Senior Technical Analyst Jim Wyckoff prepares investors with an overview of how the markets opened and closed. What moved metal prices? How do the technicals look? By looking at important developments

- Gold and silver prices are higher and hit daily highs in early U.S. trading Friday, on the heels of a major U.S. monthly economic report that landed in the camp of the U.S. monetary policy doves. Gold prices notched a three-week high. December gold was last up $13.60 at $1,980.00 and December silver was up $0.398 at $25.215.

Asian stock markets were mixed and European stock markets mostly up in overnight trading. U.S. stock indexes are pointed to higher openings when the New York day session begins. The U.S. stock indexes have posted good rebounds recently. However, veteran market watchers know history shows the months of September and October can be turbulent ones for the stock and financial markets.

Meantime, the Euro zone reported its August manufacturing PMI was 43.5 versus expectations for a reading of 43.7, and compares with the July reading of 42.7. Other U.S. economic data due for release Friday includes the U.S. manufacturing PMI, the ISM report on business manufacturing, the global manufacturing PMI, domestic auto industry sales and construction spending.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Thursday’s analyst upgrades and downgradesInside the Market’s roundup of some of today’s key analyst actions

Thursday’s analyst upgrades and downgradesInside the Market’s roundup of some of today’s key analyst actions

Read more »

Canaccord analyst sees ‘increasingly appealing dividend yield proposition’ for Canadian banksDaily roundup of research and analysis from The Globe and Mail’s market strategist Scott Barlow is reading today on the Web

Canaccord analyst sees ‘increasingly appealing dividend yield proposition’ for Canadian banksDaily roundup of research and analysis from The Globe and Mail’s market strategist Scott Barlow is reading today on the Web

Read more »

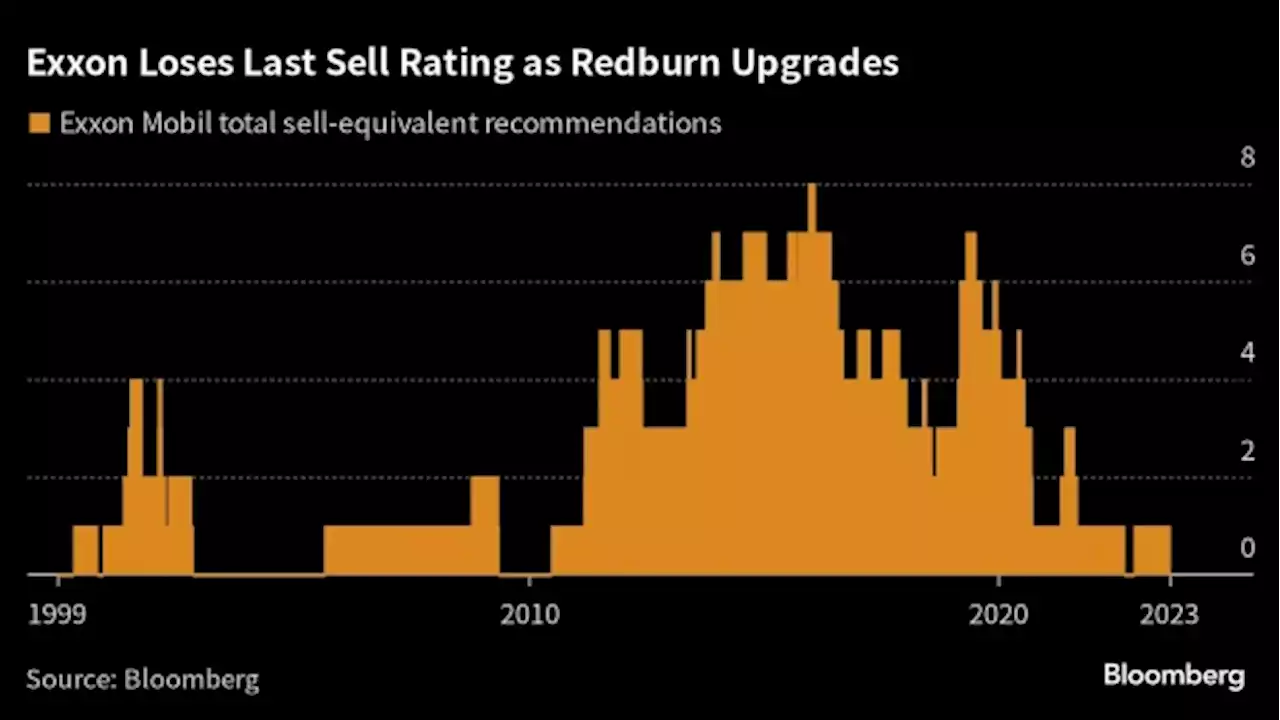

Exxon’s Last Bearish Analyst Taps Out After Oil Rally Prompts UpgradeExxon Mobil Corp. has shaken off its last bearish rating as a breakneck rally in oil prices spurred Redburn to upgrade the oil major to neutral.

