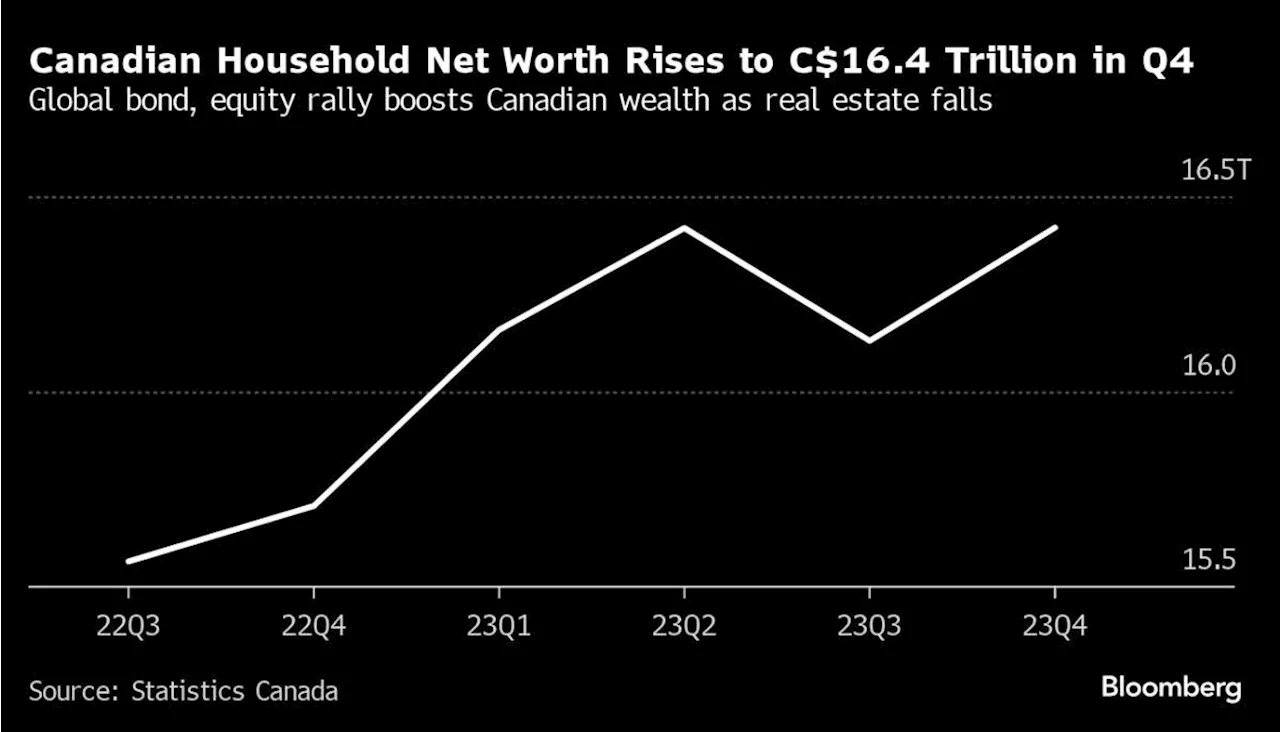

Statistics Canada reports that household credit market debt as a proportion of disposable income decreased for the third consecutive quarter, reaching 178.7% in Q4. The agency attributes this decline to slower mortgage borrowing. Additionally, household net worth increased by almost 2% to $16.4 trillion, driven by strong performance in financial markets.

Statistics Canada reports that household credit market debt as a proportion of disposable income decreased for the third consecutive quarter, reaching 178.7% in Q4. The agency attributes this decline to slower mortgage borrowing .

Additionally, household net worth increased by almost 2% to $16.4 trillion, driven by strong performance in financial markets.

Statistics Canada Household Debt Disposable Income Mortgage Borrowing Household Net Worth Financial Markets

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Stock Rally Buoys Canada Household Net Worth, Housing Drags(Bloomberg) -- A global rally in bonds and equities supported Canadians’ wealth at the end of last year, offsetting continued declines in real estate...

Stock Rally Buoys Canada Household Net Worth, Housing Drags(Bloomberg) -- A global rally in bonds and equities supported Canadians’ wealth at the end of last year, offsetting continued declines in real estate...

Read more »

The Body Shop Canada parent took revenue, left company $3.3M in debt: court docsThe head of The Body Shop Canada Ltd. says it's seeking creditor protection because its parent company stripped its Canadian arm of cash and pushed it into debt.

The Body Shop Canada parent took revenue, left company $3.3M in debt: court docsThe head of The Body Shop Canada Ltd. says it's seeking creditor protection because its parent company stripped its Canadian arm of cash and pushed it into debt.

