As the odds of a recession collapse on Wall Street, markets are back to being vulnerable to any sign that the US economy is running too hot.

From high-yield credit to equities, the odds of an economic downturn priced into financial assets have fallen to the lowest since April 2022, according to JPMorgan Chase & Co. It’s a big reversal from the doom and gloom of the past year, when a recession was effectively seen as a done deal.

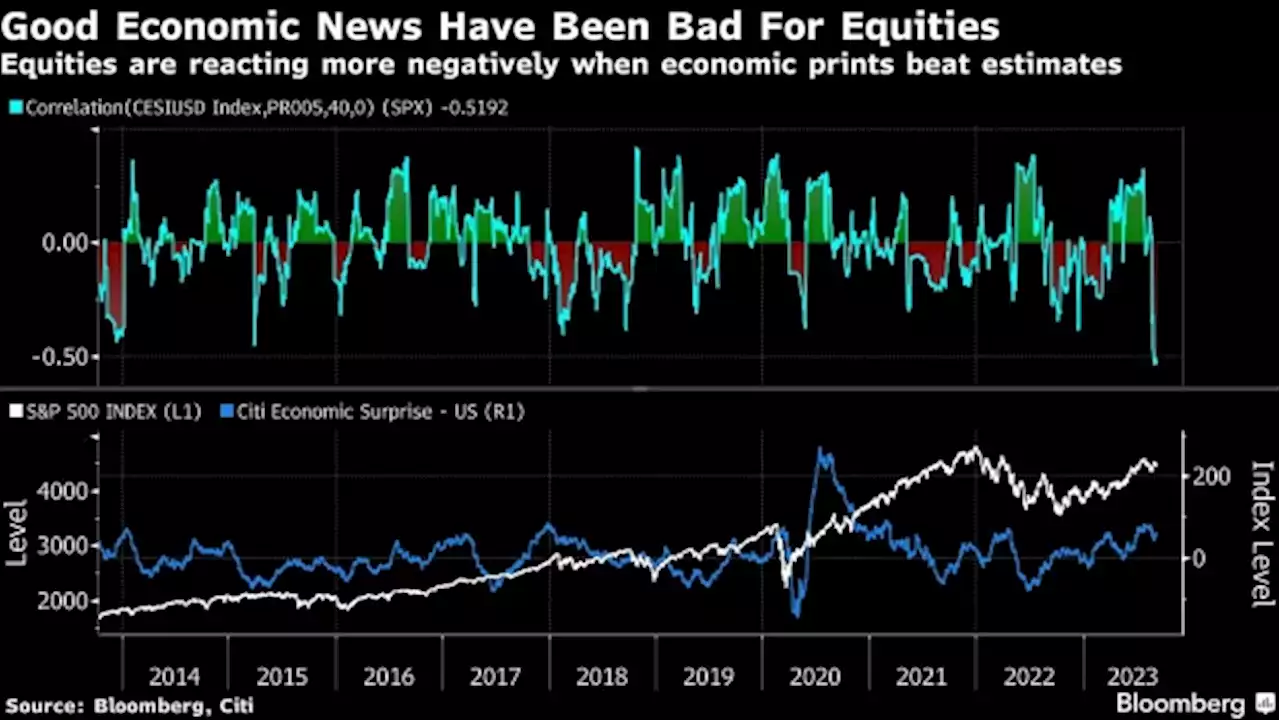

Solid jobless claims figures on Thursday and service-sector activity topping all forecasts on Wednesday, for example, reinforced the case for the Federal Reserve to keep rates elevated, fueling a drop in equities. One way of thinking about just how sensitive the market is to fresh economic data: the link between the S&P 500 and Citigroup Inc.’s widely followed surprise index for the US economy.

“We’re in the ‘bad news is good news’ part of the cycle and the reason is because the market is quite concerned about the Fed raising interest rates again,” Yung-Yu Ma, chief investment strategist at BMO Wealth, wrote in a note. With the US economy humming along at a clip of 2%, even Fed staff have written out a recession from their forecasts for this year. One widely-followed, unofficial tracker from Atlanta Fed has the US economy expanding 5.6% on an annualized basis in the third quarter.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Some Traders Bet Wall Street’s Fear Gauge Is Due for 1100% JumpThe CBOE Volatility Index hasn’t popped above 35 all year, but some traders are betting it clocks 180 over the next few months.

Some Traders Bet Wall Street’s Fear Gauge Is Due for 1100% JumpThe CBOE Volatility Index hasn’t popped above 35 all year, but some traders are betting it clocks 180 over the next few months.

Read more »

AI darling’s stock plunge highlights Wall Street's increased scrutiny over technologyAfter ripping through June, AI stocks haven't bounced much during quarterly earnings to end the summer.

AI darling’s stock plunge highlights Wall Street's increased scrutiny over technologyAfter ripping through June, AI stocks haven't bounced much during quarterly earnings to end the summer.

Read more »

Mizuho’s Katz Aims for Wall Street Big Leagues With Arm IPOLanding Arm Holdings Ltd.’s giant initial public offering is a coup for Mizuho Financial Group Inc., one of the four global investment banks leading this year’s biggest deal. Now the Japanese firm needs to prove that it’s more than just a one-time thing.

Mizuho’s Katz Aims for Wall Street Big Leagues With Arm IPOLanding Arm Holdings Ltd.’s giant initial public offering is a coup for Mizuho Financial Group Inc., one of the four global investment banks leading this year’s biggest deal. Now the Japanese firm needs to prove that it’s more than just a one-time thing.

Read more »

Wall Street’s Biggest Bear Ditches Call for 11% S&P Drop in 2023One of Wall Street’s biggest stock-market pessimists dialed back his bearish forecast for the S&P 500 Index.

Wall Street’s Biggest Bear Ditches Call for 11% S&P Drop in 2023One of Wall Street’s biggest stock-market pessimists dialed back his bearish forecast for the S&P 500 Index.

Read more »

Colombia Outlines ESG Bond Strategy in Talks With Wall StreetColombian officials are talking to investors this week about their framework for issuing environmental, social and governance labeled securities in the coming months, according to people familiar with the matter.

Colombia Outlines ESG Bond Strategy in Talks With Wall StreetColombian officials are talking to investors this week about their framework for issuing environmental, social and governance labeled securities in the coming months, according to people familiar with the matter.

Read more »

Asia Stocks to Follow Wall Street’s Apple-Led Drop: Markets WrapStocks in Asia were set to follow a big tech-led drop on Wall Street amid concern over how a Chinese ban on Apple Inc.’s iPhone could impact the industry that has driven this year’s market rally. The dollar strengthened and Treasuries rose.

Asia Stocks to Follow Wall Street’s Apple-Led Drop: Markets WrapStocks in Asia were set to follow a big tech-led drop on Wall Street amid concern over how a Chinese ban on Apple Inc.’s iPhone could impact the industry that has driven this year’s market rally. The dollar strengthened and Treasuries rose.

Read more »