The European Central Bank and the Bank of England must keep raising interest rates to ward off the risk of causing “stagflation,” the prominent economist Nouriel Roubini warned.

Airline Stocks Tumble Into Bear Market on Soaring Oil PricesCathie Wood, Boaz Weinstein Among Winners From Bitcoin Fund BetZero-Day Options Boom Is Spilling Into $7.

4 Trillion ETF MarketFund Managers See Water Risk in Semiconductor Bets Being MispricedFranklin Templeton Joins Race to Offer US Spot Bitcoin ETFFear of Stock Market Dive Creeps Back as Hedging Costs ClimbNomura Crypto Chief Warns Market Rout May Delay Unit’s ProfitWinklevoss Claims Fuel US Investigation of Barry Silbert’s DCG Crypto EmpireTraders Unfazed as Soft-Landing Calls Stoke Bets on Market CalmTelevision deals, ratings generate record-setting NFL revenueAwareness still at disadvantage...

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

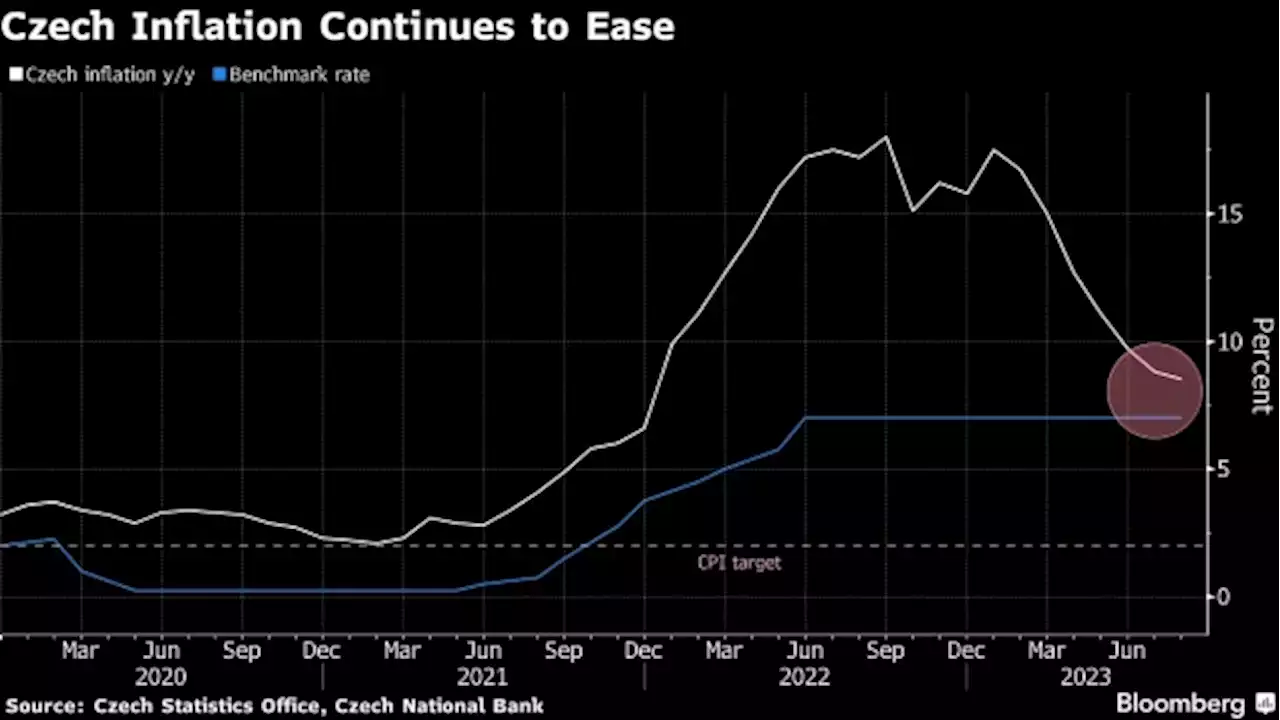

Czech Central Bank Head Says Don’t Expect Rate Cut Any Time SoonCzech central bankers must avoid easing monetary conditions any time soon because inflation remains “extremely high” and underlying price pressures are still elevated, according to Governor Ales Michl.

Czech Central Bank Head Says Don’t Expect Rate Cut Any Time SoonCzech central bankers must avoid easing monetary conditions any time soon because inflation remains “extremely high” and underlying price pressures are still elevated, according to Governor Ales Michl.

Read more »

Bank of England readies what may be its final rate hikeEconomists predict BoE will raise Bank Rate to 5.5% from 5.25%, which would mark its highest level since 2007

Bank of England readies what may be its final rate hikeEconomists predict BoE will raise Bank Rate to 5.5% from 5.25%, which would mark its highest level since 2007

Read more »

Japan's yen in spotlight ahead of 'live' BOJ meetingThe U.S. dollar and most major currencies were flatlining in early trades on Monday, barring a blip in sterling, as a Japanese holiday and a bunch of upcoming central bank meetings sucked the air out of markets. The Bank of Japan's policy meeting on Friday is the highlight of the week in Asia, after Governor Kazuo Ueda stoked speculation of an imminent move away from ultra-loose policy. In a week packed with central bank meetings, decisions are also due from the U.S. Federal Reserve on Wednesday and Bank of England on Thursday.

Japan's yen in spotlight ahead of 'live' BOJ meetingThe U.S. dollar and most major currencies were flatlining in early trades on Monday, barring a blip in sterling, as a Japanese holiday and a bunch of upcoming central bank meetings sucked the air out of markets. The Bank of Japan's policy meeting on Friday is the highlight of the week in Asia, after Governor Kazuo Ueda stoked speculation of an imminent move away from ultra-loose policy. In a week packed with central bank meetings, decisions are also due from the U.S. Federal Reserve on Wednesday and Bank of England on Thursday.

Read more »

BMO to shutter retail auto finance business as bad debt mountsMONTREAL — BMO Financial Group says it will close its retail auto finance business in order to reroute resources following a rise in bad debt. The Bank of Montreal also says the decision will trigger an unspecified number of layoffs in Canada and the U.S. It comes after the company's bad debt provisions more than tripled to $492 million in the quarter ended July 31 compared to a year earlier. In its retail line, the bank's provisions for credit losses rose 800 per cent to $81 million last quarte

BMO to shutter retail auto finance business as bad debt mountsMONTREAL — BMO Financial Group says it will close its retail auto finance business in order to reroute resources following a rise in bad debt. The Bank of Montreal also says the decision will trigger an unspecified number of layoffs in Canada and the U.S. It comes after the company's bad debt provisions more than tripled to $492 million in the quarter ended July 31 compared to a year earlier. In its retail line, the bank's provisions for credit losses rose 800 per cent to $81 million last quarte

Read more »

'Everybody should just shut up': Bank of Canada's independence under pressure from political commentsSome experts are fretting about central bank's independence when it comes to monetary policy

'Everybody should just shut up': Bank of Canada's independence under pressure from political commentsSome experts are fretting about central bank's independence when it comes to monetary policy

Read more »

'Everybody should just shut up': Bank of Canada's independence under pressure from political commentsSome experts are fretting about the Bank of Canada\u0027s independence when it comes to monetary policy. Find out more.

'Everybody should just shut up': Bank of Canada's independence under pressure from political commentsSome experts are fretting about the Bank of Canada\u0027s independence when it comes to monetary policy. Find out more.

Read more »