As fears of a severe US recession recede, investors flush with cash are looking to put money to work in junk assets. Companies with upcoming maturities are rushing to take advantage.

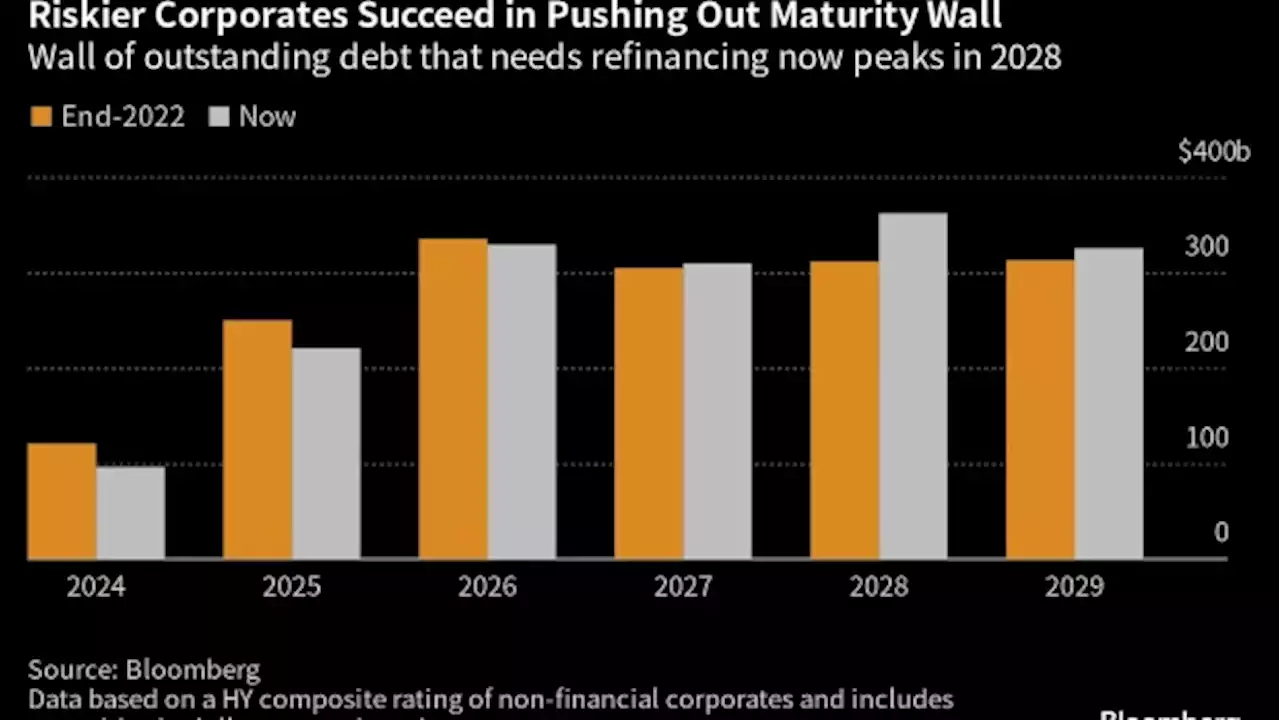

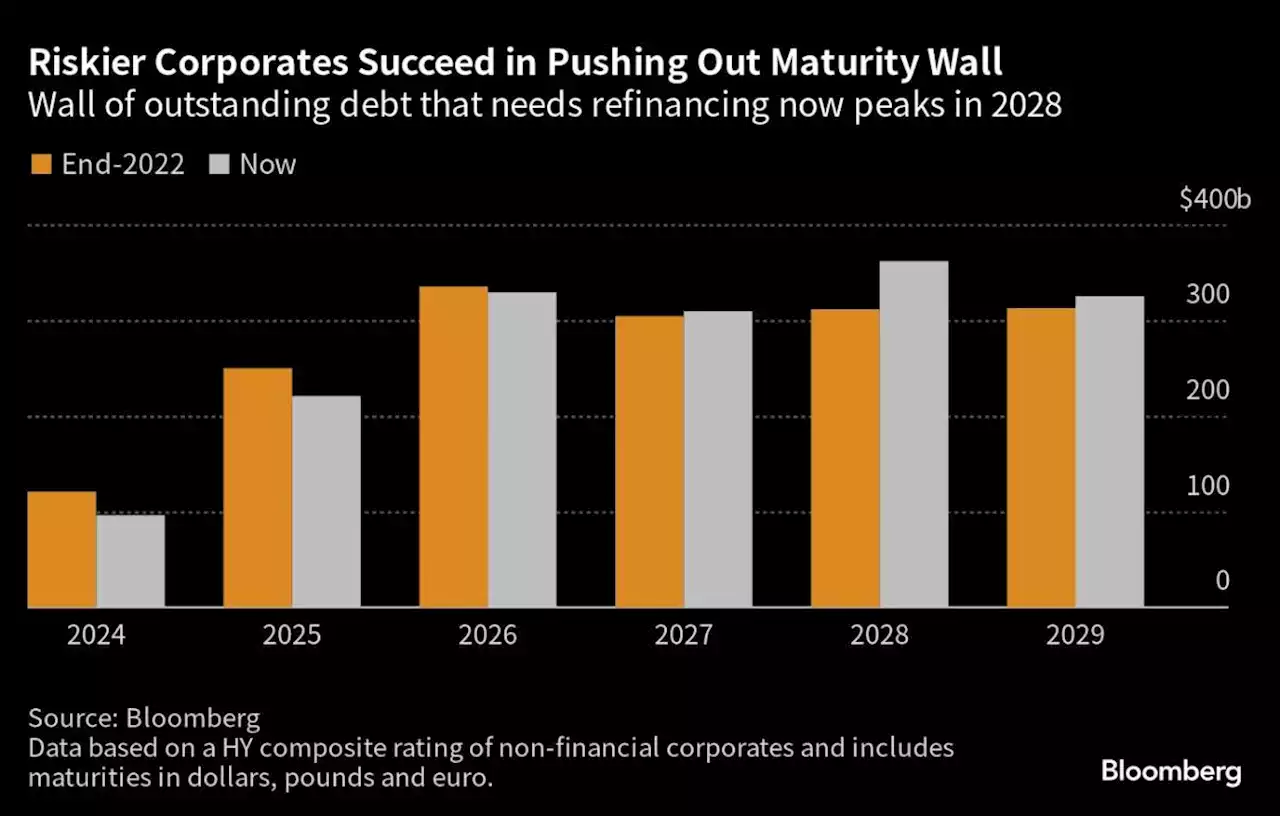

Anemic issuance means demand far exceeds supply in high-yield markets. That’s paved the way for borrowers to create a little more wiggle room via refinancing and amend-and-extend transactions ahead of a wall of more than $1.6 trillion of junk corporate debt that’s due for repayment through 2029.

“Credit spreads are now trading through our bull case in US investment grade and high yield, while approaching those levels in loans,” the strategists, including Vishwas Patkar, wrote in a note to clients. “While credit has lagged” the US rally in Europe, “overall valuations are also approaching our previous bull case targets.”

“Many corporates are choosing to wait for peak terminal rates to be behind us, allowing for a less steep increase in average cost of debt upon refinancing,” said Fraser Lundie, head of fixed income at Federated Hermes. “However, fundamentals will be increasingly challenged the longer we stay at peak terminal rate levels.”

For now, however, “a two-speed economy, sticky inflation and muddled global economic picture” looks to be “aiding high-yield assets generally but the most high-quality high-yield assets more specifically,” Bloomberg Intelligence’s chief US credit strategist Noel Hebert wrote in a note on Friday.The $1.5 trillion private credit market set a fresh record for the largest loan in its history. Lenders including Oak Hill Advisors LP, Blue Owl Capital Inc. and HPS Investment Partners LLC.

Apollo is poised to sign more than $4 billion in so-called NAV loans as it steps up unorthodox lending to private equity firms looking to raise cash in a challenging high-cost environment. Credit Agricole CIB recruited David Norton from Cantor Fitzgerald LP as a managing director in high-yield sales.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Risk Appetite Eases $1.6 Trillion Maturity Wall: Credit Weekly(Bloomberg) -- As fears of a severe US recession recede, investors flush with cash are looking to put money to work in junk assets. Companies with upcoming maturities are rushing to take advantage. Most Read from BloombergUS Consumers Near Day of Reckoning as Pandemic Cash Stash ShrinksVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkBiden’s Top Lawyer to Depart White House as Probes Ramp UpCohn and Summers Talk Trump, China and Machismo by a Hamptons PoolBama Rush Has Students Showc

