A banker who has spent more than three decades watching Japanese government bonds is bracing for the possibility that long-term yields hit levels unseen in a generation as the central bank moves away from negative rates.

Masamichi Koike, the head of global markets business at Japan’s second-largest lender, Sumitomo Mitsui Financial Group Inc., warns that 10-year yields could triple to 2% should inflation stay above the Bank of Japan’s target, prompting policymakers to eventually lift their short-term benchmark to 1%. The last time overnight rates were that high was in 1995, after the bubble economy burst.

The executive reminisces about the days when profits could be made by purchasing high-yielding bonds and selling them when central banks cut rates. Koike’s instincts on BOJ policy helped him navigate volatility in the wake of its surprise tweak to the yield-curve control in July. He had assigned a more than 50% probability to the move, building positions that delivered a profit for SMFG, which manages 33 trillion in securities, while many other investors were caught on the wrong foot.

Traders are trying to judge the level of yields needed for Japanese buyers to load up at home and offload foreign holdings, potentially setting off a repatriation that could exacerbate this year’s global bond selloff.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Renault CEO sees Ampere IPO valuation of up to 10 billion euros -FTPARIS (Reuters) - The initial public offering (IPO) of Renault's Ampere electric vehicle division could get a valuation of up to 10 billion euros ...

Renault CEO sees Ampere IPO valuation of up to 10 billion euros -FTPARIS (Reuters) - The initial public offering (IPO) of Renault's Ampere electric vehicle division could get a valuation of up to 10 billion euros ...

Read more »

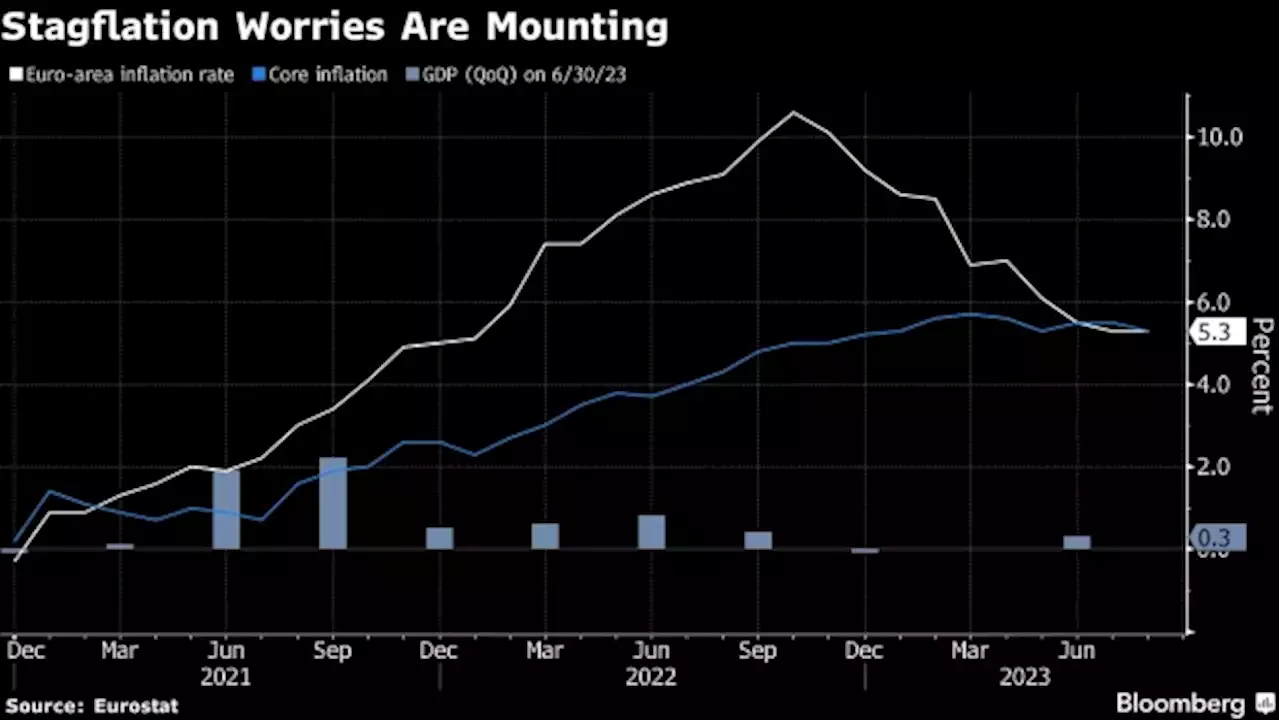

Lane Says ECB Sees Core Inflation Slowing in Coming MonthsECB Chief Economist Philip Lane offered a cautiously optimistic take on inflation, saying slowing in goods and services gauges are welcome and that underlying pressures will keep weakening.

