Blow-out growth in the $1.7 trillion private credit market has come at a cost, namely investors’ inability to exit their holdings in a crunch. Now a market where investors can unload their stakes is taking shape.

India Grants Marine Insurance Approval for Russian FirmsMangaluru to Test Development Versus Hindutva Split: India VotesMamaearth Parent Bets on Made-for-India Goods in World’s Fastest Growing Beauty MarketMicrosoft, Alphabet Face a ‘Show Me’ Moment After Meta MisfireUS Economy Slows and Inflation Jumps, Damping Soft-Landing Hopes‘A Damn Hard Thing to Do’: Tesla Co-Founder JB Straubel Takes on Battery RecyclingHomebuyers Shun New Real Estate in Vancouver, Hurting BuildersIPO Rebound Creates $5.

7 Billion Stadium Project on LakefrontKotak Shares Tumble After Ban on Cards and New Online ClientsUK Futures Broker Marex Group’s IPO Raises $292 MillionFDIC Officials Seek More Power Over ‘Passive’ Bank InvestmentsUS Pending Home Sales Jump in March to Hit Highest in YearUS Economy Slows and Inflation Jumps, Damping Soft-Landing HopesHonda to Spend $11 Billion on Electric Vehicle Strategy in CanadaDeFi Comeback Renews Questions of the Sustainability of 20% ReturnsSouth Africa Mines Minister...

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Private Credit Faces Liquidity Risks If Stress Rises, IMF SaysRegulators should scrutinize the fast-growing private-credit market more closely, given potential concerns ranging from demands on funds’ liquidity to the quality of underlying borrowers, the International Monetary Fund said in a report.

Private Credit Faces Liquidity Risks If Stress Rises, IMF SaysRegulators should scrutinize the fast-growing private-credit market more closely, given potential concerns ranging from demands on funds’ liquidity to the quality of underlying borrowers, the International Monetary Fund said in a report.

Read more »

Nigeria Curbs Banks’ Ability to Grant Loan to Reduce Market LiquidityNigeria’s central bank curbed the ability of banks to grant loans as it seeks to reduce market liquidity and help reduce an inflation rate that rose to a 28-year high in March.

Nigeria Curbs Banks’ Ability to Grant Loan to Reduce Market LiquidityNigeria’s central bank curbed the ability of banks to grant loans as it seeks to reduce market liquidity and help reduce an inflation rate that rose to a 28-year high in March.

Read more »

Nigeria Curbs Banks’ Ability to Grant Loan to Reduce Market Liquidity(Bloomberg) -- Nigeria’s central bank curbed the ability of banks to grant loans as it seeks to reduce market liquidity and help reduce an inflation rate...

Nigeria Curbs Banks’ Ability to Grant Loan to Reduce Market Liquidity(Bloomberg) -- Nigeria’s central bank curbed the ability of banks to grant loans as it seeks to reduce market liquidity and help reduce an inflation rate...

Read more »

Citi’s Muni Exit Creates Liquidity Test If Downturn Hits MarketThe recent departure of Citigroup Inc., a perennial top-10 underwriter of municipal debt, from that industry may eventually pose a challenge in the next muni downturn, said officials at two of the largest market participants.

Citi’s Muni Exit Creates Liquidity Test If Downturn Hits MarketThe recent departure of Citigroup Inc., a perennial top-10 underwriter of municipal debt, from that industry may eventually pose a challenge in the next muni downturn, said officials at two of the largest market participants.

Read more »

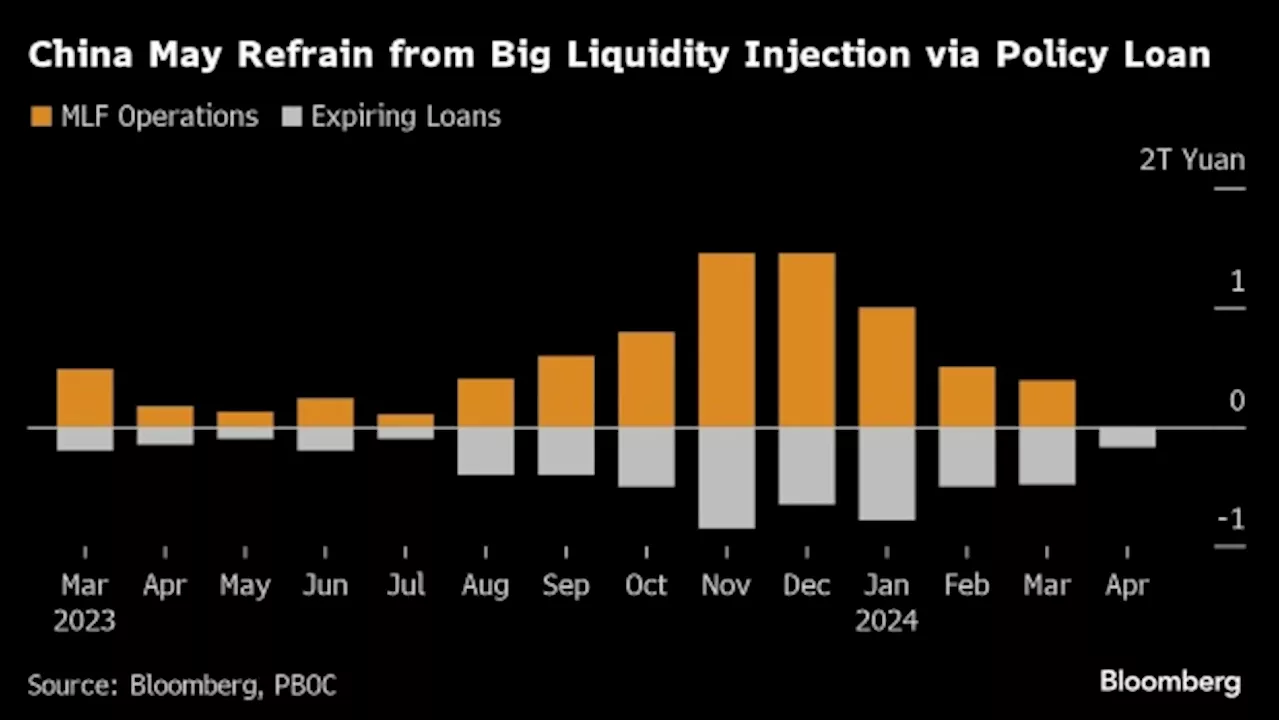

China Set to Keep Key Rate, Liquidity Steady to Cement RecoveryChina is expected to maintain its key interest rate and liquidity levels in order to solidify its economic recovery.

China Set to Keep Key Rate, Liquidity Steady to Cement RecoveryChina is expected to maintain its key interest rate and liquidity levels in order to solidify its economic recovery.

Read more »

Vanke Shares Rise After Builder Vows to Address Liquidity WoesChina Vanke Co. shares rose the most in more than a month after the state-backed builder said it has made plans to resolve liquidity pressure.

Vanke Shares Rise After Builder Vows to Address Liquidity WoesChina Vanke Co. shares rose the most in more than a month after the state-backed builder said it has made plans to resolve liquidity pressure.

Read more »