Risk Appetite Eases $1.6 Trillion Maturity Wall: Credit Weekly(Bloomberg) -- As fears of a severe US recession recede, investors flush with cash are looking to put money to work in junk assets. Companies with upcoming maturities are rushing to take advantage. Most Read from BloombergUS Consumers Near Day of Reckoning as Pandemic Cash Stash ShrinksVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkBiden’s Top Lawyer to Depart White House as Probes Ramp UpCohn and Summers Talk Trump, China and Machismo by a Hamptons PoolBama Rush Has Students Showc

Read more »

Ottawa eases foreign worker paperwork for 'trusted employers'Feds extending validity of Labour Market Impact Assessment for certain companies

Ottawa eases foreign worker paperwork for 'trusted employers'Feds extending validity of Labour Market Impact Assessment for certain companies

Read more »

Applied Materials Gives Strong Forecast as Chip Slump EasesApplied Materials Inc., the largest US maker of chipmaking machinery, gave a bullish forecast for the current quarter, indicating that an industry slump may be fading.

Applied Materials Gives Strong Forecast as Chip Slump EasesApplied Materials Inc., the largest US maker of chipmaking machinery, gave a bullish forecast for the current quarter, indicating that an industry slump may be fading.

Read more »

Ottawa eases foreign worker paperwork for 'trusted employers'Feds extending validity of Labour Market Impact Assessment for certain companies

Ottawa eases foreign worker paperwork for 'trusted employers'Feds extending validity of Labour Market Impact Assessment for certain companies

Read more »

Japan core inflation eases but price pressure remainsBy Tetsushi Kajimoto TOKYO (Reuters) - Japan's core consumer inflation slowed in July but stayed above the Bank of Japan's (BOJ) price target for the ...

Japan core inflation eases but price pressure remainsBy Tetsushi Kajimoto TOKYO (Reuters) - Japan's core consumer inflation slowed in July but stayed above the Bank of Japan's (BOJ) price target for the ...

Read more »

Japan's core inflation eases, bolstering view BOJ will stand patBy Tetsushi Kajimoto TOKYO (Reuters) -Japan's core consumer prices slowed in July, supporting expectations the Bank of Japan (BOJ) will be in no rush to ...

Japan's core inflation eases, bolstering view BOJ will stand patBy Tetsushi Kajimoto TOKYO (Reuters) -Japan's core consumer prices slowed in July, supporting expectations the Bank of Japan (BOJ) will be in no rush to ...

Read more »