The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

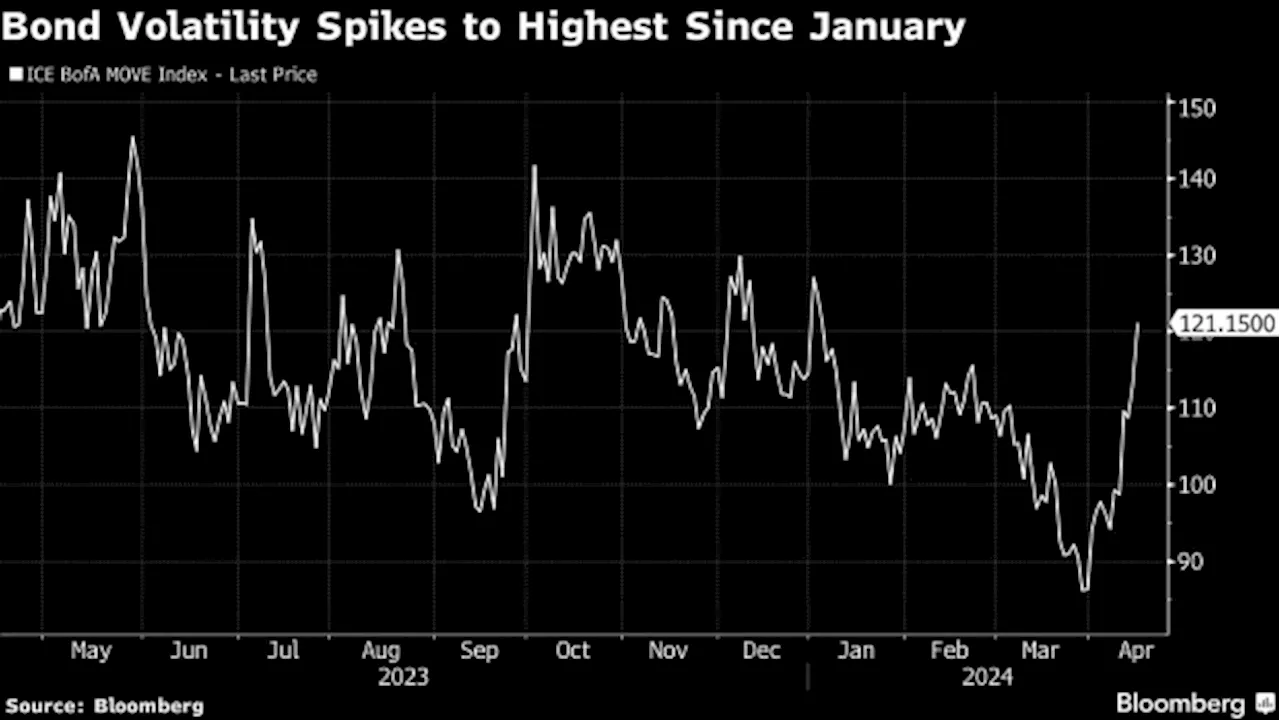

ORLANDO, Florida, May 7 - Any hope of sustaining U.S. fiscal accounts at such stretched levels and keeping the fragile bond market equilibrium intact may have to hinge on avoiding any recession at all - a cycle-busting scenario that seems far-fetched to many.

Take the unemployment rate, currently at 3.9%. The non-partisan Congressional Budget Office's baseline scenario is for unemployment to rise to 4.2% this year, 4.5% in the following year, dip back to 4.3% in 2026, average 4.4% over the next two years and then average 4.5% over the five-year period through 2034.

"The risk that the Fed monetizes excessive deficits in the next five to 10 years has to be taken seriously," says Willem Buiter, a former rate-setter at the Bank of England, adding that a return to something akin to permanent QE is"quite likely." The annual U.S. budget balance is almost always in deficit, but rarely this deep - between World War Two and the Great Financial Crisis it exceeded 5% of GDP only once, in 1983.

Gold Silver Platinum Palladium PGM Platinum Group Metals Metals Precious Metals Mining News Crypto News Bitcoin News Ethereum News Mining News Interviews Economic Reports Forecasts Central Banks US Dollar Charts Tech Metals Rare Earth Metals Currency Global Economy International Policy Politics Bank Forecasts Market Nugget Mining Minutes Roundups

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Column-Fragile Treasuries relying on rare macro serenity: McGeeverExplore stories from Atlantic Canada.

Read more »

Premarket: Shares gain, U.S. Treasuries steady ahead of U.S. inflation data releaseMarkets largely unfazed by ratings agency Fitch downgrading its China outlook

Premarket: Shares gain, U.S. Treasuries steady ahead of U.S. inflation data releaseMarkets largely unfazed by ratings agency Fitch downgrading its China outlook

Read more »

Stablecoins drive demand for Treasuries and are fundamental to the US economyThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Stablecoins drive demand for Treasuries and are fundamental to the US economyThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Read more »

Treasuries Surge as Middle East Tension Stokes Demand for HavensTreasuries rallied sharply Friday, pulling yields from near year-to-date highs, as anticipated escalation of Middle East warfare stoked demand for havens.

Treasuries Surge as Middle East Tension Stokes Demand for HavensTreasuries rallied sharply Friday, pulling yields from near year-to-date highs, as anticipated escalation of Middle East warfare stoked demand for havens.

Read more »

Markets today: Oil steadies, Treasuries dip as Iran stresses easeTreasury yields spiked after retail sales data came in much stronger than expected, signaling U.S. Federal Reserve policymakers will be in no rush to cut interest rates.

Markets today: Oil steadies, Treasuries dip as Iran stresses easeTreasury yields spiked after retail sales data came in much stronger than expected, signaling U.S. Federal Reserve policymakers will be in no rush to cut interest rates.

Read more »

Asia Open Looks Mixed; Treasuries Slide on Powell: Markets WrapStocks in Asia were set for a mixed open following hawkish comments by Jerome Powell that helped fuel a third straight drop in the S&P 500 and saw two-year Treasury yields briefly hit 5%.

Asia Open Looks Mixed; Treasuries Slide on Powell: Markets WrapStocks in Asia were set for a mixed open following hawkish comments by Jerome Powell that helped fuel a third straight drop in the S&P 500 and saw two-year Treasury yields briefly hit 5%.

Read more »