Lane Says ECB Sees Core Inflation Slowing in Coming MonthsECB Chief Economist Philip Lane offered a cautiously optimistic take on inflation, saying slowing in goods and services gauges are welcome and that underlying pressures will keep weakening.

Read more »

Scope Rating sees 'collateral damage' from Italy's bad loan proposalMarket News

Scope Rating sees 'collateral damage' from Italy's bad loan proposalMarket News

Read more »

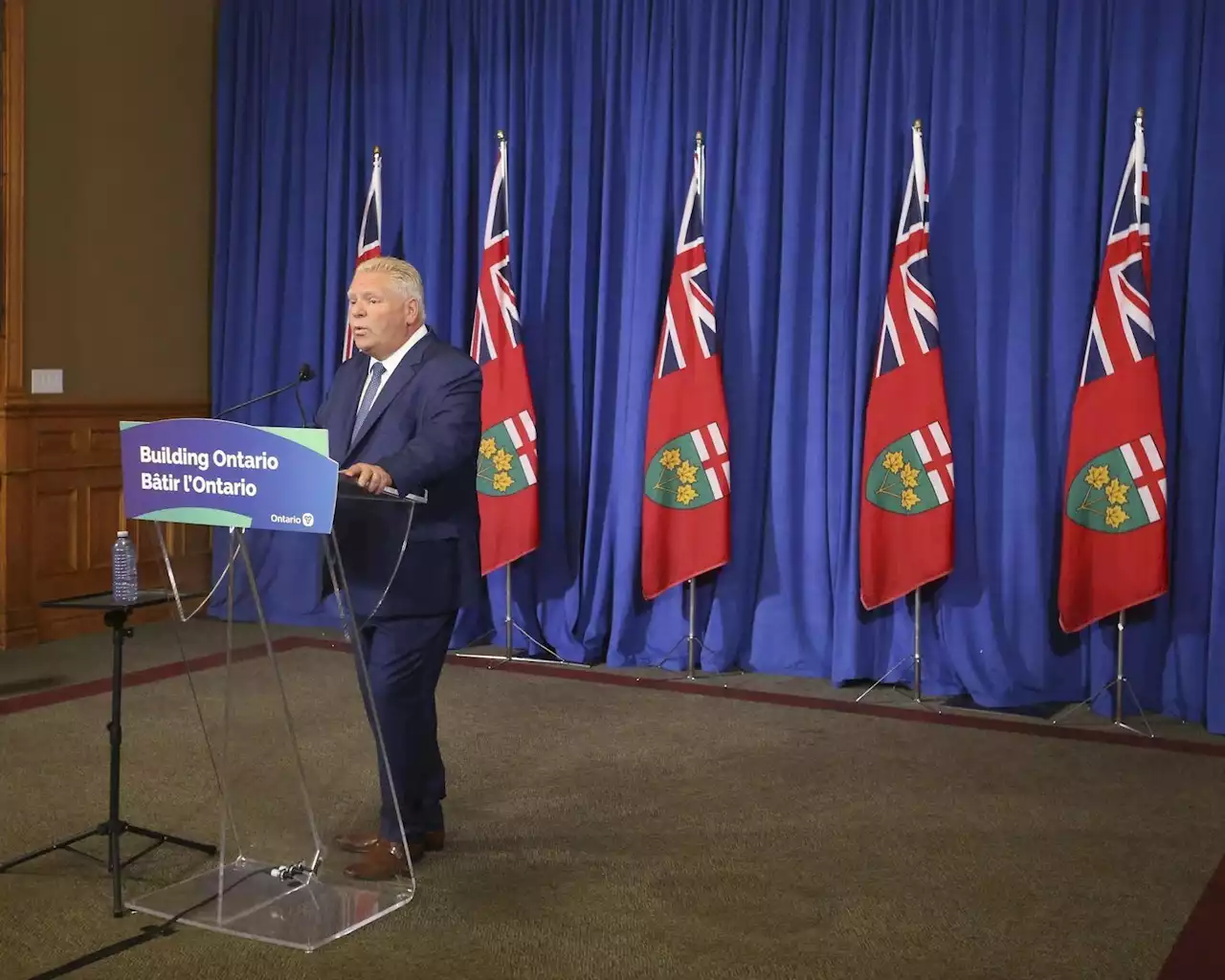

WARMINGTON: Finally Ford sees light and orders Greenbelt review he should have originallyBetter late than never! Finally, Doug Ford has read the room and realized on the Greenbelt file, something had to be done and done fast.

