By Ann Saphir and Howard Schneider JACKSON HOLE, WYOMING (Reuters) - Beating inflation will probably require one more U.S. interest-rate hike and then ...

STORY CONTINUES BELOW THESE SALTWIRE VIDEOSBy Ann Saphir and Howard Schneider

"We just don't want it to keep drifting farther out," she said. Not only do fast-rising prices impose a high cost on Americans, she said; allowing inflation to fester also leaves the economy more vulnerable to future shock. They also thought that by next year the Fed will likely begin cutting rates so that as inflation falls, they do not end up restricting the economy more than is needed.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed's Mester keeps door open for more rate hikes in CNBC interviewBy Michael S. Derby NEW YORK (Reuters) - Federal Reserve Bank of Cleveland President Loretta Mester said on Friday it's quite possible the central bank ...

Fed's Mester keeps door open for more rate hikes in CNBC interviewBy Michael S. Derby NEW YORK (Reuters) - Federal Reserve Bank of Cleveland President Loretta Mester said on Friday it's quite possible the central bank ...

Read more »

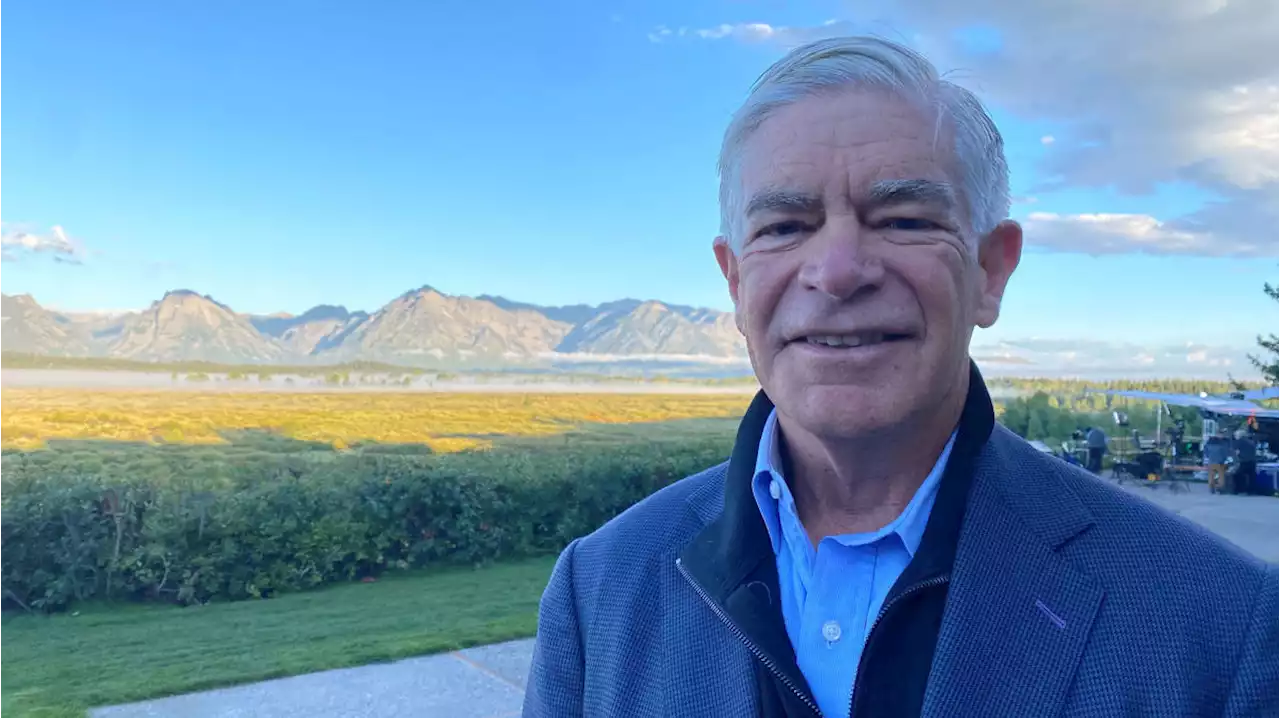

Fed 'clearly going to hold through the end of the year': Fed's HarkerFederal Reserve members, including chair Jerome Powell, are sending a clear message - they want to get rates down to two percent. However, some are taking a more hawkish stance than others. Philadelphia Federal Reserve President Patrick Harker wants to let 'things work through the economy.' Harker tells Yahoo Finance's Jennifer Schonberger what he is hearing from people who live in his district that they want to be able to digest all the rate increases the Fed has done this year. However, Harker stresses that 'not raising rates right now still means we are in a restrictive stance, we're still putting pressure on the economy,' and that data will dictate his decisions. Right now, Harker doesn't see a re-acceleration in inflation and that he would like to 'hold and see how things turn out.'The Fed is 'clearly going to hold through the end of the year,' Harker said, and that next year, data will dictate whether or not the Fed cuts rates. In order to get to a point where the Fed will cut, Harker says there needs to be 'clear signs' inflation is moving towards the Fed's two percent target, something he says 'is gong to take some time.' Overall, Harker says a soft landing scenario is the 'most probable,' but it's not guaranteed. Key video moments 00:00:22 Harker's current thinking on rates 00:02:00 Harker's on the September meeting 00:02:19 How long will the Fed keep rates high? 00:03:45 When could the Fed cut rates? 00:04:45 Harker on a soft landing 00:05:30 Relationship between wages and inflation 00:06:45 How demographics are impacting the economy and what the Fed does 00:10:00 Harker discusses what he is hearing at the symposium

