nflation has eroded purchasing power for many Canadians, but the experience with rapidly rising prices has been far from uniform.

rate has slowed noticeably in recent months. In December, the annualAlthough that's still much higher than the Bank of Canada's two per cent target, recent monthly trends suggestslows, food prices in particular have been a pain point for many Canadians. In December, grocery prices were 11 per cent higher than they were a year ago.

Workers can't always negotiate their pay to reflect the rise in the cost of living. Unionized workers, for example, negotiate contracts on fixed schedules.to be compensated for with increased wages for individuals,” Tombe said.Though most Canadians have probably experienced sticker shock at the grocery store or elsewhere, not everyone is equally strained.is not just a single, homogeneous experience that everyone is going through,” said Tombe.

With less of a savings buffer, lower-income Canadians have a harder time covering the costs of rising bills. Meanwhile, higher income earners can absorb additional costs by reducing their savings. Meanwhile, the top 20 per cent put away on average about $14,200 in the third quarter of 2022, down from $16,900.With prices rising at the fastest pace in decades and the federal Liberals on the hot seat for cost-of-living issues,Federal Conservatives have been particularly focused on affordability concerns and have been calling on the government to rein in spending.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Canadians now expect to need $1.7M in order to retire: BMO surveyCALGARY — Canadians now believe they need $1.7 million in savings in order to retire, a 20 per cent increase from 2020, according to a new BMO survey. The eye-watering figure is the largest sum since BMO first started surveying Canadians about their retirement expectations 13 years ago. It's also a drastic increase from the $1.4 million in savings Canadians expected to need for their nest eggs just two years ago. The results reflect Canadians' concerns about current economic conditions, particul

Canadians now expect to need $1.7M in order to retire: BMO surveyCALGARY — Canadians now believe they need $1.7 million in savings in order to retire, a 20 per cent increase from 2020, according to a new BMO survey. The eye-watering figure is the largest sum since BMO first started surveying Canadians about their retirement expectations 13 years ago. It's also a drastic increase from the $1.4 million in savings Canadians expected to need for their nest eggs just two years ago. The results reflect Canadians' concerns about current economic conditions, particul

Read more »

