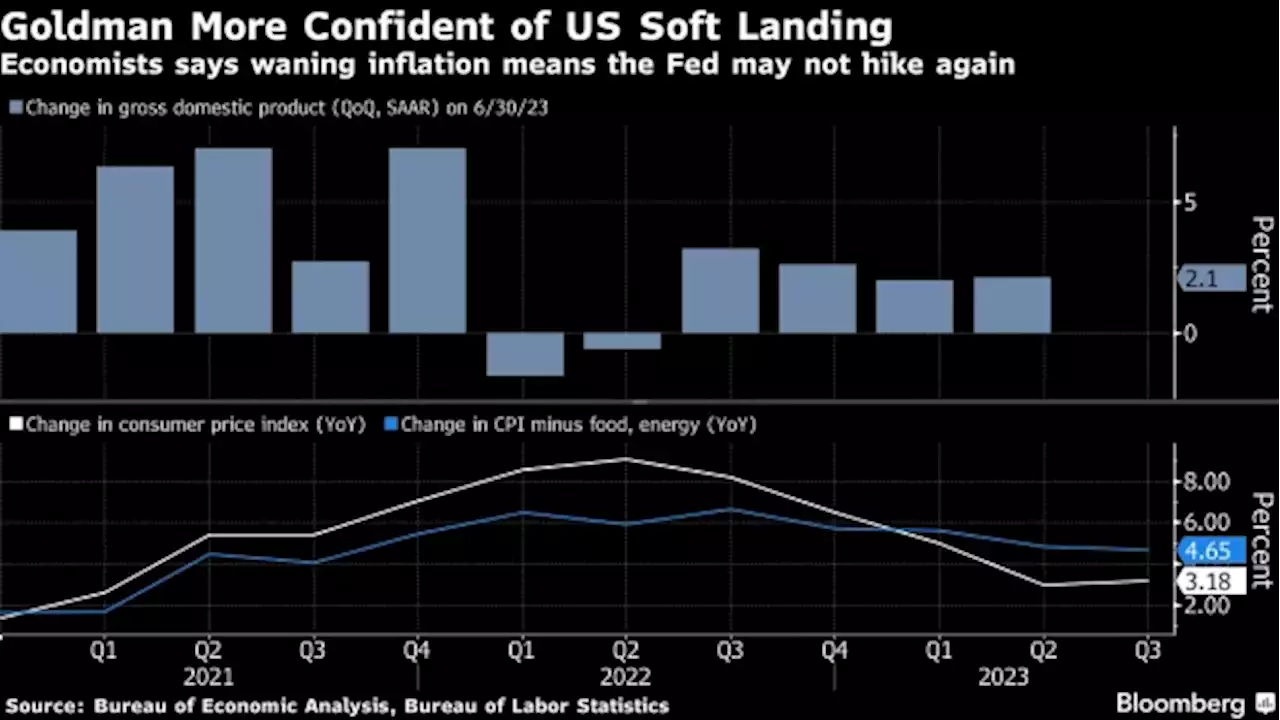

(Reuters) - Goldman Sachs on Tuesday lowered its probability that a U.S recession would start in the next 12 months to 15% from an earlier 20% ...

STORY CONTINUES BELOW THESE SALTWIRE VIDEOS - Goldman Sachs on Tuesday lowered its probability that a U.S recession would start in the next 12 months to 15% from an earlier 20% forecast.

The investment bank said it expected reacceleration in real disposable income next year on the back of continued solid job growth and rising real wages. U.S. consumer spending accelerated in July, but slowing inflation strengthened expectations that the Federal Reserve would keep interest rates unchanged in its policy meeting this month.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Goldman Cuts US Recession Chances to 15% on Improved InflationGoldman Sachs Group Inc. now sees a 15% chance the US will slide into recession, down from 20% previously as cooling inflation and a still-resilient labor market suggest the Federal Reserve may not need to raise interest rates any further.

Goldman Cuts US Recession Chances to 15% on Improved InflationGoldman Sachs Group Inc. now sees a 15% chance the US will slide into recession, down from 20% previously as cooling inflation and a still-resilient labor market suggest the Federal Reserve may not need to raise interest rates any further.

Read more »

Smoke in Edmonton jumps from 14 hours annually to 199+ in 15 yearsBetween 1981 and 2023, the number of annual 'smoke hours' in Edmonton has risen from an average of 14 to 199 hours so far this year. Experts say it's affecting our mental health.

Smoke in Edmonton jumps from 14 hours annually to 199+ in 15 yearsBetween 1981 and 2023, the number of annual 'smoke hours' in Edmonton has risen from an average of 14 to 199 hours so far this year. Experts say it's affecting our mental health.

Read more »

Galway Hitmen settle for silver at Canadian men’s fastpitch championshipsHitmen lose a 15-inning classic to the Toronto Batmen 1-0

Galway Hitmen settle for silver at Canadian men’s fastpitch championshipsHitmen lose a 15-inning classic to the Toronto Batmen 1-0

Read more »

Goldman Analysts Have Bad News for Fund Managers Ignoring ESGAsset managers trying to sell funds in Europe are finding it “increasingly difficult” to do so unless their products are registered as ESG, according to a study by analysts at Goldman Sachs Group Inc.

Goldman Analysts Have Bad News for Fund Managers Ignoring ESGAsset managers trying to sell funds in Europe are finding it “increasingly difficult” to do so unless their products are registered as ESG, according to a study by analysts at Goldman Sachs Group Inc.

Read more »

Malaysia central bank to hold rates at 3.0% through end-2024: Reuters pollBy Anant Chandak BENGALURU (Reuters) - Bank Negara Malaysia (BNM) will hold its key policy rate at 3.00% on Thursday, adopting the same no-change ...

Malaysia central bank to hold rates at 3.0% through end-2024: Reuters pollBy Anant Chandak BENGALURU (Reuters) - Bank Negara Malaysia (BNM) will hold its key policy rate at 3.00% on Thursday, adopting the same no-change ...

Read more »