WARMINGTON: Finally Ford sees light and orders Greenbelt review he should have originallyBetter late than never! Finally, Doug Ford has read the room and realized on the Greenbelt file, something had to be done and done fast.

Read more »

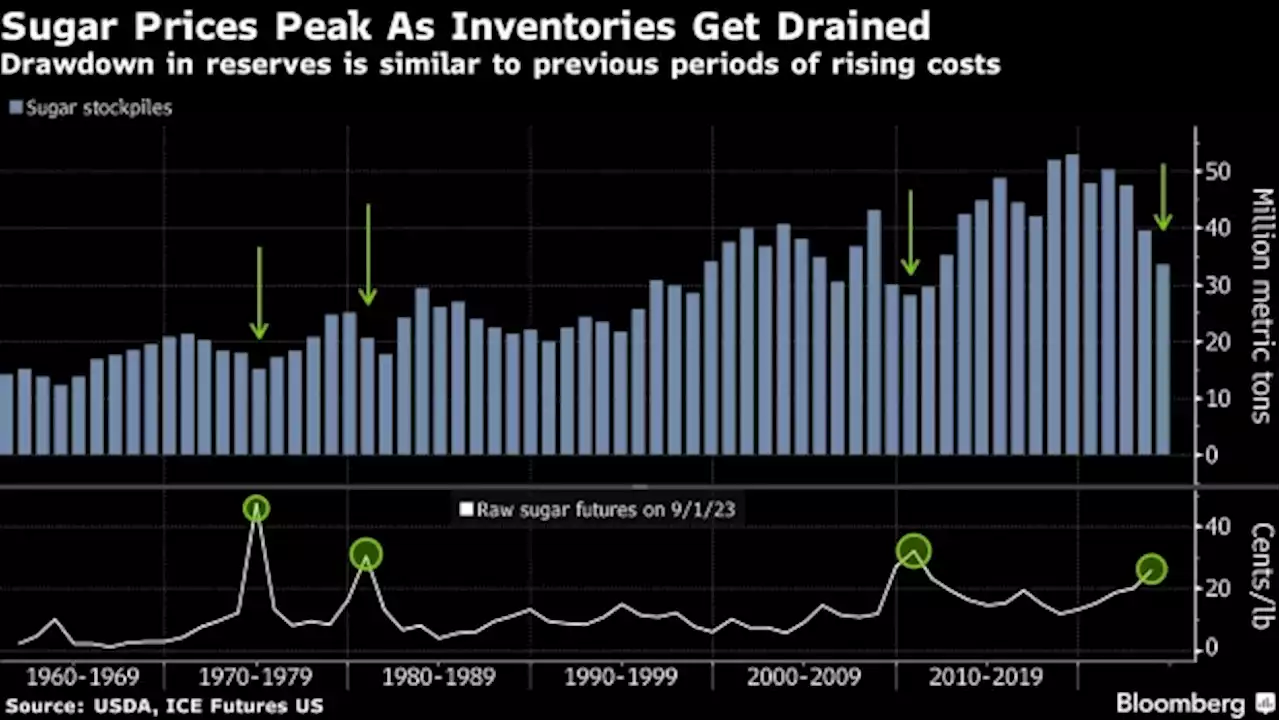

World’s Top Sugar Trader Sees Sixth Year of Shortages AheadThe world’s largest sugar trader expects a sixth straight year of deficits in the coming season as a poor outlook for India’s crops is set to drive down global stockpiles of the sweetener.

World’s Top Sugar Trader Sees Sixth Year of Shortages AheadThe world’s largest sugar trader expects a sixth straight year of deficits in the coming season as a poor outlook for India’s crops is set to drive down global stockpiles of the sweetener.

Read more »

August Slowdown Sees Home Prices Cool Off In Greater VancouverHome prices in the Greater Vancouver region have outperformed expectations this year, but dipped slightly in August.

August Slowdown Sees Home Prices Cool Off In Greater VancouverHome prices in the Greater Vancouver region have outperformed expectations this year, but dipped slightly in August.

Read more »