Emerging Asia ex-China bonds have beaten their developing-nation peers this quarter, and this outperformance looks set to continue even if US interest rates keep rising.

Regional securities have fared better even though their emerging-market counterparts have had the benefit of monetary easing as central banks start cutting rates. There are multiple factors working in favor of Asian notes including a lower correlation to US yields, support from resilient currencies and disinflationary pressures exported by China.

While the rapidity of the rise in US yields is challenging bond investors globally, “in Asia, there is a cold counter-cyclical wind coming from China, which has a much more significant impact on emerging Asian economies that supports the local bond markets,” said Rajeev De Mello, a Geneva-based global macro portfolio manager at Gama Asset Management SA.

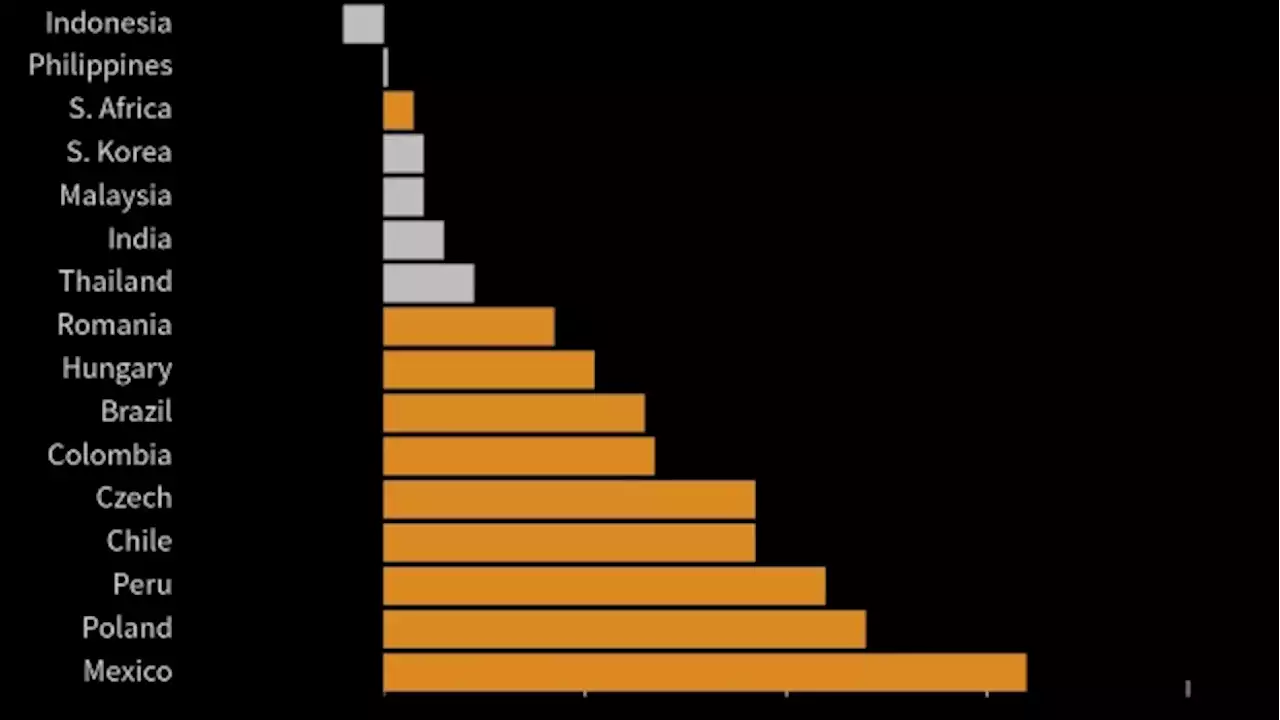

In contrast, central banks in Indonesia, Philippines, Thailand, Malaysia, India and South Korea are forecast to keep rates unchanged this year, according to economists surveyed by Bloomberg. Still, an average of 10-year benchmark yields from emerging Asia ex-China has risen 21 basis points this quarter, less than the 26 basis points gain recorded in EMEA and 53 basis points increase in Latin America, according to Bloomberg calculations.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Industry Perspectives Op-Ed: Clarity on use of lien bonds on Crown land - constructconnect.com“Ensuring payment of contractors and subcontractors and encouraging liquidity in the flow of funds to them are both significant preoccupations in the construction industry.” Our previous article, discussing the case of Bird Construction Group vs. Trotter

Industry Perspectives Op-Ed: Clarity on use of lien bonds on Crown land - constructconnect.com“Ensuring payment of contractors and subcontractors and encouraging liquidity in the flow of funds to them are both significant preoccupations in the construction industry.” Our previous article, discussing the case of Bird Construction Group vs. Trotter

Read more »

Industry Perspectives Op-Ed: Clarity on use of lien bonds on Crown land - constructconnect.com“Ensuring payment of contractors and subcontractors and encouraging liquidity in the flow of funds to them are both significant preoccupations in the construction industry.” Our previous article, discussing the case of Bird Construction Group vs. Trotter

Industry Perspectives Op-Ed: Clarity on use of lien bonds on Crown land - constructconnect.com“Ensuring payment of contractors and subcontractors and encouraging liquidity in the flow of funds to them are both significant preoccupations in the construction industry.” Our previous article, discussing the case of Bird Construction Group vs. Trotter

Read more »

Transaction Costs for Municipal Bonds Rose for Retail InvestorsTransaction costs for retail investors buying municipal bonds in the secondary market have jumped since 2021 as falling bond prices have made the securities riskier for dealers to hold, according to a study released on Tuesday.

Transaction Costs for Municipal Bonds Rose for Retail InvestorsTransaction costs for retail investors buying municipal bonds in the secondary market have jumped since 2021 as falling bond prices have made the securities riskier for dealers to hold, according to a study released on Tuesday.

Read more »

Premarket: Weak European data hits euro, lifts bondsMarkets await Nvidia results, Fed chair Jerome Powell’s Jackson Hole speech

Premarket: Weak European data hits euro, lifts bondsMarkets await Nvidia results, Fed chair Jerome Powell’s Jackson Hole speech

Read more »

Uruguay Bankers’ Pension Fund to Sell Local Bonds in Rescue PlanThe pension fund serving Uruguay’s financial industry workers is set to sell as much as $400 million in local currency bonds as part of a rescue plan for the deficit-plagued institution.

Uruguay Bankers’ Pension Fund to Sell Local Bonds in Rescue PlanThe pension fund serving Uruguay’s financial industry workers is set to sell as much as $400 million in local currency bonds as part of a rescue plan for the deficit-plagued institution.

Read more »

China’s Firmer Stance on Yuan Sparks Relief in Emerging MarketsSigns that China is becoming more forceful in supporting its markets provided some relief for developing-nation assets battered by concerns over the world’s second-largest economy.

China’s Firmer Stance on Yuan Sparks Relief in Emerging MarketsSigns that China is becoming more forceful in supporting its markets provided some relief for developing-nation assets battered by concerns over the world’s second-largest economy.

Read more »