(Bloomberg) -- The yen weakened beyond 155 per dollar for the first time in more than three decades, fueling risk that the key level may prompt Japan to step...

-- The yen weakened beyond 155 per dollar for the first time in more than three decades, fueling risk that the key level may prompt Japan to step into the market.Meta Projects Higher Spending in Deeper Push Into AI

Japanese officials have said repeatedly that they will take necessary action to address excessive moves in the yen if needed. The authorities have emphasized a focus on the pace of the currency’s depreciation rather than a precise level. Traders will be alert to any comments from officials in Tokyo on Thursday that suggest a higher state of readiness for intervention.

“A surprising rate hike would make much more sense than FX interventions,” said Piotr Matys, senior FX analyst at InTouch Capital Markets Ltd. While Matys sees it as a low-probability scenario, “the most efficient way to stabilize a battered currency is to surprise the market with a rate hike.” Japan intervened in markets three times in 2022 to prop up the yen after the currency weakened to 151.95 against the dollar. Tokyo spent more than ¥9 trillion across three occasions in that campaign, which was conducted largely without criticism from international allies including the US.

Japan Bank Of Japan Japan Brown Brothers Harriman

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Japan won't intervene unless yen slides below 155, says ex-FX diplomat WatanabeExplore stories from Atlantic Canada.

Japan won't intervene unless yen slides below 155, says ex-FX diplomat WatanabeExplore stories from Atlantic Canada.

Read more »

Asian shares rise as yen weakens, gold hits record highA 1.6% bounce in the Nikkei has led Asian shares higher so far today as the yen skids on pretty much all the major crosses. Copper has reached a 13-month peak and gold another record above $2,300 an ounce.

Asian shares rise as yen weakens, gold hits record highA 1.6% bounce in the Nikkei has led Asian shares higher so far today as the yen skids on pretty much all the major crosses. Copper has reached a 13-month peak and gold another record above $2,300 an ounce.

Read more »

Asian shares rise as yen weakens, gold benefits from buyingA 1.6% bounce in the Nikkei has led Asian shares higher so far today as the yen skids on pretty much all the major crosses. Copper may have been boosted by China's moves to promote auto trade-ins and scrap government-set minimum down payments for consumers financing new car purchases. Gold seems to be benefiting from buying by momentum funds and commodity trading advisors (CTAs) since its clean break of $2,072 resistance. There's also a sense that investors are concerned at the mountain of debt global governments are issuing, seeking to put money in assets that are limited in quantity.

Asian shares rise as yen weakens, gold benefits from buyingA 1.6% bounce in the Nikkei has led Asian shares higher so far today as the yen skids on pretty much all the major crosses. Copper may have been boosted by China's moves to promote auto trade-ins and scrap government-set minimum down payments for consumers financing new car purchases. Gold seems to be benefiting from buying by momentum funds and commodity trading advisors (CTAs) since its clean break of $2,072 resistance. There's also a sense that investors are concerned at the mountain of debt global governments are issuing, seeking to put money in assets that are limited in quantity.

Read more »

Asian shares rise as yen weakens, gold benefits from buyingA 1.6% bounce in the Nikkei has led Asian shares higher so far today as the yen skids on pretty much all the major crosses. Copper may have been boosted by China's moves to promote auto trade-ins and scrap government-set minimum down payments for consumers financing new car purchases. Gold seems to be benefiting from buying by momentum funds and commodity trading advisors (CTAs) since its clean break of $2,072 resistance. There's also a sense that investors are concerned at the mountain of debt global governments are issuing, seeking to put money in assets that are limited in quantity.

Asian shares rise as yen weakens, gold benefits from buyingA 1.6% bounce in the Nikkei has led Asian shares higher so far today as the yen skids on pretty much all the major crosses. Copper may have been boosted by China's moves to promote auto trade-ins and scrap government-set minimum down payments for consumers financing new car purchases. Gold seems to be benefiting from buying by momentum funds and commodity trading advisors (CTAs) since its clean break of $2,072 resistance. There's also a sense that investors are concerned at the mountain of debt global governments are issuing, seeking to put money in assets that are limited in quantity.

