Investors are eagerly awaiting the Treasury Department's new borrowing plan, which will reveal the extent to which longer-term debt will be sold to fund a widening budget deficit. The plan comes hours ahead of the Federal Reserve's interest-rate decision.

-- The Federal Reserve ’s policy statement is setting up to be the No. 2 event on Wednesday, with investor focus instead likely to be on the Treasury Department ’s new borrowing plan , due hours ahead of the interest-rate decision.GM Hit With More Strikes While Stellantis Reaches Deal With UAW

Many bond dealers predict a refunding size of $114 billion, representing the same cadence of increases per each refunding security as laid out in the $103 billion August plan, which marked the first step up in issuance in more than two years. On Monday, the Treasury will set the stage for its issuance plans with an update of quarterly borrowing estimates, and for its cash balance. In August, officials penciled in net borrowing of $852 billion for October through December. Lou Crandall at Wrightson ICAP LLC says he’s not expecting any downward revision in Monday’s update.

That’s not the universal view, however. Wells Fargo, Goldman Sachs Group Inc., Barclays Plc and Morgan Stanley are among those expecting the Treasury to tilt this time more toward short-term securities, in part given the rise in long-term rates.Solid demand for Treasury bills, which yield well over 5%, means there would be ready buyers, but bills currently make up more than 20% of marketable Treasuries.

Israel says it will fight Elon Musk's effort to supply Starlink internet to 'internationally recognized aid organizations' in Gaza

Treasury Department Borrowing Plan Longer-Term Debt Budget Deficit Federal Reserve Interest-Rate Decision

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

South Africa to Increase Borrowing While Curbing DebtGoldman predicts potential stock bargains due to souring US growth views. Lisbon sees an influx of digital nomads while Portugal's youth leave. TC Energy explores $10 billion stake sales. Google to invest $2 billion in AI startup Anthropic. Acapulco Airport reopens for aid and escape flights after Hurricane Otis. Hasbro and Mattel contribute to a gloomy holiday shopping outlook. October marks the worst month for stocks in five years. Canadians face financial stress and tech workers earn 46% less than their US counterparts.

South Africa to Increase Borrowing While Curbing DebtGoldman predicts potential stock bargains due to souring US growth views. Lisbon sees an influx of digital nomads while Portugal's youth leave. TC Energy explores $10 billion stake sales. Google to invest $2 billion in AI startup Anthropic. Acapulco Airport reopens for aid and escape flights after Hurricane Otis. Hasbro and Mattel contribute to a gloomy holiday shopping outlook. October marks the worst month for stocks in five years. Canadians face financial stress and tech workers earn 46% less than their US counterparts.

Read more »

South Africa to Increase Borrowing While Curbing DebtGoldman predicts potential stock bargains due to souring US growth views. Lisbon sees an influx of digital nomads while Portugal's youth leave. TC Energy explores $10 billion stake sales. Google to invest $2 billion in AI startup Anthropic. Acapulco Airport reopens for aid and escape flights after Hurricane Otis. Hasbro and Mattel contribute to a gloomy holiday shopping outlook. October marks the worst month for stocks in five years. Canadians face financial stress and tech workers earn 46% less than their US counterparts.

South Africa to Increase Borrowing While Curbing DebtGoldman predicts potential stock bargains due to souring US growth views. Lisbon sees an influx of digital nomads while Portugal's youth leave. TC Energy explores $10 billion stake sales. Google to invest $2 billion in AI startup Anthropic. Acapulco Airport reopens for aid and escape flights after Hurricane Otis. Hasbro and Mattel contribute to a gloomy holiday shopping outlook. October marks the worst month for stocks in five years. Canadians face financial stress and tech workers earn 46% less than their US counterparts.

Read more »

South Africa to Increase Borrowing While Curbing DebtGoldman predicts potential stock bargains due to souring US growth views. Lisbon sees an influx of digital nomads while Portugal's youth leave. TC Energy explores $10 billion stake sales. Google to invest $2 billion in AI startup Anthropic. Acapulco Airport reopens for aid and escape flights after Hurricane Otis. Hasbro and Mattel contribute to a gloomy holiday shopping outlook. October marks the worst month for stocks in five years. Canadians face financial stress and tech workers earn 46% less than their US counterparts.

South Africa to Increase Borrowing While Curbing DebtGoldman predicts potential stock bargains due to souring US growth views. Lisbon sees an influx of digital nomads while Portugal's youth leave. TC Energy explores $10 billion stake sales. Google to invest $2 billion in AI startup Anthropic. Acapulco Airport reopens for aid and escape flights after Hurricane Otis. Hasbro and Mattel contribute to a gloomy holiday shopping outlook. October marks the worst month for stocks in five years. Canadians face financial stress and tech workers earn 46% less than their US counterparts.

Read more »

Emerging-market Companies Face Refinancing Challenges as Borrowing Rates SurgeGlobal borrowing rates surge to highest levels since financial crisis, halting refinancing opportunities for $400 billion worth of debt maturities. Refinancing challenges likely to worsen as another $300 billion worth of corporate bonds come due in 2025. Some emerging-market companies, particularly from China, Argentina, Brazil, and Ukraine, are vulnerable to failed refinancing deals, leading to defaults or bankruptcies.

Emerging-market Companies Face Refinancing Challenges as Borrowing Rates SurgeGlobal borrowing rates surge to highest levels since financial crisis, halting refinancing opportunities for $400 billion worth of debt maturities. Refinancing challenges likely to worsen as another $300 billion worth of corporate bonds come due in 2025. Some emerging-market companies, particularly from China, Argentina, Brazil, and Ukraine, are vulnerable to failed refinancing deals, leading to defaults or bankruptcies.

