China remains embedded in US supply chains even as American firms have taken steps to reduce direct imports from the Asian country, according to a paper presented at the Federal Reserve’s conference in Jackson Hole, Wyoming.

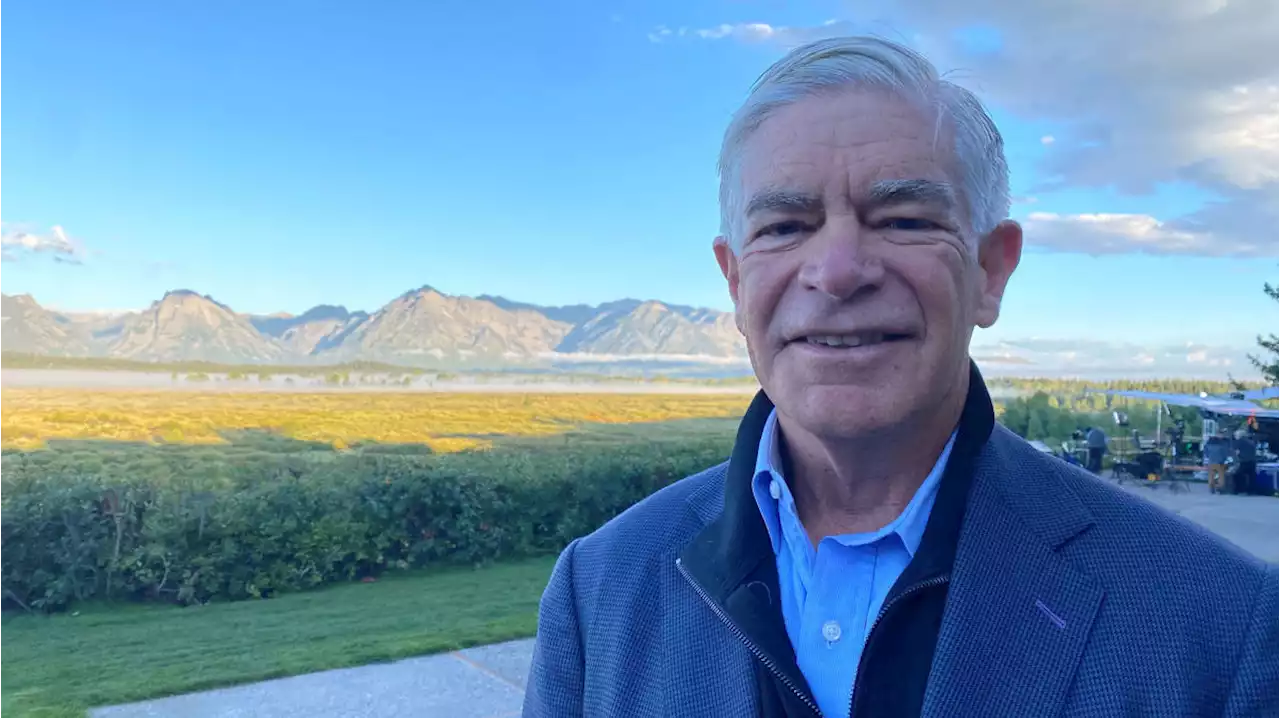

Policymakers from around the world have traveled to the resort town for a two-day economic symposium hosted by the Kansas City Fed. In a speech to the gathering on Friday, Fed Chair Jerome Powell said the US central bank is prepared to raise interest rates further should the economy and inflation fail to cool.

A trio of legislation championed by Biden – stepped-up infrastructure spending, increased investment in a green economy and a build-up in semiconductor manufacturing – helped galvanize demand in the second quarter and is likely to have a bigger impact going forward. “It’s critically important that inflation expectations remain anchored at 2%,” said said in the BTV interview.Former Federal Reserve Bank of Kansas City President Esther George said central banks have to wait and see whether they have done enough to curb inflation and that they can’t yet declare victory.

“I’ve joined with a number of Kansas Citians there to make sure that the city is ready to be on the world stage for that and I’m enjoying that,” she said, adding she will be a referee in one of the games.European Central Bank Governing Council member Martins Kazaks said it’s better to err on the side of tighter monetary policy than allow the risk of reaccelerating inflation.

“In the current environment, this means — for the ECB — setting interest rates at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to our 2% medium-term target,” Lagarde said in her speech at Jackson Hole.Cleveland Fed President Loretta Mester said not raising interest rates sufficiently to curb inflation would be “a worse mistake” than raising them too much.

