US stock investors have gotten so confident that it’s concerning strategists at JPMorgan Chase & Co.

“There is complacency in sentiment evident, VIX is near record low and positioning has increased” to above-average levels, a team led by Mislav Matejka wrote in a note. “There is no more safety net” and FOMO — the fear of missing out — is in full swing.

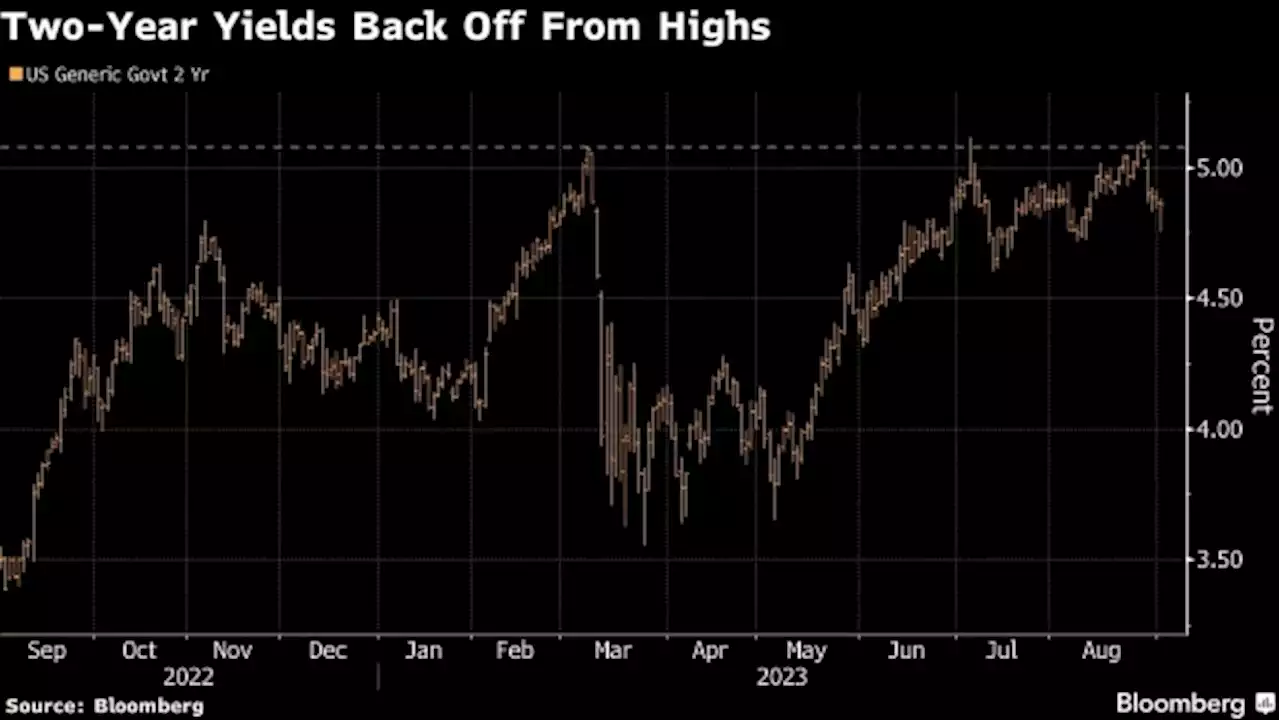

US equities have rallied this year amid hopes interest rates will peak soon while the economy holds up better than expected. The gains were especially pronounced in tech stocks over optimism about developments in artificial intelligence. Sentiment and positioning are far from bearish even though September is typically weak for stocks, Matejka said.

“There is no cushion anymore, as investor sentiment is now fully signed up to a soft landing,” the strategists said. The 12-month forward price-to-earnings ratio of 19 times for the MSCI USA Index is stretched at these levels, especially versus higher real yields, his team wrote. While multiples show a positive correlation with earnings-per-share momentum, earnings revisions might turn lower again, they said.

International equities continue to screen more attractive than the US, according to the Matejka. His team remains overweight on the rest of the world, with a focus on Switzerland, while remaining underweight on the US — a strategy that hasn’t yet panned out as the S&P 500 is outperforming the MSCI All-Country World Index excluding the US this year.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors SayThis year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors SayThis year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.

Read more »

Father, daughter stock car racers carrying on family’s Maritime racing legacyDave O’Blenis taught his daughters Courtney, and Alexandra O’Blenis how to drive race cars. Now they compete together on tracks in New Brunswick and PEI

Father, daughter stock car racers carrying on family’s Maritime racing legacyDave O’Blenis taught his daughters Courtney, and Alexandra O’Blenis how to drive race cars. Now they compete together on tracks in New Brunswick and PEI

Read more »

Noteworthy: An oversold loonie, and five other insights to watchPlus, Apple as an under-owned stock, Treasury bonds and renewable power stocks

Noteworthy: An oversold loonie, and five other insights to watchPlus, Apple as an under-owned stock, Treasury bonds and renewable power stocks

Read more »

Hong Kong’s Stock Market Liquidity Task Force to Meet This WeekHong Kong’s stock-market liquidity task force will hold its first meeting this week to study methods to expand capital sources and flows, attract more high-quality listings and boost efficiency and competitiveness, the city’s financial secretary Paul Chan wrote in a blog Sunday.

Hong Kong’s Stock Market Liquidity Task Force to Meet This WeekHong Kong’s stock-market liquidity task force will hold its first meeting this week to study methods to expand capital sources and flows, attract more high-quality listings and boost efficiency and competitiveness, the city’s financial secretary Paul Chan wrote in a blog Sunday.

Read more »

Ports in Europe Lure Investors Into Clean Energy Gateway PlanPorts in Europe are racing to win a key role in the bloc’s ambitious climate strategy as they try to evolve from entry points for fossil-fuel imports into industrial clusters for clean energy.

Ports in Europe Lure Investors Into Clean Energy Gateway PlanPorts in Europe are racing to win a key role in the bloc’s ambitious climate strategy as they try to evolve from entry points for fossil-fuel imports into industrial clusters for clean energy.

Read more »

From BlackRock to Pimco, Bond Investors Bet Fed Hiking Is OverFor the first time since the Federal Reserve started raising interest rates almost 18 months ago, the labor market is showing enough cracks to embolden some of the world’s largest bond investors to bet that the tightening cycle is finally ending.

From BlackRock to Pimco, Bond Investors Bet Fed Hiking Is OverFor the first time since the Federal Reserve started raising interest rates almost 18 months ago, the labor market is showing enough cracks to embolden some of the world’s largest bond investors to bet that the tightening cycle is finally ending.

Read more »