The government was able to release P6,727,009,499, considerably less than the total amount allotted under the Bayanihan 2 law. The amount reached 39,323 MSMEs, less than 5% of the total 957,620 MSMEs registered in 2020.

MANILA, Philippines – Olivene Gozar and her partners opened Smoky’s, a restaurant on Visayas Avenue in Quezon City, in February 2020. They were excited, she recalled, as the venture raked in P300,000 in revenues in a month. Gozar and her partners were optimistic they would recover their investments within six months and open a second branch within the year.

Bayanihan Cares was allocated P10 billion in funding under Republic Act 11494 or the Bayanihan to Recover as One Act, the follow-up stimulus budget measure known as “Bayanihan 2.” Bayanihan Cares, with its P10-billion funding, was meant to revive the Philippine economy by providing financing to struggling MSMEs. Small businesses, after all, are the backbone of any economy, and the Philippines is no exception. According to data from the Philippine Statistics Authority , MSMEs accounted for 99.51% of businesses in the Philippines in 2020.

Small business closures also resulted in higher joblessness as MSMEs accounted for more than 60% of total employment in 2019. Unemployment rose to 17.7% as 7.3 million workers were unemployed in April 2020, or more than three times the 5.1% unemployment rate recorded in the same month of 2019. In January 2020, two months before the lockdowns, the jobless rate stood at just 5.3%.

The program was launched in May 2020 with a P1-billion fund. With the passage of Bayanihan 2, it was given P10 billion in funding and renamed Bayanihan Cares. Because the money came in the form of capital infusion, the amount that could be taken in by SBCorp was limited by its authorized capital stock, Budget Assistant Secretary Rolando Toledo said in an email to the Philippine Center for Investigative Journalism .

The implementing rules pertaining to SBCorp state: “Any excess at par value shall be treated as a share premium resolution to an additional paid in capital of SBCorp. This initial APIC can later act as a safety net against expected further losses in net income arising from the mandated objective, purposes and features of the CARES program under the Bayanihan to Recover as One Act. This is in consonance with the purposes of APIC, which is to provide a layer of defense against potential losses.

“[T]hat argument became moot when the law expired. There is no reason for this fund for the pandemic because the law authorizing us to assist MSMEs under special terms expired,” said Robert Bastillo, SBCorp head of innovation and advocacy. Quimbo, a member of the House of Representatives panel to the bicameral conference committee that crafted the final version of Bayanihan 2, said lawmakers made sure that the language in the Bayanihan 2 law was broadly worded to allow SBCorp to receive the full amount under the law.

In an email interview, Sen. Juan Edgardo “Sonny” Angara, chairman of the Senate panel during bicameral deliberations on the Bayanihan 2 law, said it was reasonable for DBM not to download the remaining amount to SBCorp given the slow uptake of loans. The underutilization of funds was due to the slow uptake of Cares for Travel, which originally had a P6-billion share out of the P10-billion fund, SBCorp officials pointed out.

Angara said Congress was aware that tourism MSMEs were cautious over getting loans. However, the Department of Tourism wrote to Congress asking for working capital loans and other credit facilities for tourism businesses, he said. “We never really knew when the lockdowns would end. It was a series of lockdowns. If we had known that there would have been no lockdown then we would have pressed DOT to push the product, and if they could not, then we could have negotiated earlier to open it up to [multisectoral loans].… So we just cannot unilaterally use the [funds],” SBCorp’s Bastillo explained.

For its part, the DOT said it had anticipated a fast uptake of loans from tourism-related enterprises due to numerous requests for financial assistance in 2020. The DOT clarified that it exerted numerous efforts to promote the loan program. A total of 21 “DOT Cares for Travel Webinars” were conducted from October 2020 to December 2021, it said.Although Bayanihan Cares was marketed as an interest- and collateral-free loan, borrowers still had to pay an effective interest of 2% to 4% per annum as SBCorp charged processing fees of 4% to 8% depending on the loan terms, according to state auditors.

SBCorp officials, however, said the corporation could not afford to waive processing fees as the funds it had received from the government did not include mobilization costs. “The funds were in the form of equity so there were no funds for mobilization),” Cacanando, the SBCorp president, explained. The high processing fees, however, could have contributed to the low takeup. A survey by state auditors found that some respondents were hesitant to proceed with their loan applications due to the processing fees imposed by SBCorp.She pointed out that the House’s original version of the stimulus package bill, House Bill 6815 or the “Accelerated Recovery and Investments Stimulus for the Economy of the Philippines” bill, had provisions for administrative costs.

She, however, stressed that MSMEs still benefited from the Bayanihan Cares program despite the processing fees imposed. “Let’s admit that it was less than perfect.But for Gozar, a zero effective interest rate would have been more beneficial for struggling businesses. “That processing fee could have been used to pay for electricity. That’s how business owners think.”Hand-holding MSMEs

In a survey conducted by state auditors, three out of six MSMEs reported that their loan applications were canceled as of June 30, 2021, citing difficulties in collecting and submitting documents. Two out of six MSMEs experienced technical challenges during loan application. Two out of 10 MSMEs whose loans were disapproved had difficulty gathering and submitting documents or had technical difficulty during the loan application process.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