“It’s not normally an option for central banks, that you could get inflation down without a big recession,” he said in an interview on BTV. “That’d be a major triumph for the Fed or anybody. It’d be virtually without precedent. But we’re part of the way down that road and we’ve been getting good news. We just have to keep getting good news.

Asked whether the Fed should change its inflation target from 2% given that annual price growth has slowed, Goolsbee said: “I think not — inflation’s not fully down to 3%.” Mester said not much has changed in her outlook since June, when she penciled in two more rate increases for this year — one of which was rolled out in July — and did not anticipate any rate cuts next year.

“We are focused on the outlook for the South African economy for both growth and inflation. The job is not yet done,” Lesetja Kganyago said on BTV. “The decline in inflation is welcome. But we’ve just had two good prints of inflation. That does not mean that the inflation monster has been conquered. There are still risks on the horizon and we will watch that very closely.”

Asked when rates cuts would start, the Philadelphia Fed chief said “clearly not until next year at the earliest, and when next year? Again, the data will have to dictate that.”Central bank interest-rate increases have a substantial impact on innovation, which in turn can impact the productive capacity of an economy, according to a paper presented at the symposium.

The Fed chief welcomed the slower price gains the US economy has achieved thanks to tighter monetary policy and further loosening of supply constraints after the pandemic. However, he cautioned that the process “still has a long way to go, even with the more favorable recent readings.

While the data suggest that economic activity is cooling, “we don’t see that much of it in the inflation rates,” Vujcic said. The question for the coming months will be whether services inflation eases sufficiently and “whether we will feel the consequences of the slowdown in the labor market.” “It’s for me much too early to think about a pause,” the Bundesbank chief told Bloomberg TV at Jackson Hole Thursday, adding that he’ll wait for additional figures before making a decision. “We shouldn’t forget inflation is still around 5%. So this is much too high. Our target is 2%. So there’s some way to go.”

“We may need additional increments, and we may be very near a place where we can hold for a substantial amount of time,” she said in an interview with Yahoo! Finance from Jackson Hole.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed Latest: China Still Embedded in US Supply Chain, Paper Finds(Bloomberg) -- China remains embedded in US supply chains even as American firms have taken steps to reduce direct imports from the Asian country, according to a paper presented at the Federal Reserve’s conference in Jackson Hole, Wyoming.Most Read from BloombergSpaceX Blast Left Officials in Disbelief Over Environmental DamageTesla Investors to Get $12,000 Each From Musk’s SEC DealPowell Signals Fed Will Raise Rates If Needed, Keep Them HighAfter 15 Years, a New Private Jet Is America’s Most Po

Fed Latest: China Still Embedded in US Supply Chain, Paper Finds(Bloomberg) -- China remains embedded in US supply chains even as American firms have taken steps to reduce direct imports from the Asian country, according to a paper presented at the Federal Reserve’s conference in Jackson Hole, Wyoming.Most Read from BloombergSpaceX Blast Left Officials in Disbelief Over Environmental DamageTesla Investors to Get $12,000 Each From Musk’s SEC DealPowell Signals Fed Will Raise Rates If Needed, Keep Them HighAfter 15 Years, a New Private Jet Is America’s Most Po

Read more »

Fed's Collins: May be at a place where Fed can hold steadyNEW YORK (Reuters) - Federal Reserve Bank of Boston President Susan Collins said Thursday the central bank may be in a place where it doesn't need to ...

Fed's Collins: May be at a place where Fed can hold steadyNEW YORK (Reuters) - Federal Reserve Bank of Boston President Susan Collins said Thursday the central bank may be in a place where it doesn't need to ...

Read more »

Fed 'clearly going to hold through the end of the year': Fed's HarkerFederal Reserve members, including chair Jerome Powell, are sending a clear message - they want to get rates down to two percent. However, some are taking a more hawkish stance than others. Philadelphia Federal Reserve President Patrick Harker wants to let 'things work through the economy.' Harker tells Yahoo Finance's Jennifer Schonberger what he is hearing from people who live in his district that they want to be able to digest all the rate increases the Fed has done this year. However, Harker stresses that 'not raising rates right now still means we are in a restrictive stance, we're still putting pressure on the economy,' and that data will dictate his decisions. Right now, Harker doesn't see a re-acceleration in inflation and that he would like to 'hold and see how things turn out.'The Fed is 'clearly going to hold through the end of the year,' Harker said, and that next year, data will dictate whether or not the Fed cuts rates. In order to get to a point where the Fed will cut, Harker says there needs to be 'clear signs' inflation is moving towards the Fed's two percent target, something he says 'is gong to take some time.' Overall, Harker says a soft landing scenario is the 'most probable,' but it's not guaranteed. Key video moments 00:00:22 Harker's current thinking on rates 00:02:00 Harker's on the September meeting 00:02:19 How long will the Fed keep rates high? 00:03:45 When could the Fed cut rates? 00:04:45 Harker on a soft landing 00:05:30 Relationship between wages and inflation 00:06:45 How demographics are impacting the economy and what the Fed does 00:10:00 Harker discusses what he is hearing at the symposium