Read more »

Calgary and Edmonton residents carrying the most consumer debt in Canada: Equifax reportThe high cost of living and inflation is taking a toll on Canadians, but those living in Calgary and Edmonton are burdened by the most debt, a new report indicates.

Calgary and Edmonton residents carrying the most consumer debt in Canada: Equifax reportThe high cost of living and inflation is taking a toll on Canadians, but those living in Calgary and Edmonton are burdened by the most debt, a new report indicates.

Read more »

Labour market gains 41K jobs in Canada, supports Bank of Canada holding rates for longerStatistics Canada said February's increase in the labour market was driven by a rise in full-time work.

Labour market gains 41K jobs in Canada, supports Bank of Canada holding rates for longerStatistics Canada said February's increase in the labour market was driven by a rise in full-time work.

Read more »

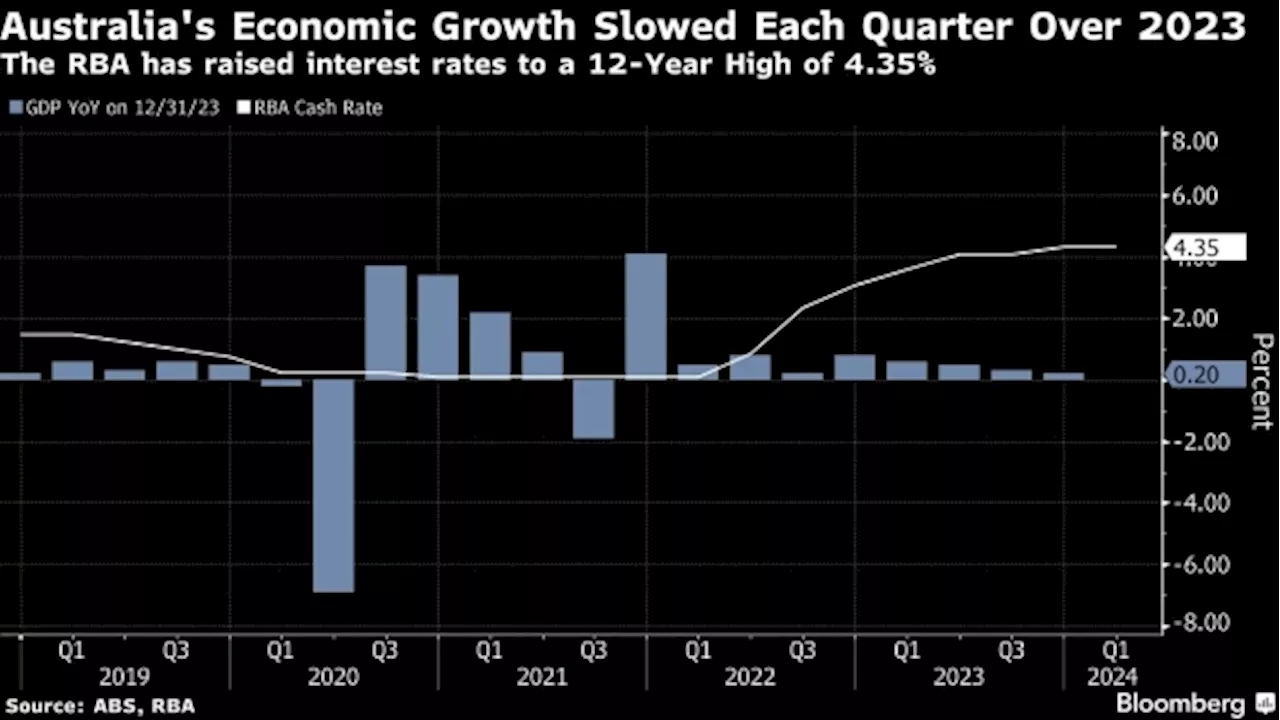

Australian Household Spending Gauge Drops as Rate Hikes BiteThe Australian household spending gauge has dropped due to the impact of rate hikes. This indicates a decrease in consumer spending and a potential slowdown in the economy.

Australian Household Spending Gauge Drops as Rate Hikes BiteThe Australian household spending gauge has dropped due to the impact of rate hikes. This indicates a decrease in consumer spending and a potential slowdown in the economy.

Read more »

Say goodbye to clogged drains with these simple household cleaning hacksDeep clean your shower, unclog your drains and properly clean your dryer vents. Cleaning Expert Melissa Maker shares her favourite spring-cleaning hacks!

Say goodbye to clogged drains with these simple household cleaning hacksDeep clean your shower, unclog your drains and properly clean your dryer vents. Cleaning Expert Melissa Maker shares her favourite spring-cleaning hacks!

Read more »