risk analysis: FinScore opens Credit Risk AcademyOn May 29, FinScore will launch Credit Risk Academy. This comprehensive six-week online course is designed to help professionals working in banks and financial institutions to interpret and create better scoring models.

Read more »

Maharlika eyes investments in Clark Freeport, New Clark CityThe Maharlika Investment Corporation is exploring possible investments in the Clark International Airport and in New Clark City projects, among others

Maharlika eyes investments in Clark Freeport, New Clark CityThe Maharlika Investment Corporation is exploring possible investments in the Clark International Airport and in New Clark City projects, among others

Read more »