UBS Group AG agreed to sell $8 billion in unwanted assets to Apollo Global Management Inc. as part of the carve-out of Credit Suisse’s securitized products group, after renegotiating key parts of the accord.

UBS, Apollo Agree to Change Deal Terms for Credit Suisse’s SPGOil Giants Plan to Bury Massive Amounts of CO2 in Southeast AsiaBiden’s Methane Crackdown Reaches Oil Wells on Federal LandOil Heads for Quarterly Advance as OPEC+ Holds the Line on Cuts‘Princess of Wahaha’ Looks to Revive a Fortune Down $18 BillionPetroChina Boosts Green Ambitions as Big Oil Walks Back PledgesAustralia to Invest A$1 Billion on Domestic Solar Panel Push to Cut Reliance on ChinaTrafigura to Pay $126 Million and Plead...

5M targetBusiness leaders say housing biggest risk to economy: KPMG surveyCFIB says 200,000 small businesses took new loans to meet CEBA repayment deadlineThe Daily Chase: Cocoa hits record highThe Daily Chase: Boeing CEO to depart, EU cracks down on Big TechHigher chocolate prices part of wider trend as climate, other factors disrupt supplyCanada's economy to slow with new limits on temporary migrantsStatistics Canada reports retail sales down in January as new car sales fellAlberta set to...

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

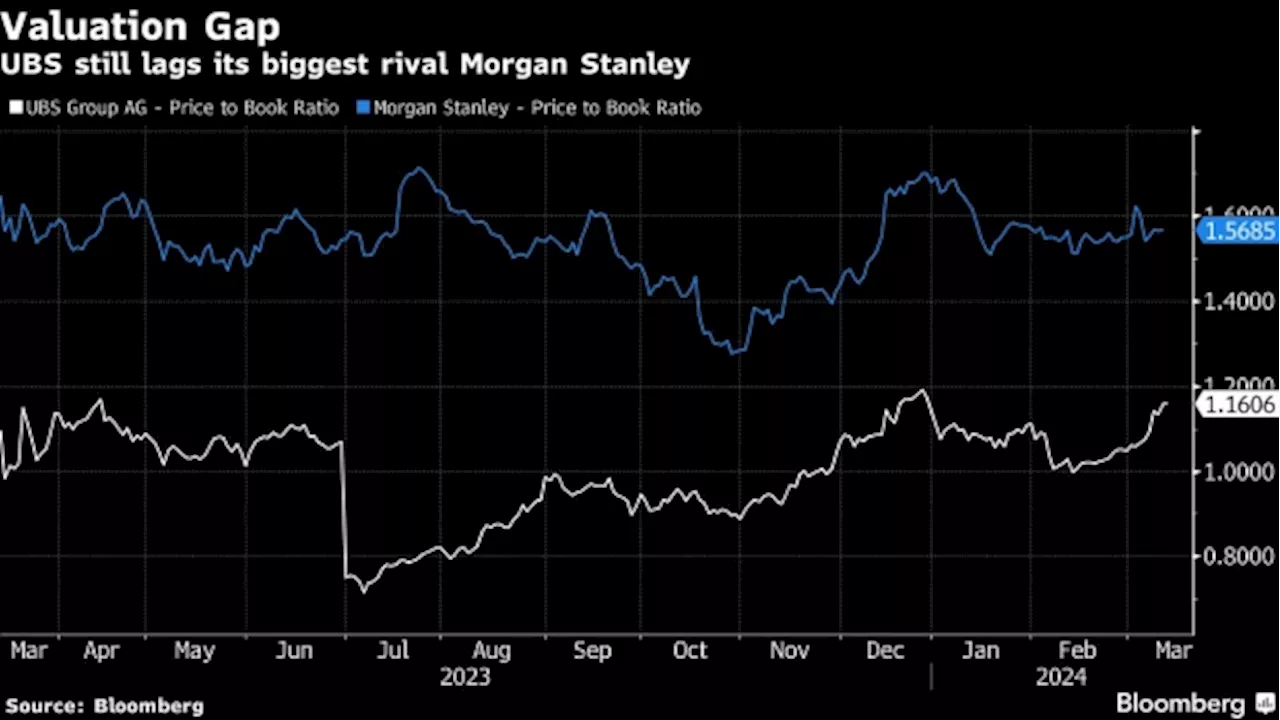

UBS Powers Past $100 Billion One Year After Credit Suisse ShockOn the first anniversary of UBS Group AG’s historic takeover of its former rival Credit Suisse, it’s becoming clear just how advantageous the deal has been for the bank. It has pushed its market capitalization past $100 billion to the highest level in almost 16 years and cemented its leading role in global wealth management.

UBS Powers Past $100 Billion One Year After Credit Suisse ShockOn the first anniversary of UBS Group AG’s historic takeover of its former rival Credit Suisse, it’s becoming clear just how advantageous the deal has been for the bank. It has pushed its market capitalization past $100 billion to the highest level in almost 16 years and cemented its leading role in global wealth management.

Read more »

UBS to Shut Thousands of Smaller Credit Suisse Accounts in AsiaUBS Group AG is planning to shut smaller-value Credit Suisse accounts numbering in the low thousands at its Asia Pacific wealth management arm to exit relationships with poor returns, according to people familiar with the matter.

UBS to Shut Thousands of Smaller Credit Suisse Accounts in AsiaUBS Group AG is planning to shut smaller-value Credit Suisse accounts numbering in the low thousands at its Asia Pacific wealth management arm to exit relationships with poor returns, according to people familiar with the matter.

Read more »

B.C.’s unemployment drops, but opposition fears loss of private-sector jobsCredit rating agency raises concerns about B.C.’s financial trajectory, but maintains AA credit rating.

B.C.’s unemployment drops, but opposition fears loss of private-sector jobsCredit rating agency raises concerns about B.C.’s financial trajectory, but maintains AA credit rating.

Read more »

UBS to boost Asia assets, sees growth from wealth and asset managementAssets sourced from Asia would be up to 20% in five-six years, from around 15%, UBS Chief Executive Sergio Ermotti said on Tuesday

UBS to boost Asia assets, sees growth from wealth and asset managementAssets sourced from Asia would be up to 20% in five-six years, from around 15%, UBS Chief Executive Sergio Ermotti said on Tuesday

Read more »

Man's credit score plummets due to old unpaid ticketRichard McGrath received a credit score alert last week, informing him that his credit score had unexpectedly dropped. He later discovered that an unpaid ticket from 2005 had resurfaced, causing his credit score to plummet. McGrath expressed frustration that the city had not contacted him about the ticket before it affected his credit score.

Man's credit score plummets due to old unpaid ticketRichard McGrath received a credit score alert last week, informing him that his credit score had unexpectedly dropped. He later discovered that an unpaid ticket from 2005 had resurfaced, causing his credit score to plummet. McGrath expressed frustration that the city had not contacted him about the ticket before it affected his credit score.

Read more »

UBS Has No Need for More Capital, Kelleher Tells NZZ am SonntagUBS Group AG Chairman Colm Kelleher said that higher capital requirements for the Swiss banking behemoth would penalize shareholders and clients, and called instead for stronger powers for the country’s banking watchdog.

UBS Has No Need for More Capital, Kelleher Tells NZZ am SonntagUBS Group AG Chairman Colm Kelleher said that higher capital requirements for the Swiss banking behemoth would penalize shareholders and clients, and called instead for stronger powers for the country’s banking watchdog.

Read more »