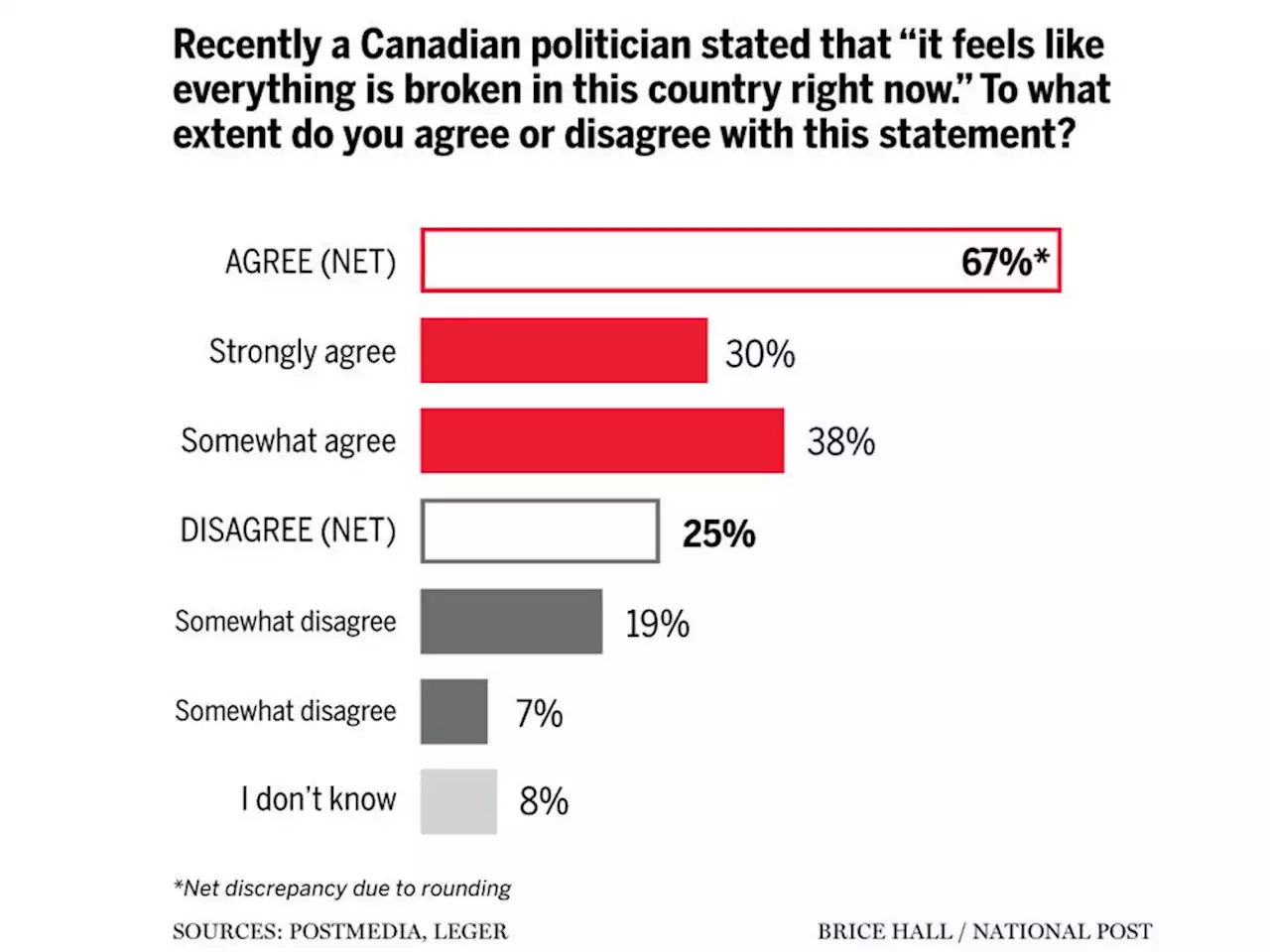

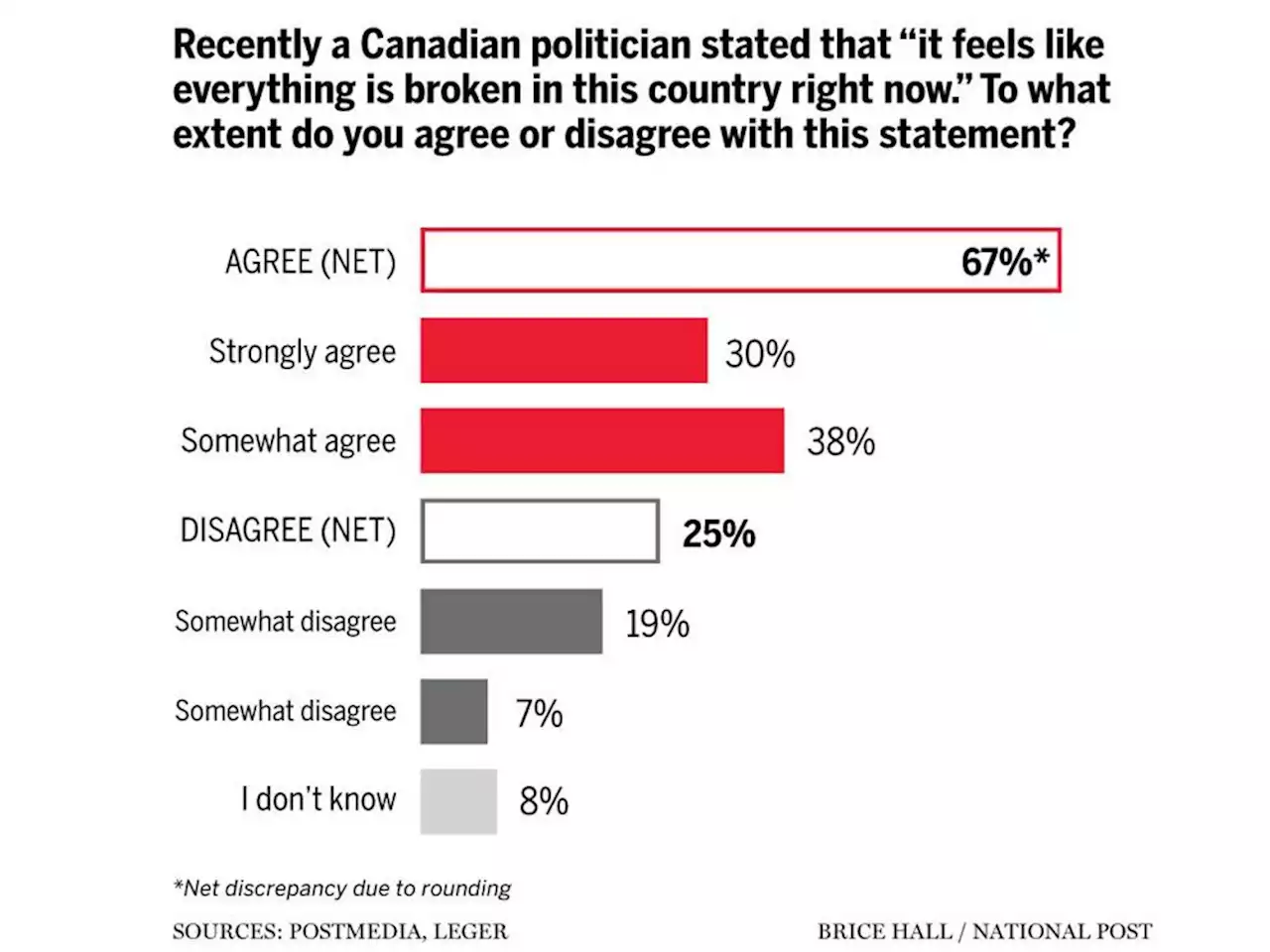

Most Canadians agree 'Canada is broken' — and they're angry about it: National pollA higher percentage of women agreed Canada is broken than did men, and more in the youngest age brackets than among the oldest

Most Canadians agree 'Canada is broken' — and they're angry about it: National pollA higher percentage of women agreed Canada is broken than did men, and more in the youngest age brackets than among the oldest

Read more »

Most Canadians agree 'Canada is broken' — and they're angry about it: National pollA higher percentage of women agreed Canada is broken than did men, and more in the youngest age brackets than among the oldest

Most Canadians agree 'Canada is broken' — and they're angry about it: National pollA higher percentage of women agreed Canada is broken than did men, and more in the youngest age brackets than among the oldest

Read more »

Most Canadians agree 'Canada is broken' — and they're angry about it: National pollA higher percentage of women agreed Canada is broken than did men, and more in the youngest age brackets than among the oldest

Most Canadians agree 'Canada is broken' — and they're angry about it: National pollA higher percentage of women agreed Canada is broken than did men, and more in the youngest age brackets than among the oldest

Read more »

Most Canadians agree 'Canada is broken' — and they're angry about it: National pollA higher percentage of women agreed Canada is broken than did men, and more in the youngest age brackets than among the oldest

Most Canadians agree 'Canada is broken' — and they're angry about it: National pollA higher percentage of women agreed Canada is broken than did men, and more in the youngest age brackets than among the oldest

Read more »

John Ivison: Liberals could freeze beer taxes and show Canadians they actually careEliminating the escalator tax on beer would be an easy, cost\u002Deffective win for a government that is accused of being aloof and remote.

John Ivison: Liberals could freeze beer taxes and show Canadians they actually careEliminating the escalator tax on beer would be an easy, cost\u002Deffective win for a government that is accused of being aloof and remote.

Read more »