Fed 'clearly going to hold through the end of the year': Fed's HarkerFederal Reserve members, including chair Jerome Powell, are sending a clear message - they want to get rates down to two percent. However, some are taking a more hawkish stance than others. Philadelphia Federal Reserve President Patrick Harker wants to let 'things work through the economy.' Harker tells Yahoo Finance's Jennifer Schonberger what he is hearing from people who live in his district that they want to be able to digest all the rate increases the Fed has done this year. However, Harker stresses that 'not raising rates right now still means we are in a restrictive stance, we're still putting pressure on the economy,' and that data will dictate his decisions. Right now, Harker doesn't see a re-acceleration in inflation and that he would like to 'hold and see how things turn out.'The Fed is 'clearly going to hold through the end of the year,' Harker said, and that next year, data will dictate whether or not the Fed cuts rates. In order to get to a point where the Fed will cut, Harker says there needs to be 'clear signs' inflation is moving towards the Fed's two percent target, something he says 'is gong to take some time.' Overall, Harker says a soft landing scenario is the 'most probable,' but it's not guaranteed. Key video moments 00:00:22 Harker's current thinking on rates 00:02:00 Harker's on the September meeting 00:02:19 How long will the Fed keep rates high? 00:03:45 When could the Fed cut rates? 00:04:45 Harker on a soft landing 00:05:30 Relationship between wages and inflation 00:06:45 How demographics are impacting the economy and what the Fed does 00:10:00 Harker discusses what he is hearing at the symposium

Read more »

Jackson Hole roundup: Fed Chair Powell, Fed Presidents, key advisers, and moreFederal Reserve Chair Jerome Powell delivered his annual speech at the Jackson Hole Economic Symposium on Friday morning. Yahoo Finance spoke to experts across the industry to break down Powell's speech, what it means for inflation and interest rates at the Fed meeting in September, the impact on the economy, and more. Video highlights: 00:00:04 - Yahoo Finance's Jennifer Schonberger 00:00:27 - Federal Reserve Board Chair Jerome Powell 00:00:57 - Philadelphia Federal Reserve President Patrick Harker 00:01:18 - Former St. Louis Fed President 00:01:50 - Council of Economic Advisers Chair Jared Berstein 00:02:07 - Boston Fed President Susan Collins 00:02:25 - Former Fed Vice Chair Alan Blinder

Jackson Hole roundup: Fed Chair Powell, Fed Presidents, key advisers, and moreFederal Reserve Chair Jerome Powell delivered his annual speech at the Jackson Hole Economic Symposium on Friday morning. Yahoo Finance spoke to experts across the industry to break down Powell's speech, what it means for inflation and interest rates at the Fed meeting in September, the impact on the economy, and more. Video highlights: 00:00:04 - Yahoo Finance's Jennifer Schonberger 00:00:27 - Federal Reserve Board Chair Jerome Powell 00:00:57 - Philadelphia Federal Reserve President Patrick Harker 00:01:18 - Former St. Louis Fed President 00:01:50 - Council of Economic Advisers Chair Jared Berstein 00:02:07 - Boston Fed President Susan Collins 00:02:25 - Former Fed Vice Chair Alan Blinder

Read more »

Powell says Fed 'prepared to raise rates further' to bring inflation downFed Chair Jay Powell reiterated his message that the Fed will keep monetary policy tight until the Fed brings inflation back to its 2% target.

Powell says Fed 'prepared to raise rates further' to bring inflation downFed Chair Jay Powell reiterated his message that the Fed will keep monetary policy tight until the Fed brings inflation back to its 2% target.

Read more »

No real fix to the sharp rise in public debt loads, economists sayBy Ann Saphir Jackson Hole, Wyoming (Reuters) - The steep jump in public debt loads over the past decade and a half, as governments borrowed large ...

No real fix to the sharp rise in public debt loads, economists sayBy Ann Saphir Jackson Hole, Wyoming (Reuters) - The steep jump in public debt loads over the past decade and a half, as governments borrowed large ...

Read more »

Powell’s steady hand steers greenback higherFed chair’s Jackson Hole speech is likely good news for dollar bulls

Powell’s steady hand steers greenback higherFed chair’s Jackson Hole speech is likely good news for dollar bulls

Read more »