The increase of the sales and service tax (SST) being collected from 6% to 8% kicks in today, including for e-commerce and streaming services.

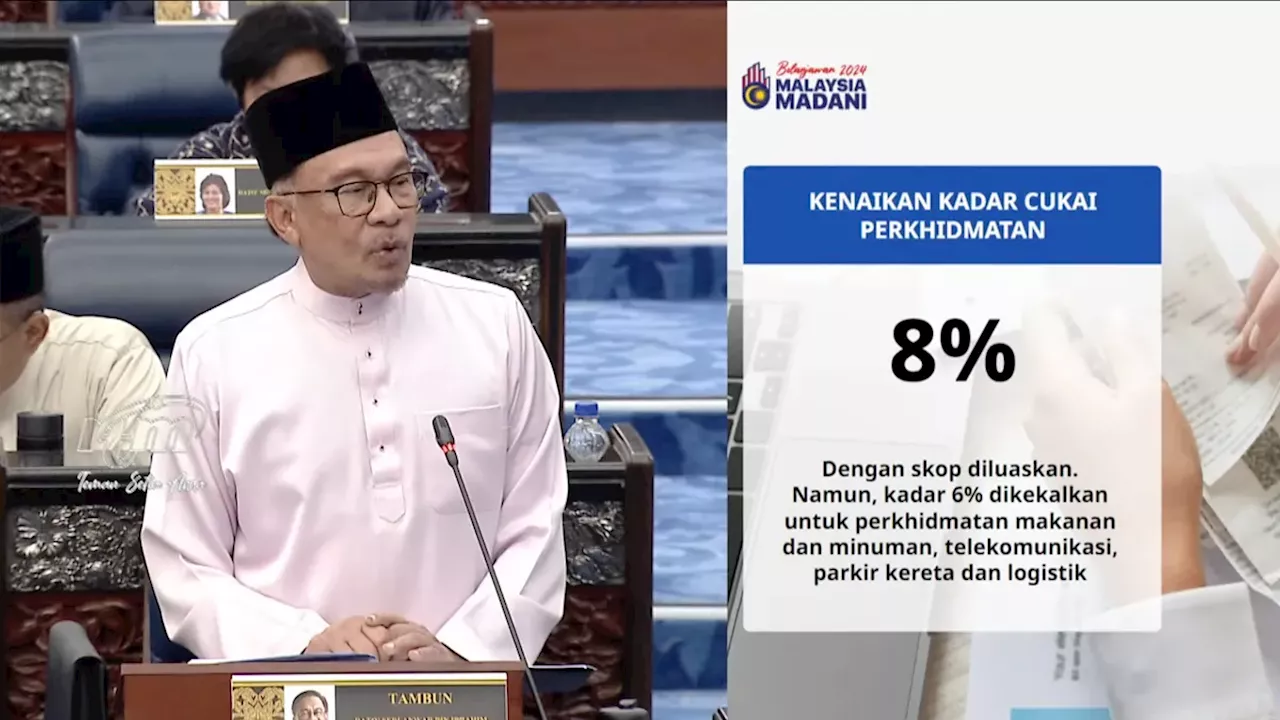

During the tabling of Budget 2024 last October, prime minister and finance minister Anwar Ibrahim announced that the sales and service tax rate will be increased from 6% to 8%. This was announce to be effective starting 1 March, which is today, so expect most things to see a small jump in price moving forward.

In case you missed it, this will not apply to a small number of services. These are ones related to food and beverages, as well as telecommunication, which will remain at the previous 6% SST rate. There's the possibility of electricity and water bills being part of the exception, but the government has not come to a final decision on this yet.

On the flip side, what is definitely being affected by the 2% increase in SST rate are e-commerce platforms and streaming services. On the former, platforms like Lazada and Shopee have already indicated their implementation of this change, mostly via the way it would affect sellers on their respective platforms.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Wee Ka Siong Praised for Begging Govt to Exempt SST Hike on Water & Electricity BillsIt's no secret that Malaysians, especially those from the B40 and M40 communities, are struggling with inflation and the price hikes that come with it.

Read more »

Sales and services tax hike not expected to cause sharp price increases, says Finance MinistryThe sales and services tax (SST) hike is not expected to cause sharp price increases that would lead to an economic shock, says the Finance Ministry. The statement also noted the 2% increase would affect discretionary activities and business-to-business services, while key essential services such as food and beverage, telecommunications, parking and logistics are exempt. Meanwhile starting March 1, electricity users over 600kWh will be affected by the sales and services tax (SST) hike from 6% to 8% among other services. The increased SST is set to generate an additional RM3bil revenue, said the Finance Ministry.

Sales and services tax hike not expected to cause sharp price increases, says Finance MinistryThe sales and services tax (SST) hike is not expected to cause sharp price increases that would lead to an economic shock, says the Finance Ministry. The statement also noted the 2% increase would affect discretionary activities and business-to-business services, while key essential services such as food and beverage, telecommunications, parking and logistics are exempt. Meanwhile starting March 1, electricity users over 600kWh will be affected by the sales and services tax (SST) hike from 6% to 8% among other services. The increased SST is set to generate an additional RM3bil revenue, said the Finance Ministry.

Read more »

Kapar crash: Postmortem of victims expected to be completed todayAfter 36 years of marriage and five children, this couple still seem like newlyweds, holding hands and going everywhere together.

Kapar crash: Postmortem of victims expected to be completed todayAfter 36 years of marriage and five children, this couple still seem like newlyweds, holding hands and going everywhere together.

Read more »

Bersih demo today signals patience running thin with unity government amid sluggish reform, say analystsKUALA LUMPUR, Feb 27 — The slow pace of reforms, opacity in governance, and a notable departure from election promises were the driving factors behind electoral watchdog...

Bersih demo today signals patience running thin with unity government amid sluggish reform, say analystsKUALA LUMPUR, Feb 27 — The slow pace of reforms, opacity in governance, and a notable departure from election promises were the driving factors behind electoral watchdog...

Read more »

Traditional and Complementary Medicine Services Exempted from Sales and Service TaxConsumers can heave a sigh of relief as Traditional and Complementary Medicine (T&CM) services will now be exempted from the 8% Sales and Service Tax (SST) from March 1, a U-turn from what was previously gazetted. This reversal by the Finance Ministry reflects a consideration for the well-being of the people, prioritising healthcare accessibility.

Traditional and Complementary Medicine Services Exempted from Sales and Service TaxConsumers can heave a sigh of relief as Traditional and Complementary Medicine (T&CM) services will now be exempted from the 8% Sales and Service Tax (SST) from March 1, a U-turn from what was previously gazetted. This reversal by the Finance Ministry reflects a consideration for the well-being of the people, prioritising healthcare accessibility.

Read more »