Read more »

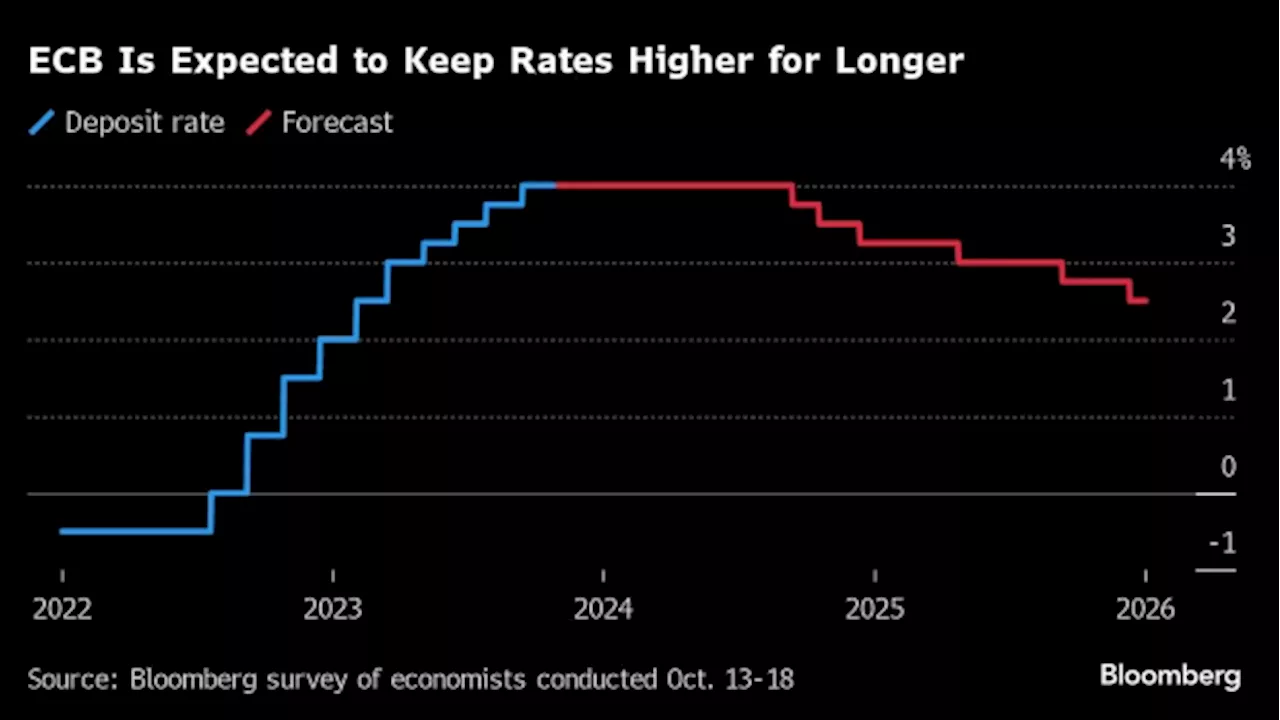

Treasury Traders on Edge as 2023 Enters Make-or-Break WeekTraders in the treasury market are feeling anxious as the final week of 2023 approaches, with high stakes and uncertainty ahead. Ongoing ground activity in Northern Gaza raises concerns in Israel. A meeting in Malta aims to advance peace efforts in Ukraine. Italy rejects alternative plans for Telecom Italia. An Iranian girl dies after an alleged assault by morality police. Inflation picks up in the US and Tokyo. ECB President Lagarde faces a test of endurance in keeping interest rates at record levels. Surveys show women are less likely to request a raise or negotiate salary. Fans advise timing and patience for affordable concert and sports resale tickets. Money manager explains how meditation informs his decisions. HELOCs are highlighted as a vital tool in personal finance. Budget travelers can consider price freezing and other trends. RBC survey reveals financial uncertainty as the new normal for many Canadians. Silent portfolio killers that could drain retirement savings. Lisbon sees an influx of digital nomads while Portugal's youth leave in droves. Ivanka Trump ordered to testify in her father's civil trial in New York. UK announces 5...

Treasury Traders on Edge as 2023 Enters Make-or-Break WeekTraders in the treasury market are feeling anxious as the final week of 2023 approaches, with high stakes and uncertainty ahead. Ongoing ground activity in Northern Gaza raises concerns in Israel. A meeting in Malta aims to advance peace efforts in Ukraine. Italy rejects alternative plans for Telecom Italia. An Iranian girl dies after an alleged assault by morality police. Inflation picks up in the US and Tokyo. ECB President Lagarde faces a test of endurance in keeping interest rates at record levels. Surveys show women are less likely to request a raise or negotiate salary. Fans advise timing and patience for affordable concert and sports resale tickets. Money manager explains how meditation informs his decisions. HELOCs are highlighted as a vital tool in personal finance. Budget travelers can consider price freezing and other trends. RBC survey reveals financial uncertainty as the new normal for many Canadians. Silent portfolio killers that could drain retirement savings. Lisbon sees an influx of digital nomads while Portugal's youth leave in droves. Ivanka Trump ordered to testify in her father's civil trial in New York. UK announces 5...

Read more »

Frazzled U.S. stock investors eye frothy Treasury market as Fed loomsFinancial markets are bracing for what could be a momentous week, with a Federal Reserve meeting, U.S. employment data and earnings from technology...

Frazzled U.S. stock investors eye frothy Treasury market as Fed loomsFinancial markets are bracing for what could be a momentous week, with a Federal Reserve meeting, U.S. employment data and earnings from technology...

Read more »