Pacific Investment Management Co. is standing by its bullish position on emerging markets, even as a rout in the asset class deepens on concern over global interest rates and the plight of China’s economy.

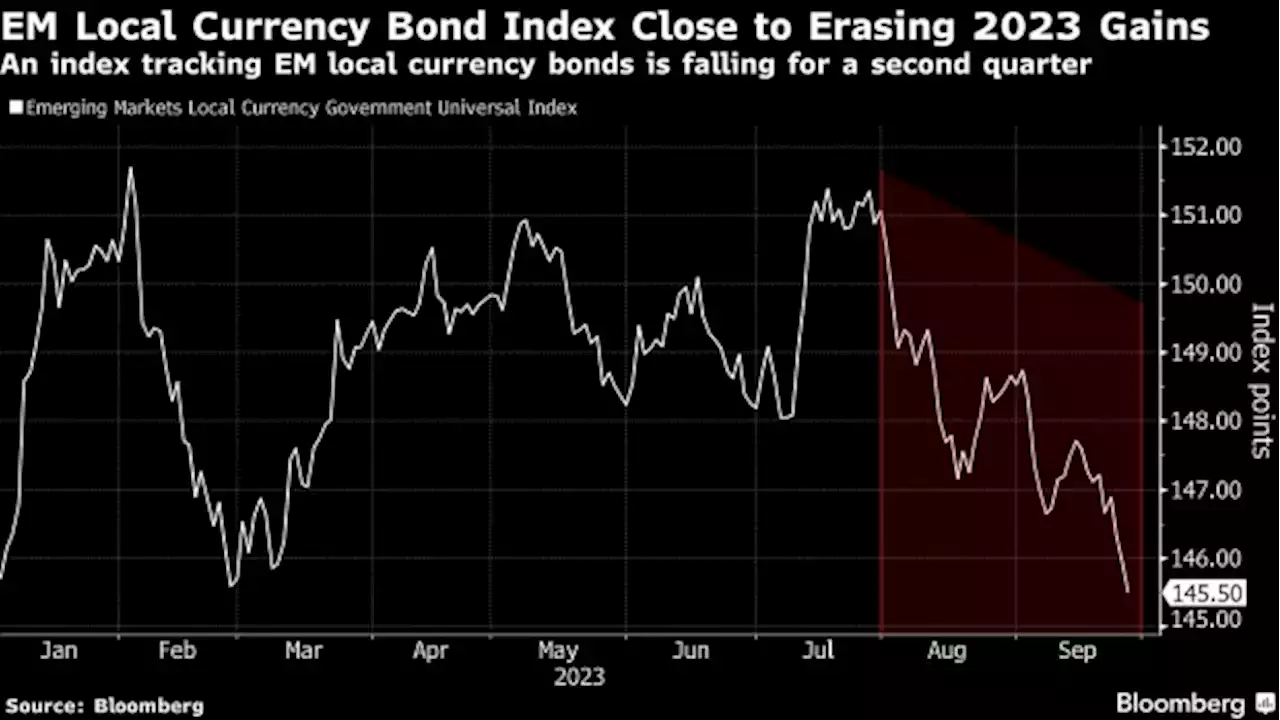

In the past two weeks, developing nation stocks gave up the last of their gains for the year, while currencies posted their lowest close since February. Local- and hard-currency fixed income indexes are heading toward their worst quarterly returns since the third quarter of 2022, according to data compiled by Bloomberg.

“It’s not been anything of true concern, we haven’t seen any EM-driven panic,” said Pramol Dhawan, Pimco’s head of emerging-market debt. “This has just been a broader risk-asset selloff.” Dhawan said there is a “disconnect” now between what the market is pricing in regarding recession probabilities, and Pimco’s views. According to economists surveyed by Bloomberg, the US faces slightly more than a fifty-fifty chance the economy will slide into recession over the next year. Traders in the market for fed funds futures, meanwhile, have now pushed back the timing of a first rate cut from the Federal Reserve to the middle of next year.

“There’s a warranted view of a cautious overall tone, but within pockets where we like risk, we think there are collective EM opportunities,” he said. “We like EM currencies within that spectrum.”

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

India Sticks to Borrowing Plan After JPMorgan Index Inclusion(Bloomberg) -- India’s government maintained its borrowing plan for the remainder of this fiscal year, as higher revenues obviate the need to raise more funds from the market. Bonds were slightly lower. Most Read from BloombergDimon Warns 7% Fed Rate Still Possible, Times of India SaysRepublican Moderates Turn to Rare Maneuver to Avoid Lengthy Government ShutdownChina Puts Evergrande’s Billionaire Founder Under Police ControlIndians Have Five Days to Deposit $3 Billion in Soon-to-Be-Withdrawn Ba

India Sticks to Borrowing Plan After JPMorgan Index Inclusion(Bloomberg) -- India’s government maintained its borrowing plan for the remainder of this fiscal year, as higher revenues obviate the need to raise more funds from the market. Bonds were slightly lower. Most Read from BloombergDimon Warns 7% Fed Rate Still Possible, Times of India SaysRepublican Moderates Turn to Rare Maneuver to Avoid Lengthy Government ShutdownChina Puts Evergrande’s Billionaire Founder Under Police ControlIndians Have Five Days to Deposit $3 Billion in Soon-to-Be-Withdrawn Ba

Read more »

India Sticks to Borrowing Plan After JPMorgan Index InclusionIndia’s government maintained its borrowing plan for the remainder of this fiscal year, as higher revenues obviate the need to raise more funds from the market. Bonds were slightly lower.

India Sticks to Borrowing Plan After JPMorgan Index InclusionIndia’s government maintained its borrowing plan for the remainder of this fiscal year, as higher revenues obviate the need to raise more funds from the market. Bonds were slightly lower.

Read more »

India Sticks to Borrowing Plan After JPMorgan Index InclusionIndia’s government maintained its borrowing plan for the remainder of this fiscal year, as higher revenues obviate the need to raise more funds from the market. Bonds were slightly lower.

India Sticks to Borrowing Plan After JPMorgan Index InclusionIndia’s government maintained its borrowing plan for the remainder of this fiscal year, as higher revenues obviate the need to raise more funds from the market. Bonds were slightly lower.

Read more »

BNB sees short-term bullish sentiment fade but here’s why it may rally againOver the past few hours, even as the price of Binance Coin [BNB] climbed to $212, the Open Interest fell swiftly from $327 million to $320 million

BNB sees short-term bullish sentiment fade but here’s why it may rally againOver the past few hours, even as the price of Binance Coin [BNB] climbed to $212, the Open Interest fell swiftly from $327 million to $320 million

Read more »

ATOM’s bullish rally stalls: Are sellers back?ATOM’s strong recovery from the $6.2 price zone stalled at the $7.5 price level after 18% gains in September.

ATOM’s bullish rally stalls: Are sellers back?ATOM’s strong recovery from the $6.2 price zone stalled at the $7.5 price level after 18% gains in September.

Read more »

China’s strong metal imports not as bullish as they seemRobust copper and aluminum imports come with important caveats and the broader metals trade picture is far more mixed

China’s strong metal imports not as bullish as they seemRobust copper and aluminum imports come with important caveats and the broader metals trade picture is far more mixed

Read more »