Seventy-six other retirees over the past two years turned to Fidrec after buying financial products that left them worse off.

We all put a huge amount of trust in banks, but sometimes that trust is misplaced, as five retirees found out in recent years when they were misled into buying unsuitable products that brought only financial pain.

It took a year for the man to realise that he had been taken for a ride: He had not received any income and he had to fork out a significant sum for interest on the loan. For instance, anyone who tries to sell products to people over 62 years old who are not proficient in spoken or written English must take more steps to verify that the buyers truly understand the risks and benefits.

Overall, Fidrec received 525 “market conduct claims” in the last two years involving customers of all ages who suffered losses after buying investment products. The man, who is not proficient in English as he had only primary school education, told the manager at the meeting that he wanted a stable and consistent income for his retirement and would renew his fixed deposit as usual.

But the retiree said the forms stated that he had secondary school education, a decent income and experience in investment-linked policies. In this case, an insurance agent sold an investment-linked policy to her friend who worked as a flight attendant. The annual premium was $12,000 with a payment term of 70 years. Her friend signed all the documents because she was under the impression that she could reduce the premium amount at any time.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Jail for retrenched chef, 27, hired by Chinese police impersonators to use forged MAS papers to scam retireeSINGAPORE — Soon after he was retrenched as a chef, a man in his 20s was tricked into giving up his personal details to scammers.

Jail for retrenched chef, 27, hired by Chinese police impersonators to use forged MAS papers to scam retireeSINGAPORE — Soon after he was retrenched as a chef, a man in his 20s was tricked into giving up his personal details to scammers.

Read more »

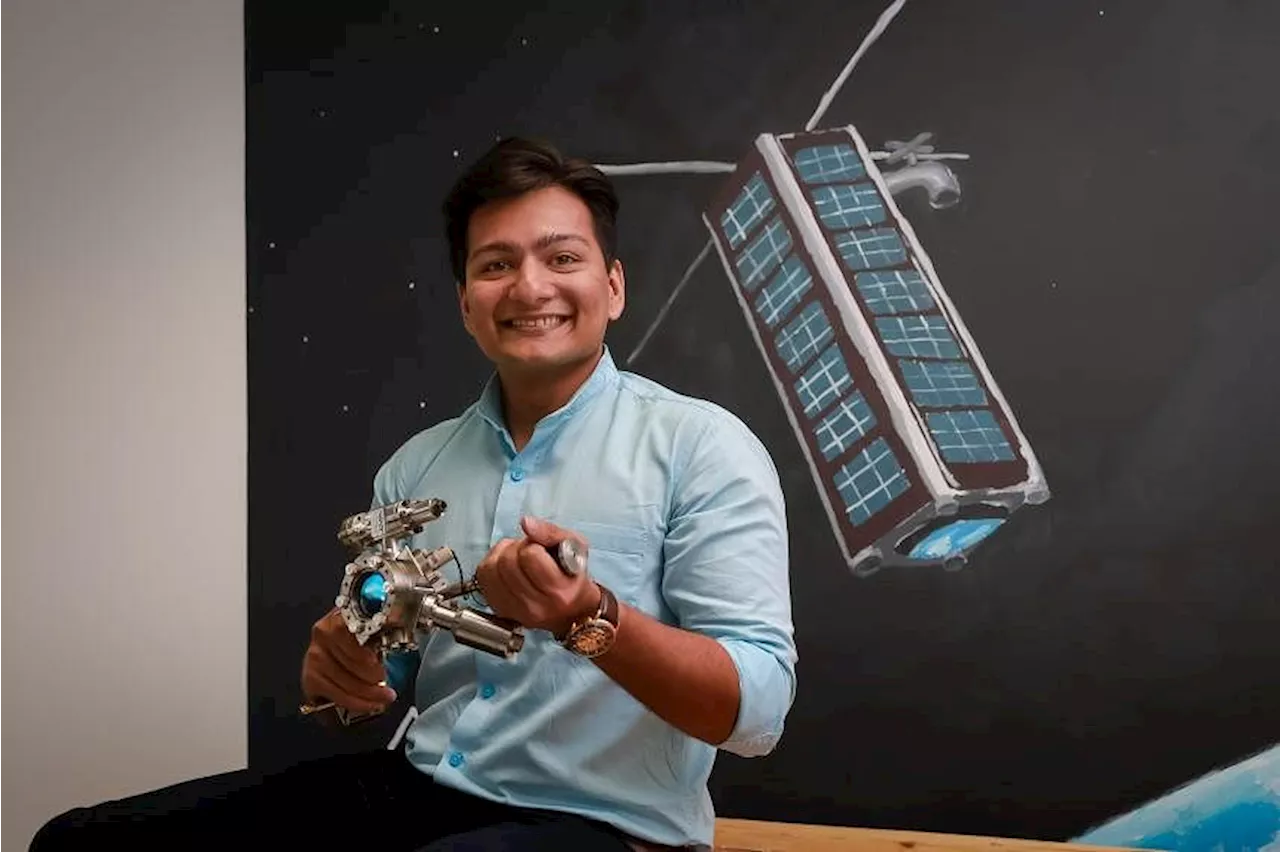

Me & My Money: He put all his eggs in one start-up to commit to its successStart-up founder believes key metric to track in investing is time in the market rather than timing the market.

Me & My Money: He put all his eggs in one start-up to commit to its successStart-up founder believes key metric to track in investing is time in the market rather than timing the market.

Read more »

Is investing in property near JB’s RTS Link a good idea?Although this may be a “no” for some, others find this to be a potential earning opportunity, and we have some key factors to ponder as well

Is investing in property near JB’s RTS Link a good idea?Although this may be a “no” for some, others find this to be a potential earning opportunity, and we have some key factors to ponder as well

Read more »

Uni grad with S$37k savings worries about high cost of therapyThe 22-year-old student said she is facing deep financial insecurity as she's paying for school and her expenses herself.

Uni grad with S$37k savings worries about high cost of therapyThe 22-year-old student said she is facing deep financial insecurity as she's paying for school and her expenses herself.

Read more »

Despite repaying over $15,000 for $300 debt, Malaysian family still hounded by loan sharksHe repaid his debt many times over, but loan sharks continued to hound his family for months. A Malaysian man working in Singapore took a $300 loan online and ended up repaying a total of $15,000, China Press reported. On Monday (March 4), Yang Zhiyong, 25, asked the loan sharks in question to stop harassing him as he had repaid...

Despite repaying over $15,000 for $300 debt, Malaysian family still hounded by loan sharksHe repaid his debt many times over, but loan sharks continued to hound his family for months. A Malaysian man working in Singapore took a $300 loan online and ended up repaying a total of $15,000, China Press reported. On Monday (March 4), Yang Zhiyong, 25, asked the loan sharks in question to stop harassing him as he had repaid...

Read more »

Man, 40, arrested for loan shark harassmentA 40-year-old man suspected of loan shark harassment in Sengkang was arrested on March 7, after a three-day police investigation. He is believed to be involved in other cases of loan sharking islandwide, said the police in a statement on March 8. They were alerted...

Man, 40, arrested for loan shark harassmentA 40-year-old man suspected of loan shark harassment in Sengkang was arrested on March 7, after a three-day police investigation. He is believed to be involved in other cases of loan sharking islandwide, said the police in a statement on March 8. They were alerted...

Read more »