UBS Group AG’s wealth unit will double its coverage of single stocks and increase the bonds it covers sixfold as it integrates some of Credit Suisse’s research with its own.

The single securities research of Credit Suisse’s wealth management will become part of UBS’s chief investment office over the course of the next month, according to memos sent to clients of both banks. The memos were seen by Bloomberg News and the contents were confirmed by a UBS spokesperson.

The move will enable UBS to double equities coverage to over 3,000 stocks while increasing bond coverage to 18,000 bonds from a previous universe of 2,600 bonds, according to the lender’s memo. UBS is in the middle of one of the most complex integrations in global banking since the financial crisis, as it seeks to retain the wealthy clients and private banking talent of its long-time rival while shedding riskier assets, for instance in the investment bank. The lender last week outlined major targets for that process and posted the biggest ever quarterly profit for a bank on the back of the bargain deal that closed in June.

Credit Suisse’s securities research for the investment bank will also be integrated with UBS, according to a separate memo. As a result, it will start terminating coverage on Sept. 18. Credit Suisse clients will continue to have access to “historic” Credit Suisse research until early October and institutional clients will be given access to the UBS research platform in the coming weeks, subject to their onboarding, according to the Credit Suisse memo.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

UBS to absorb Credit Suisse's Securities Research offering(Reuters) -UBS will absorb Credit Suisse's Securities Research service later this month, wrapping the business into its own research operations, the bank ...

UBS to absorb Credit Suisse's Securities Research offering(Reuters) -UBS will absorb Credit Suisse's Securities Research service later this month, wrapping the business into its own research operations, the bank ...

Read more »

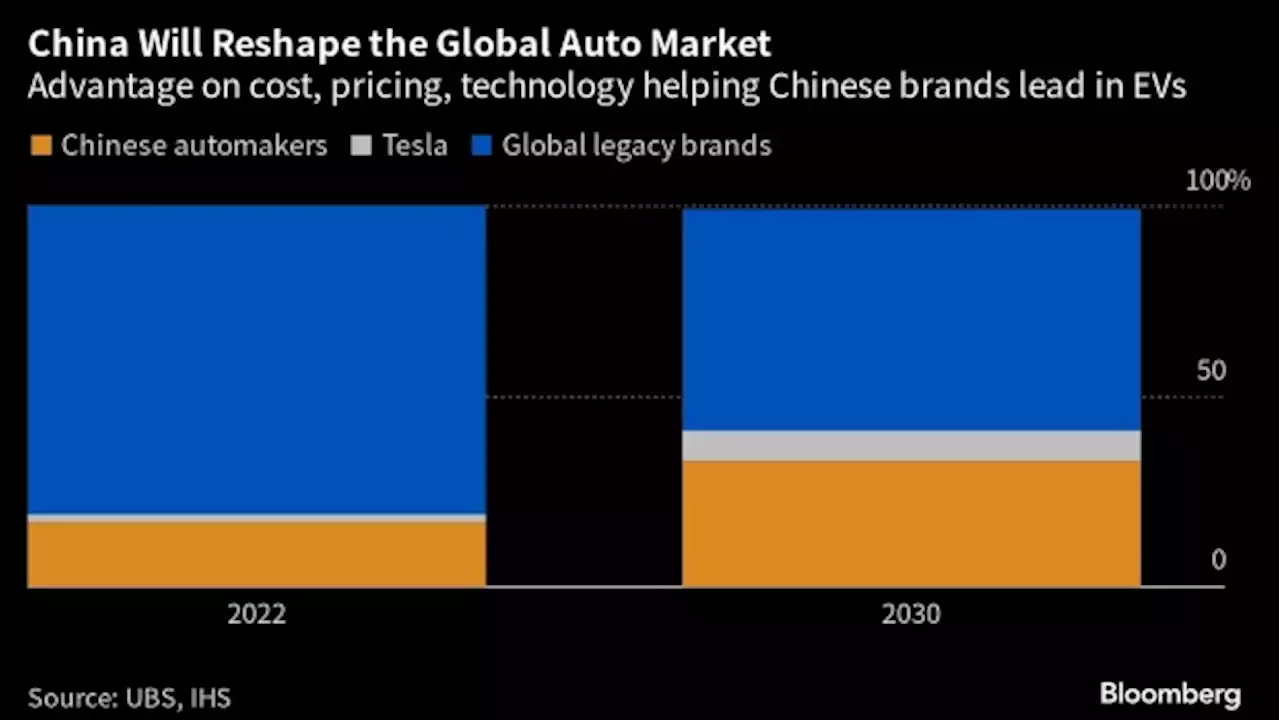

Rise of China’s EV Makers Threatens Western Firms, UBS SaysWestern automakers are set to lose a fifth of their global market share due to the unstoppable rise of more-affordable, cheaper-to-produce Chinese electric vehicles, according to UBS Group AG analysts.

Rise of China’s EV Makers Threatens Western Firms, UBS SaysWestern automakers are set to lose a fifth of their global market share due to the unstoppable rise of more-affordable, cheaper-to-produce Chinese electric vehicles, according to UBS Group AG analysts.

Read more »

First African Offsets Platform Begins With Record 2 Million Credit TradeAfrica’s first verifiable emissions reduction platform has begun operations with a carbon futures transaction of more than two million credits, a continental record.

First African Offsets Platform Begins With Record 2 Million Credit TradeAfrica’s first verifiable emissions reduction platform has begun operations with a carbon futures transaction of more than two million credits, a continental record.

Read more »

BCI gets more credit approvalsPotash developer BCI Minerals has received credit approvals for a further A$150-million of project finance for its Mardie salt project, in Western Australia, from two commercial bank debt providers. The latest credit approval for a minimum of A$150-million in project finance was in addition to the A$650-million of credit approvals received last month from the Northern Australia Infrastructure Facility (NAIF) and Export Finance Australia (EFA).

BCI gets more credit approvalsPotash developer BCI Minerals has received credit approvals for a further A$150-million of project finance for its Mardie salt project, in Western Australia, from two commercial bank debt providers. The latest credit approval for a minimum of A$150-million in project finance was in addition to the A$650-million of credit approvals received last month from the Northern Australia Infrastructure Facility (NAIF) and Export Finance Australia (EFA).

Read more »

Mozambique Leader Wins Immunity in Tuna Bond Scandal in Setback for Credit SuisseMozambique President Filipe Nyusi has received immunity from any allegations he was involved in the conspiracy at the heart of multibillion dollar fishing-boat scandal, in a fresh setback for Credit Suisse.

Mozambique Leader Wins Immunity in Tuna Bond Scandal in Setback for Credit SuisseMozambique President Filipe Nyusi has received immunity from any allegations he was involved in the conspiracy at the heart of multibillion dollar fishing-boat scandal, in a fresh setback for Credit Suisse.

Read more »

Credit Suisse collapse led balance sheet of Swiss banks to contractIn Switzerland, the balance sheet of banks fell 6.9% to 3,339.7 billion Swiss francs ($3.76 trillion) in 2022, said the Banking Barometer, an annual report on banking industry trends. 'The downturn among the big banks was especially large and probably driven mainly by shifts in customer funds at Credit Suisse,' the report said.

Credit Suisse collapse led balance sheet of Swiss banks to contractIn Switzerland, the balance sheet of banks fell 6.9% to 3,339.7 billion Swiss francs ($3.76 trillion) in 2022, said the Banking Barometer, an annual report on banking industry trends. 'The downturn among the big banks was especially large and probably driven mainly by shifts in customer funds at Credit Suisse,' the report said.

Read more »