(Bloomberg) -- With energy stocks trading near all-time highs and oil climbing as well, hedge funds think they’ve found a trade to capitalize: Sell the...

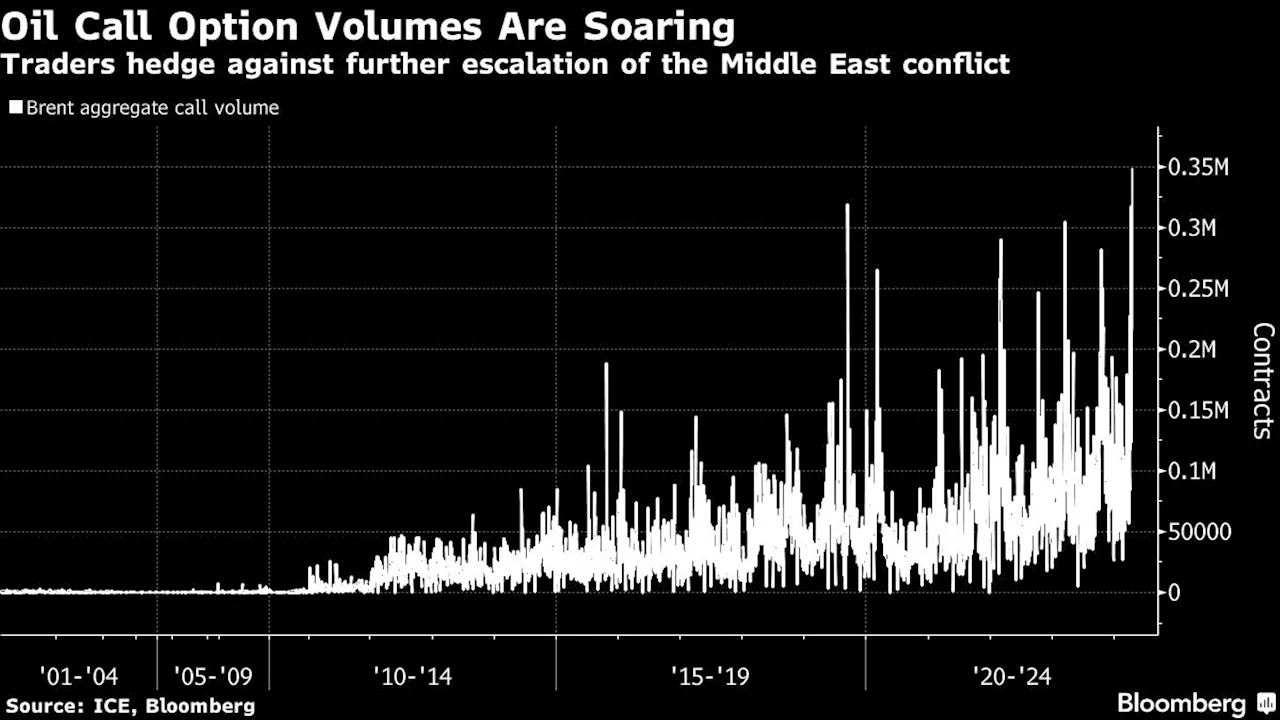

-- With energy stocks trading near all-time highs and oil climbing as well, hedge funds think they’ve found a trade to capitalize: Sell the shares and pour the profits into buying more crude.Hedge funds have been selling US energy stocks for three straight weeks, according to prime brokerage data from Goldman Sachs Group Inc. The net allocation to energy also is well below historical levels, with energy now making up just 2.2% of overall US net exposure on Goldman’s prime brokerage book.

“The historical dynamic with energy stocks is a like a boom-bust: oil runs, these stocks run and then, there’s a supply response causing prices to fall and these stocks drop,” said Walter Todd, chief investment officer at Greenwood Capital Associates, who owns stocks like Exxon Mobil Corp., ConocoPhillips and EOG Resources Inc.

Trump says $175 million bond is financially secure, asks judge to reject New York attorney general’s challenge "The inflation data for March should give monetary policymakers confidence that the progress made in taming consumer price pressures is sustainable."NEW YORK — The stock price for Donald Trump's social media company slid again Monday, pushing it more than 66% below its peak set late last month. Trump Media & Technology Group closed down 18.4% at $26.61 as more of the euphoria that surrounded the stock fades.

Bloomberg Hedge Funds Oil Prices Brent Crude Prime Brokerage

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Trend hedge funds could sell up to $42 billion in US shares, says GoldmanExplore stories from Atlantic Canada.

Trend hedge funds could sell up to $42 billion in US shares, says GoldmanExplore stories from Atlantic Canada.