Exxon’s Last Bearish Analyst Taps Out After Oil Rally Prompts UpgradeExxon Mobil Corp. has shaken off its last bearish rating as a breakneck rally in oil prices spurred Redburn to upgrade the oil major to neutral.

Read more »

Dollar General 'not winning at this moment' over sales, shrink: AnalystDiscount retailer Dollar General (DG) is seeing its shares dive this morning as the chain cuts its full-year forecast and warns on the lasting impact of inventory shrink, or retail theft. Telsey Advisory Group Analyst Joe Feldman joins Yahoo Finance Live to discuss the consumer environment for Dollar General and its discount retail peers Dollar Tree (DLTR) and Five Below (FIVE). 'I think the surprise for me is on the top line,' Feldman says, comparing Dollar General to its discount and dollar store competitors. 'So even though some of those others have taken down their guidance for the full year, it was really more because of the increase in shrinkage related to the profitability pressure. It wasn't because of sales. That's a bit more concerning here with Dollar Tree, that the sales are a bit tougher.' Feldman also comments on back-to-school drivers boosting discount retailers.

Dollar General 'not winning at this moment' over sales, shrink: AnalystDiscount retailer Dollar General (DG) is seeing its shares dive this morning as the chain cuts its full-year forecast and warns on the lasting impact of inventory shrink, or retail theft. Telsey Advisory Group Analyst Joe Feldman joins Yahoo Finance Live to discuss the consumer environment for Dollar General and its discount retail peers Dollar Tree (DLTR) and Five Below (FIVE). 'I think the surprise for me is on the top line,' Feldman says, comparing Dollar General to its discount and dollar store competitors. 'So even though some of those others have taken down their guidance for the full year, it was really more because of the increase in shrinkage related to the profitability pressure. It wasn't because of sales. That's a bit more concerning here with Dollar Tree, that the sales are a bit tougher.' Feldman also comments on back-to-school drivers boosting discount retailers.

Read more »

Goldman Sachs tech conference: Analyst's 3 things to watchThe Goldman Sachs Communacopia + Technology Conference is set to begin Tuesday, September 5th. Kash Rangan, Goldman Sachs U.S. Software Equity Research Analyst, explains 'three big things' to look out for from the conference. Rangan says what he's telling clients 'to look for is what kind of uptick we’re going to see with generative AI' in calendar ’24. Rangan notes that 'we’ve seen a slew of launches' from companies like Microsoft (MSFT), Salesforce (CRM), ServiceNow (NOW), and Adobe (ADBE), and these companies are hoping 'to get more customer wallet share in return for all the productivity.' 'So when is that going to start to really manifest in revenue?,' Rangan says. The second thing is 'what’s happening with macro?,' Rangan says. Last year, 'we were heading into this inflation spiral... company growth rates start to really decelerate,' Rangan notes, but 'now, we’re at a point where things are stabilizing.' So, Rangan says, 'what is your macro outlook? What is the pulse of the spending environment?' and 'what do budgets for calendar ’24 look like?' The third thing is, 'when are you going to start to hire?,' Rangan says. 'There’s no growth in the software industry unless you really hire,' Rangan explains. We’ve seen layoffs and hiring freezes, but when is 'that going to start to turn around?,' Rangan adds. Be sure to tune in next week to see Yahoo Finance Executive Editor Brian Sozzi's interviews with some of the biggest names attending the Goldman Sachs Communacopia + Technology Conference.

Goldman Sachs tech conference: Analyst's 3 things to watchThe Goldman Sachs Communacopia + Technology Conference is set to begin Tuesday, September 5th. Kash Rangan, Goldman Sachs U.S. Software Equity Research Analyst, explains 'three big things' to look out for from the conference. Rangan says what he's telling clients 'to look for is what kind of uptick we’re going to see with generative AI' in calendar ’24. Rangan notes that 'we’ve seen a slew of launches' from companies like Microsoft (MSFT), Salesforce (CRM), ServiceNow (NOW), and Adobe (ADBE), and these companies are hoping 'to get more customer wallet share in return for all the productivity.' 'So when is that going to start to really manifest in revenue?,' Rangan says. The second thing is 'what’s happening with macro?,' Rangan says. Last year, 'we were heading into this inflation spiral... company growth rates start to really decelerate,' Rangan notes, but 'now, we’re at a point where things are stabilizing.' So, Rangan says, 'what is your macro outlook? What is the pulse of the spending environment?' and 'what do budgets for calendar ’24 look like?' The third thing is, 'when are you going to start to hire?,' Rangan says. 'There’s no growth in the software industry unless you really hire,' Rangan explains. We’ve seen layoffs and hiring freezes, but when is 'that going to start to turn around?,' Rangan adds. Be sure to tune in next week to see Yahoo Finance Executive Editor Brian Sozzi's interviews with some of the biggest names attending the Goldman Sachs Communacopia + Technology Conference.

Read more »