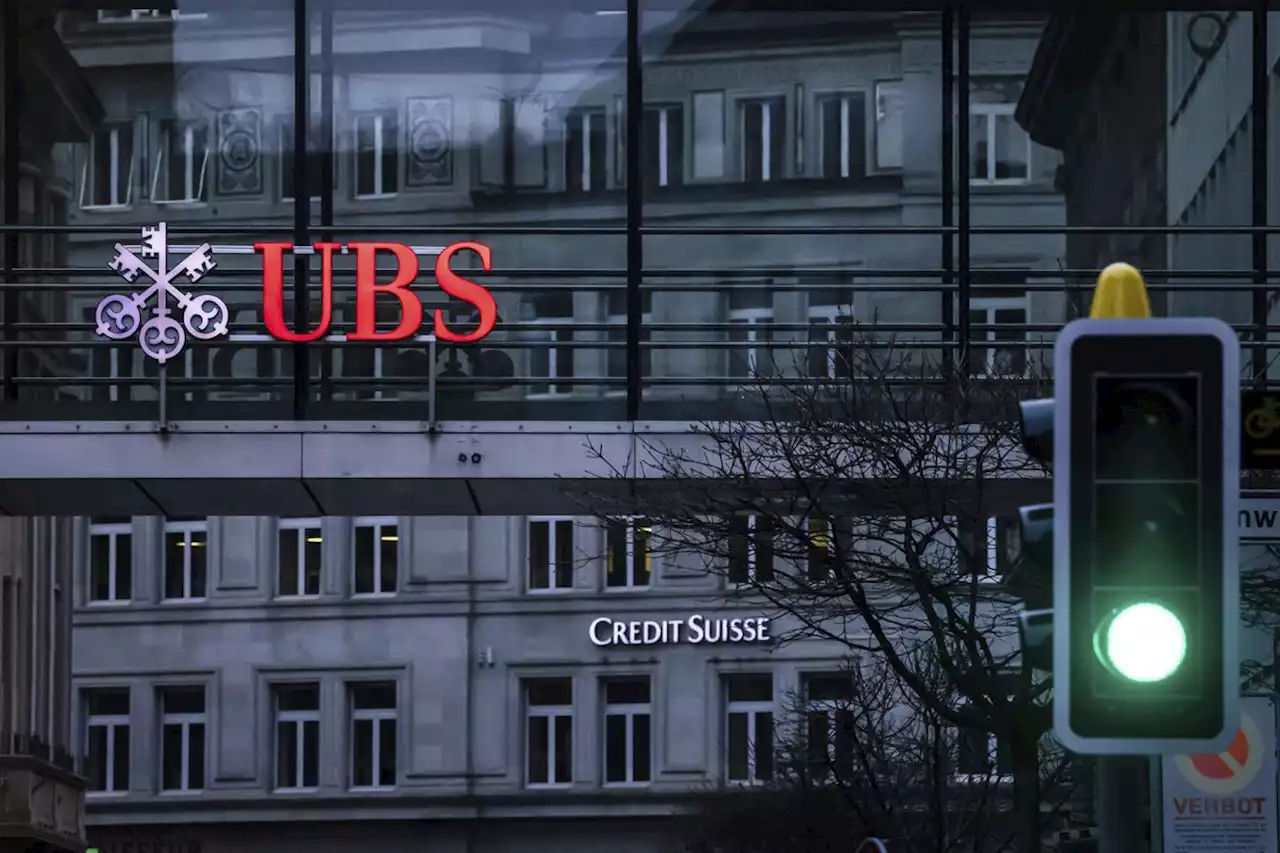

The announcement came as the Zurich-based bank reported $29 billion in net and pre-tax profit in the second quarter, its first earnings release since the government-orchestrated merger to help stave off a possible global financial meltdown

Underlying profit before taxes came in at $1.1 billion, which excludes some $29 billion in negative goodwill, integration costs and other impacts of the takeover. Goodwill is an accounting technique, and the figure stems from the difference between the $3.25 billion that UBS paid for Credit Suisse and the underlying value of its assets.

“Let me emphasize, the vast majority of the cost reductions will come from natural attrition, retirements and internal mobility. Around 1,000 redundancies will result from the integration of Credit Suisse ,” Ermotti said. UBS said it planned to “substantially complete” the integration of Credit Suisse’s operations by the end of 2026 and to “achieve gross cost reductions of over $10 billion over that time.”

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Credit Suisse’s Banker to Russian Billionaires Retained by UBSCredit Suisse’s go-to banker for Russian billionaires has joined UBS Group AG, in one of the highest-profile moves yet for the merged bank’s wealth management business.

Credit Suisse’s Banker to Russian Billionaires Retained by UBSCredit Suisse’s go-to banker for Russian billionaires has joined UBS Group AG, in one of the highest-profile moves yet for the merged bank’s wealth management business.

Read more »

Swiss Antitrust Watchdog Reviewing UBS-Credit Suisse Deal ImpactSwitzerland’s competition commission is reviewing the effects of the government-brokered takeover of Credit Suisse by UBS Group AG, a spokesman said.

Swiss Antitrust Watchdog Reviewing UBS-Credit Suisse Deal ImpactSwitzerland’s competition commission is reviewing the effects of the government-brokered takeover of Credit Suisse by UBS Group AG, a spokesman said.

Read more »

After Credit Suisse takeover, UBS gives first glimpse of new groupMarket News

After Credit Suisse takeover, UBS gives first glimpse of new groupMarket News

Read more »

UBS, Swiss finance blog settle Credit Suisse legacy lawsuitMarket News

UBS, Swiss finance blog settle Credit Suisse legacy lawsuitMarket News

Read more »

UBS winds down Credit Suisse Global Markets businessZURICH (Reuters) - Credit Suisse said it will reduce the volume of new markets business from Sept. 22 while UBS integrates its former rival, the bank ...

UBS winds down Credit Suisse Global Markets businessZURICH (Reuters) - Credit Suisse said it will reduce the volume of new markets business from Sept. 22 while UBS integrates its former rival, the bank ...

Read more »

UBS Slips in ESG Asset-Manager Ranking After Credit Suisse DealThe asset management arm of UBS Group AG has slipped in an ESG ranking published by Morningstar Inc., which pointed to its acquisition of Credit Suisse as the main reason for the decline.

UBS Slips in ESG Asset-Manager Ranking After Credit Suisse DealThe asset management arm of UBS Group AG has slipped in an ESG ranking published by Morningstar Inc., which pointed to its acquisition of Credit Suisse as the main reason for the decline.

Read more »