Read more »

Asia-focused hedge funds thrive in Q1 2024 on Japanese stock rallyAsia-focused hedge funds had a strong first quarter in 2024, benefiting from a prolonged rally in Japanese stocks, a turnaround in Chinese equities, and a boom in AI stocks.

Asia-focused hedge funds thrive in Q1 2024 on Japanese stock rallyAsia-focused hedge funds had a strong first quarter in 2024, benefiting from a prolonged rally in Japanese stocks, a turnaround in Chinese equities, and a boom in AI stocks.

Read more »

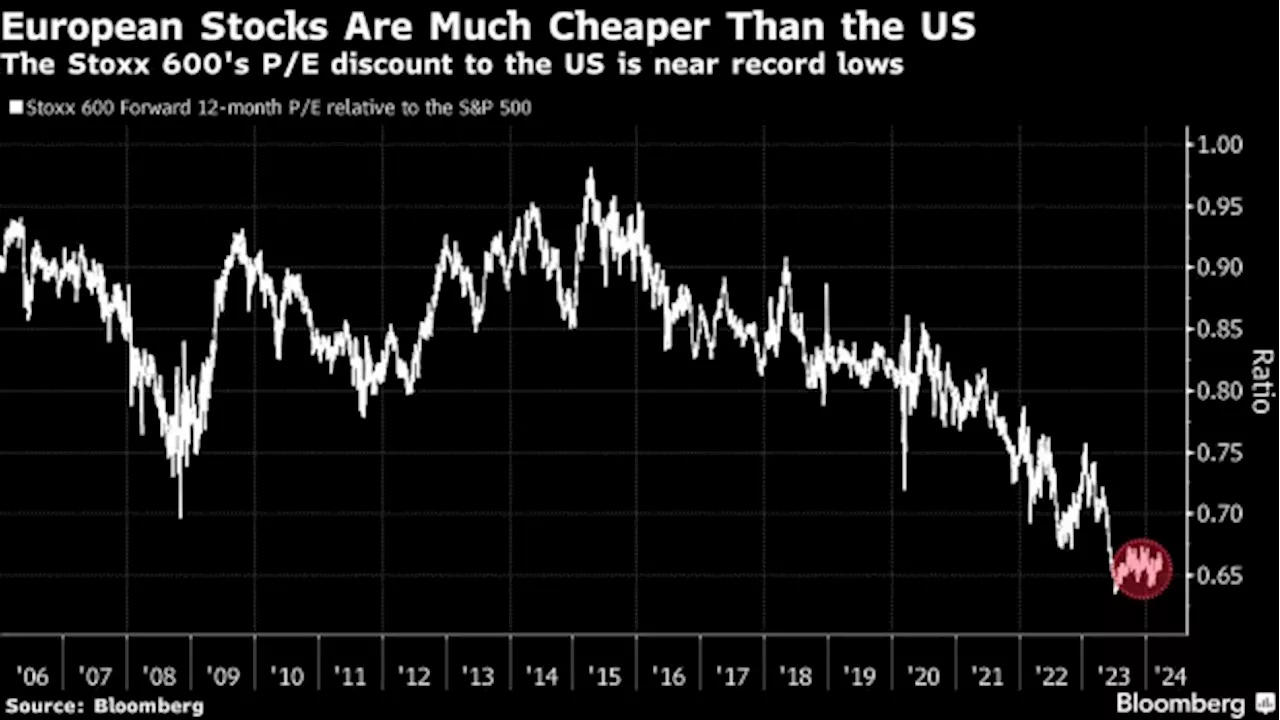

Hedge Funds Bet on Europe in Hunt for Next Leg of Stock RallyInvestors are betting that Europe will drive the next leg of the global equity rally, broadening their playbooks as a more expensive US market evokes memories of the dot-com bubble.

Hedge Funds Bet on Europe in Hunt for Next Leg of Stock RallyInvestors are betting that Europe will drive the next leg of the global equity rally, broadening their playbooks as a more expensive US market evokes memories of the dot-com bubble.

Read more »

Hedge Funds Bet on Europe in Hunt for Next Leg of Stock Rally(Bloomberg) -- Investors are betting that Europe will drive the next leg of the global equity rally, broadening their playbooks as a more expensive US market...

Hedge Funds Bet on Europe in Hunt for Next Leg of Stock Rally(Bloomberg) -- Investors are betting that Europe will drive the next leg of the global equity rally, broadening their playbooks as a more expensive US market...

Read more »

Hedge funds flock to Europe, ditch US stocksExplore stories from Atlantic Canada.

Hedge funds flock to Europe, ditch US stocksExplore stories from Atlantic Canada.

Read more »

It’s silver’s turn to shine as hedge funds turn their attention away from goldThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

It’s silver’s turn to shine as hedge funds turn their attention away from goldThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Read more »