The multi-manager model has generated years of exceptional returns. But rising interest rates and a brutal battle for talent are now taking their toll.

As an undergraduate at Harvard University, Ken Griffin had a satellite dish installed on the roof of his dorm room so he could trade convertible bonds, laying the foundations for the launch of his Citadel hedge fund in 1990.

The ascent of the firm, which now has $US62 billion under management, illustrates the rise of the multi-manager model. Over the past five years in particular, it has emerged as the fastest-growing and most profitable corner of the global hedge fund industry. said one large investor. During that episode, a number of quantitative hedge funds faced substantial losses and a mass sell-off of their positions roiled markets.Performance so far in 2023 has also struggled to keep up with the past few years, and Griffin acknowledges the purple patch cannot last for ever. “The stories of markets are always stories of cycles and strategies that come and go in terms of popularity,” he says.

There are only around 40 of such multi-manager platforms globally, according to estimates from prime brokers, running around $US300 billion or 8 per cent of the hedge fund industry’s overall $4tn under management. But they punch above their weight: as of 2022, Goldman estimated multi-managers account for 27 per cent of the total hedge fund industry’s holdings in US equities, up from 14 per cent since 2014.

For the past decade or so, rising costs and more onerous regulation have made it less appealing to launch a hedge fund, allowing multi-manager platforms to hire managers who might once have struck out on their own. This high cost base is enabled by the defining characteristic of their businesses: the “pass-through” expenses model, where instead of an annual management fee the manager passes on all costs to their end investors.

The model “is not scalable”, says Nick Moakes, chief investment officer of the Wellcome Trust, a £37.8 billion endowment that allocates to the platforms. He calls it the “Groucho Marx syndrome,” referring to the American comedian who didn’t want to be a member of any club that would admit him. “The [funds] that are good are capacity-constrained,” adds Moakes. “The ones that aren’t . . . you probably don’t want to give your money to.

Jerome Powell, chief of the US Federal Reserve. The central bank has been rapidly raising interest rates.Sign-on packages of $US10 million-$US15 million are not uncommon, according to market participants, and guaranteed payouts can stretch into tens of millions of dollars. They often include upfront payments to make up for forgone bonuses and two-year guarantees that are paid out regardless of whether the hire lasts the course.

Ermanno Dal Pont, managing director in prime services at Barclays, says that while the success of the multi-managers is partly due to their cost structure, which allows them to heavily invest in people and infrastructure, it “could be an area of vulnerability.”

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Inside the wild ride of Will Vicars’ CaledoniaThree decades since Caledonia, Australia’s largest and most private hedge fund, was created, it still follows its bigger bets with an almost religious fervour.

Inside the wild ride of Will Vicars’ CaledoniaThree decades since Caledonia, Australia’s largest and most private hedge fund, was created, it still follows its bigger bets with an almost religious fervour.

Read more »

FIFA suspends Spain football boss after World Cup kiss scandalLuis Rubiales has been provisionally suspended by FIFA following the Spanish Football Federation president's conduct at the women's World Cup final in Sydney.

FIFA suspends Spain football boss after World Cup kiss scandalLuis Rubiales has been provisionally suspended by FIFA following the Spanish Football Federation president's conduct at the women's World Cup final in Sydney.

Read more »

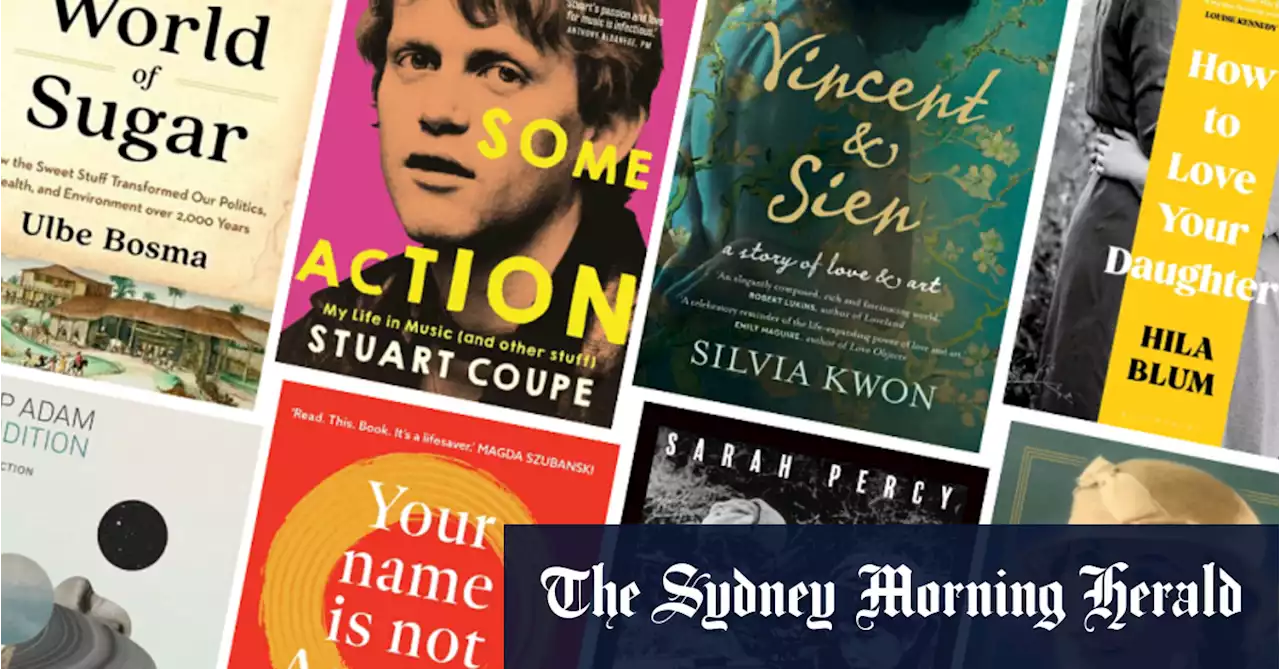

Eight books to read to fill the World Cup voidOur reviewers look at recent fiction and non-fiction books, including two that consider very different mother-daughter relationships.

Eight books to read to fill the World Cup voidOur reviewers look at recent fiction and non-fiction books, including two that consider very different mother-daughter relationships.

Read more »

Tears after injury heartbreak for Brazil; ‘masterful’ NBA wizard Doncic stuns: World Cup WrapTears as star stretchered off; ‘masterful’ NBA wizard stuns: World Cup Wrap

Tears after injury heartbreak for Brazil; ‘masterful’ NBA wizard Doncic stuns: World Cup WrapTears as star stretchered off; ‘masterful’ NBA wizard stuns: World Cup Wrap

Read more »

Eight books to read to fill the World Cup voidOur reviewers look at recent fiction and non-fiction books, including two that consider very different mother-daughter relationships.

Eight books to read to fill the World Cup voidOur reviewers look at recent fiction and non-fiction books, including two that consider very different mother-daughter relationships.

Read more »

Inside the ‘dog-eat-dog’ world of Australia’s most successful PE firmThe quick and brutal exit of long-serving Quadrant deal-doer Jonathon Pearce has reminded the market it is always Chris Hadley who calls the shots.

Inside the ‘dog-eat-dog’ world of Australia’s most successful PE firmThe quick and brutal exit of long-serving Quadrant deal-doer Jonathon Pearce has reminded the market it is always Chris Hadley who calls the shots.

Read more »