Bond traders are ramping up bets that the Federal Reserve will cut interest rates by half a percentage point in September instead of the standard quarter-point increment.

Edward Bolingbroke, Bloomberg NewsVishal Khanduja, senior portfolio manager at Morgan Stanley Investment Management, joins BNN Bloomberg to discuss Fed rate cut expectations.

That’s evident in the federal funds futures market, where softer-than-anticipated inflation data released Thursday morning unleashed a wave of buying of October contracts, which continued on Friday. Expiring Oct. 31, the contracts already fully price in a quarter-point rate cut at policymakers’ Sept. 18 meeting.

“The Fed is very well-placed to potentially cut in September,” said Marilyn Watson, head of global fundamental fixed-income strategy at BlackRock Inc., on Bloomberg TV. While she expects a quarter-point cut, “we think they’ll probably tee things up potentially in July. We know that the Fed has been very, very data dependent.”

Futures open-interest data from CME Group Inc. suggest that Thursday’s buying established new risk. Volume was just short of 260,000 contracts, a record for the October tenor. Buying interest remained high on Friday, with volume over 150,000 by 1:30 p.m. New York time

Business Company News White House Financials Currencies General Government Industry Markets North America Top News Unites States World Top World

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

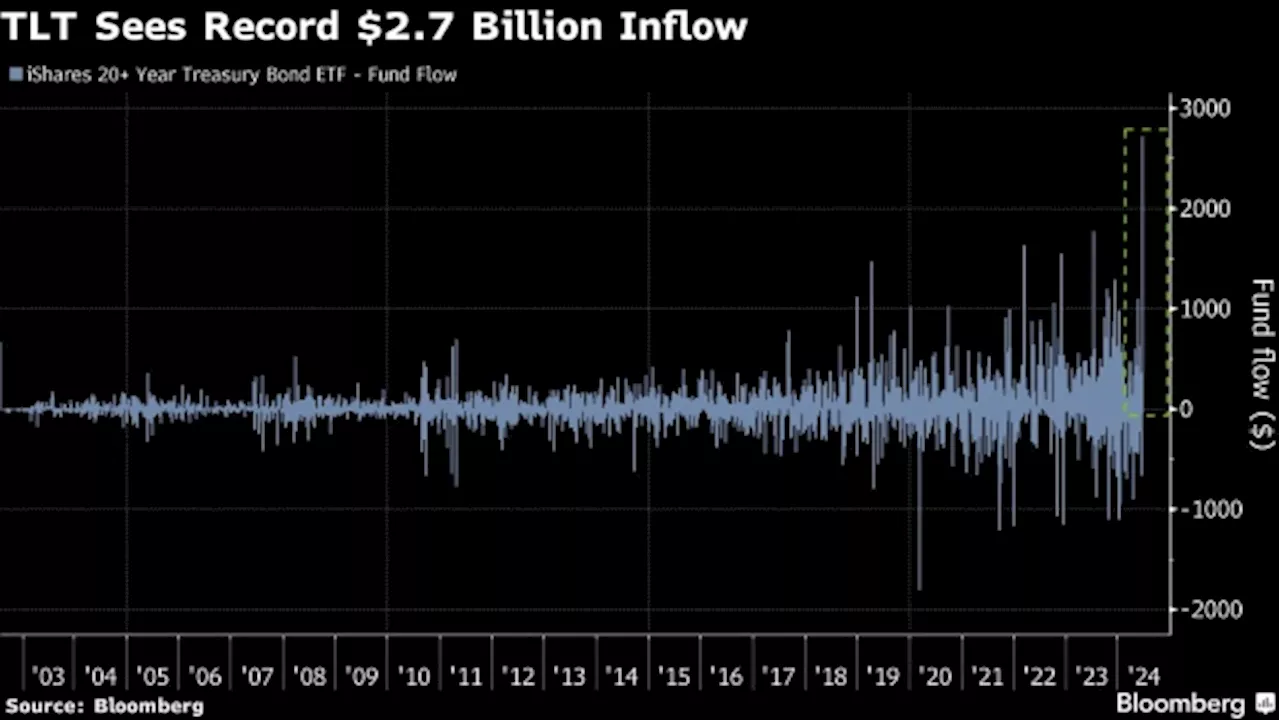

A $54 Billion Long-Bond ETF Sees Record Haul as Traders ‘Fight the Fed’The biggest long-duration bond ETF raked in record cash this week as a cohort of investors recalibrate bets on when the Federal Reserve will cut interest rates this year.

A $54 Billion Long-Bond ETF Sees Record Haul as Traders ‘Fight the Fed’The biggest long-duration bond ETF raked in record cash this week as a cohort of investors recalibrate bets on when the Federal Reserve will cut interest rates this year.

Read more »

Bond Traders Boldly Bet on 300 Basis Points of Fed Cuts by March(Bloomberg) -- Traders in the US rates options market are embracing a nascent wager on the Federal Reserve’s interest-rate path: a whopping 3 percentage...

Bond Traders Boldly Bet on 300 Basis Points of Fed Cuts by March(Bloomberg) -- Traders in the US rates options market are embracing a nascent wager on the Federal Reserve’s interest-rate path: a whopping 3 percentage...

Read more »

Bond Traders Boldly Bet on 300 Basis Points of Fed Cuts by MarchTraders in the US rates options market are embracing a nascent wager on the Federal Reserve’s interest-rate path: a whopping 3 percentage points worth of cuts in the next nine months.

Bond Traders Boldly Bet on 300 Basis Points of Fed Cuts by MarchTraders in the US rates options market are embracing a nascent wager on the Federal Reserve’s interest-rate path: a whopping 3 percentage points worth of cuts in the next nine months.

Read more »

For Bond Traders, Data Matter More Than What the Fed Is Saying(Bloomberg) -- The US bond market is driving home a lesson about the new world investors are living in: The data matter far more than anything the Federal...

For Bond Traders, Data Matter More Than What the Fed Is Saying(Bloomberg) -- The US bond market is driving home a lesson about the new world investors are living in: The data matter far more than anything the Federal...

Read more »

For Bond Traders, Data Matter More Than What the Fed Is SayingThe US bond market is driving home a lesson about the new world investors are living in: The data matter far more than anything the Federal Reserve might say.

For Bond Traders, Data Matter More Than What the Fed Is SayingThe US bond market is driving home a lesson about the new world investors are living in: The data matter far more than anything the Federal Reserve might say.

Read more »

Fed's Mester: Mortgage bond sales should remain option for FedAs she heads toward retirement at the end of the month, Federal Reserve Bank of Cleveland President Loretta Mester still believes the central bank needs to...

Fed's Mester: Mortgage bond sales should remain option for FedAs she heads toward retirement at the end of the month, Federal Reserve Bank of Cleveland President Loretta Mester still believes the central bank needs to...

Read more »