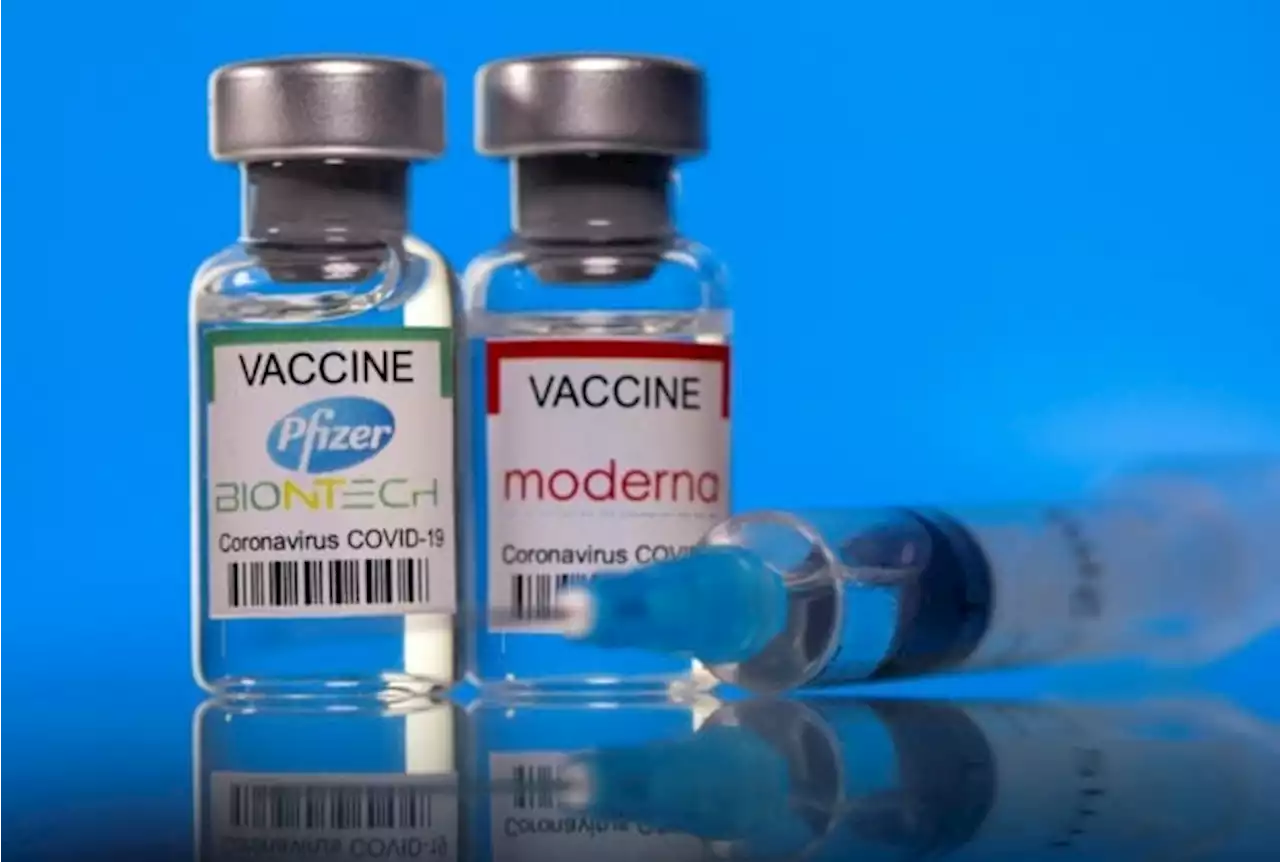

Low public interest, short shelf life to blame for wasted COVID jabs – DOHMANILA, Philippines — The wasted COVID-19 vaccines can be attributed to a lowered public interest and the short shelf life, said Department of Health officer-in-charge (DOH-OIC) Maria Rosario

Low public interest, short shelf life to blame for wasted COVID jabs – DOHMANILA, Philippines — The wasted COVID-19 vaccines can be attributed to a lowered public interest and the short shelf life, said Department of Health officer-in-charge (DOH-OIC) Maria Rosario

Read more »

Caroling, silenced by COVID, survives trying timesMANILA, Philippines—For the last two years, tight health restrictions ushered in by the COVID-19 pandemic drastically altered how Filipinos celebrated Christmas. It’s well known that the

Caroling, silenced by COVID, survives trying timesMANILA, Philippines—For the last two years, tight health restrictions ushered in by the COVID-19 pandemic drastically altered how Filipinos celebrated Christmas. It’s well known that the

Read more »

OCTA: New COVID-19 cases may go up to 1,200 on Dec. 7The new COVID-19 infections nationwide may go as high as 1,200 on Wednesday, December 7, 2022, based on the projections of independent monitoring group OCTA Research.

OCTA: New COVID-19 cases may go up to 1,200 on Dec. 7The new COVID-19 infections nationwide may go as high as 1,200 on Wednesday, December 7, 2022, based on the projections of independent monitoring group OCTA Research.

Read more »

Students protest campus lockdown as China eases Covid curbsStudents protested against a lockdown at a university in eastern China, highlighting continued anger as huge numbers of people across the country still face restrictions despite the government easing its zero-Covid policy.

Students protest campus lockdown as China eases Covid curbsStudents protested against a lockdown at a university in eastern China, highlighting continued anger as huge numbers of people across the country still face restrictions despite the government easing its zero-Covid policy.

Read more »

Beijing drops COVID-19 testing burden as wider easing beckonsResidents of China&39;s capital were allowed into parks, supermarkets, offices and airports without a negative COVID-19 test on Tuesday, the latest in a mix of easing steps nationwide after unprecedented protests against a tough zero-COVID policy.

Beijing drops COVID-19 testing burden as wider easing beckonsResidents of China&39;s capital were allowed into parks, supermarkets, offices and airports without a negative COVID-19 test on Tuesday, the latest in a mix of easing steps nationwide after unprecedented protests against a tough zero-COVID policy.

Read more »