Read more »

Yen Weakens on US Data, Raising Risk of Japanese FX InterventionThe yen is weakening toward 152 per dollar, a key level that traders see elevating risk that Japanese officials intervene in the market, as strong US factory data boosted the dollar.

Yen Weakens on US Data, Raising Risk of Japanese FX InterventionThe yen is weakening toward 152 per dollar, a key level that traders see elevating risk that Japanese officials intervene in the market, as strong US factory data boosted the dollar.

Read more »

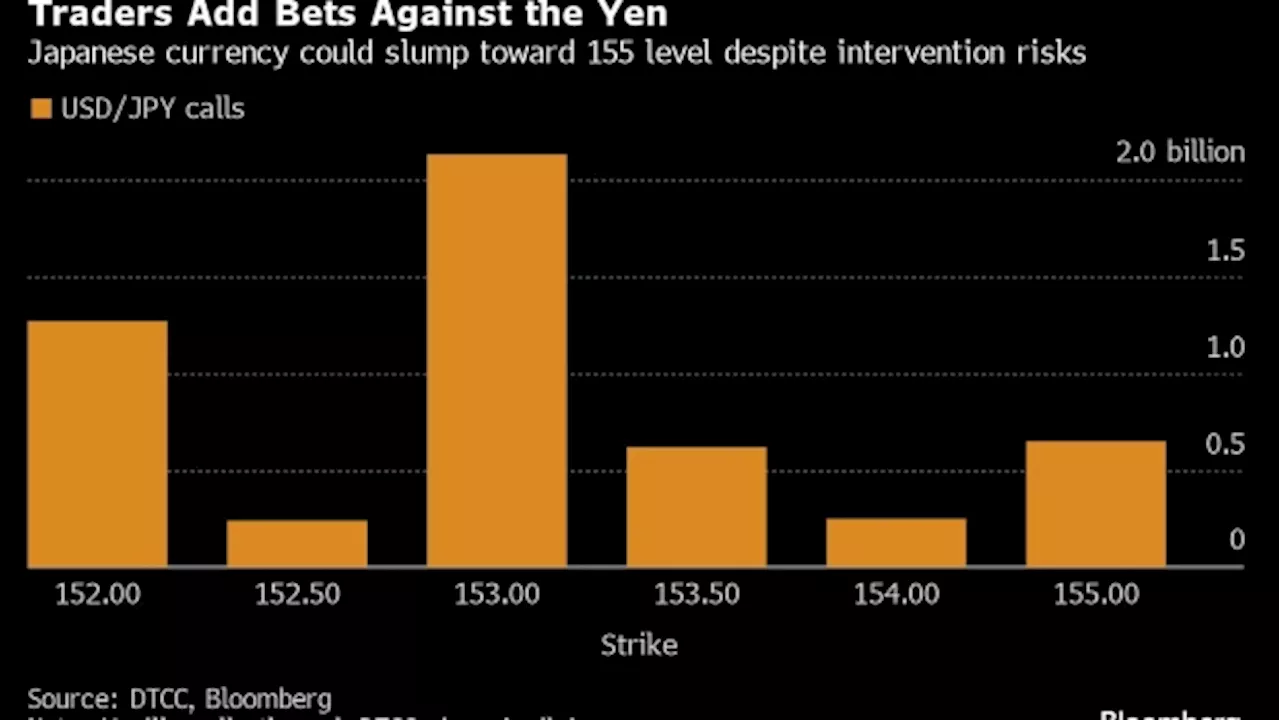

Yen Traders Are Targeting Slump Beyond Key 152 Per Dollar LevelCurrency traders are betting that the yen will tumble beyond the closely-watched 152 per dollar level, and are ramping up wagers on a slide toward 155.

Yen Traders Are Targeting Slump Beyond Key 152 Per Dollar LevelCurrency traders are betting that the yen will tumble beyond the closely-watched 152 per dollar level, and are ramping up wagers on a slide toward 155.

Read more »