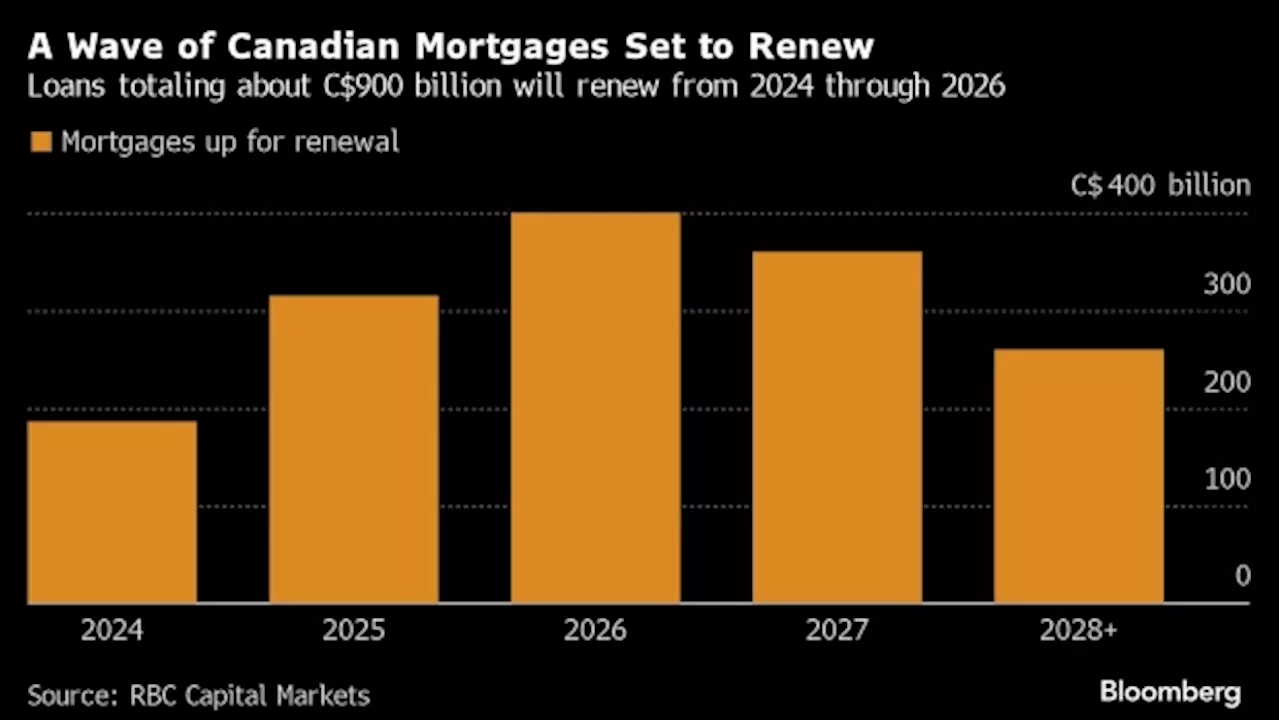

With 60% of Canadian mortgages set to come up for renewal within the next three years, homeowners are facing a “payment shock” unless interest rates come down in a significant way, according to Royal Bank of Canada.

Nigeria’s Rising Food Prices Hit Nation’s Beloved Jollof DishIsrael Latest: Netanyahu Under Pressure as Ground War ExpandsJefferies Sees 25% Drop in India Stocks if BJP Loses 2024 PollsBrazil’s Lula Taps Two New Central Bank Directors as Rate Cuts ContinueConsultant Aksia Withdraws Approval for Brookfield Fund After Leaders ExitGold Holds Near $2,000 After Israel Starts Ground OffensiveKrispy Kreme Drops on Worries Ozempic Will Hit Doughnut DemandSoFi Surges Most in Three Months on Higher...

2 Billion Asset Sale Windfall: The London RushWar With Hamas Tests Israel’s Economic Resilience to Its LimitIt’s Time to Short European Banks After Rally, JPMorgan SaysHSBC Says China Property Sector May Worsen, Sets Aside FundsHouse Prices Are Falling in Most Parts of the UK, Zoopla SaysUAW Urges All Unions in US to Prepare for May Day 2028 StrikesNovogratz Reiterates That He Expects Spot Bitcoin ETF Approval This YearWestern Digital to Split Into Two Public, Data-Storage CompaniesHackers...

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

RBC Capital Market's Report Warns of Mortgage Payment Shock in Canadian BanksRBC Capital Market's bank research team predicts a significant increase in mortgage payments in the next three years, posing a risk to Canadian banks. Unless interest rates decline, credit losses are expected to rise in 2025 and beyond.

RBC Capital Market's Report Warns of Mortgage Payment Shock in Canadian BanksRBC Capital Market's bank research team predicts a significant increase in mortgage payments in the next three years, posing a risk to Canadian banks. Unless interest rates decline, credit losses are expected to rise in 2025 and beyond.

Read more »

Young Canadians more anxious about debt, more likely to miss a bill payment, Equifax saysIn a survey conducted in September, Equifax Canada says 36% of younger adults reported having missed a bill payment this year, compared with 23% overall

Young Canadians more anxious about debt, more likely to miss a bill payment, Equifax saysIn a survey conducted in September, Equifax Canada says 36% of younger adults reported having missed a bill payment this year, compared with 23% overall

Read more »

Young Canadians more likely to have missed a bill payment this year: surveyEquifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.

Young Canadians more likely to have missed a bill payment this year: surveyEquifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.

Read more »

Young Canadians more anxious about debt, more likely to miss a bill payment: EquifaxEquifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.

Young Canadians more anxious about debt, more likely to miss a bill payment: EquifaxEquifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.

Read more »

Young Canadians more anxious about debt, more likely to miss a bill payment: EquifaxEquifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.

Young Canadians more anxious about debt, more likely to miss a bill payment: EquifaxEquifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.

Read more »

Young Canadians more anxious about debt, more likely to miss a bill payment: EquifaxTORONTO — Equifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.

Young Canadians more anxious about debt, more likely to miss a bill payment: EquifaxTORONTO — Equifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.

Read more »