Fed 'clearly going to hold through the end of the year': Fed's HarkerFederal Reserve members, including chair Jerome Powell, are sending a clear message - they want to get rates down to two percent. However, some are taking a more hawkish stance than others. Philadelphia Federal Reserve President Patrick Harker wants to let 'things work through the economy.' Harker tells Yahoo Finance's Jennifer Schonberger what he is hearing from people who live in his district that they want to be able to digest all the rate increases the Fed has done this year. However, Harker stresses that 'not raising rates right now still means we are in a restrictive stance, we're still putting pressure on the economy,' and that data will dictate his decisions. Right now, Harker doesn't see a re-acceleration in inflation and that he would like to 'hold and see how things turn out.'The Fed is 'clearly going to hold through the end of the year,' Harker said, and that next year, data will dictate whether or not the Fed cuts rates. In order to get to a point where the Fed will cut, Harker says there needs to be 'clear signs' inflation is moving towards the Fed's two percent target, something he says 'is gong to take some time.' Overall, Harker says a soft landing scenario is the 'most probable,' but it's not guaranteed. Key video moments 00:00:22 Harker's current thinking on rates 00:02:00 Harker's on the September meeting 00:02:19 How long will the Fed keep rates high? 00:03:45 When could the Fed cut rates? 00:04:45 Harker on a soft landing 00:05:30 Relationship between wages and inflation 00:06:45 How demographics are impacting the economy and what the Fed does 00:10:00 Harker discusses what he is hearing at the symposium

Read more »

Jackson Hole roundup: Fed Chair Powell, Fed Presidents, key advisers, and moreFederal Reserve Chair Jerome Powell delivered his annual speech at the Jackson Hole Economic Symposium on Friday morning. Yahoo Finance spoke to experts across the industry to break down Powell's speech, what it means for inflation and interest rates at the Fed meeting in September, the impact on the economy, and more. Video highlights: 00:00:04 - Yahoo Finance's Jennifer Schonberger 00:00:27 - Federal Reserve Board Chair Jerome Powell 00:00:57 - Philadelphia Federal Reserve President Patrick Harker 00:01:18 - Former St. Louis Fed President 00:01:50 - Council of Economic Advisers Chair Jared Berstein 00:02:07 - Boston Fed President Susan Collins 00:02:25 - Former Fed Vice Chair Alan Blinder

Jackson Hole roundup: Fed Chair Powell, Fed Presidents, key advisers, and moreFederal Reserve Chair Jerome Powell delivered his annual speech at the Jackson Hole Economic Symposium on Friday morning. Yahoo Finance spoke to experts across the industry to break down Powell's speech, what it means for inflation and interest rates at the Fed meeting in September, the impact on the economy, and more. Video highlights: 00:00:04 - Yahoo Finance's Jennifer Schonberger 00:00:27 - Federal Reserve Board Chair Jerome Powell 00:00:57 - Philadelphia Federal Reserve President Patrick Harker 00:01:18 - Former St. Louis Fed President 00:01:50 - Council of Economic Advisers Chair Jared Berstein 00:02:07 - Boston Fed President Susan Collins 00:02:25 - Former Fed Vice Chair Alan Blinder

Read more »

Fed Latest: Central Bankers Gather for Jackson Hole ConferenceCentral bankers from around the world are gathering in Jackson Hole, Wyoming, for the Federal Reserve Bank of Kansas City’s annual two-day gathering. Before the meeting officially gets underway Thursday evening, officials including Philadelphia Fed President Patrick Harker and his Boston Fed counterpart, Susan Collins, will comment ahead of Chair Jerome Powell’s opening speech Friday.

Fed Latest: Central Bankers Gather for Jackson Hole ConferenceCentral bankers from around the world are gathering in Jackson Hole, Wyoming, for the Federal Reserve Bank of Kansas City’s annual two-day gathering. Before the meeting officially gets underway Thursday evening, officials including Philadelphia Fed President Patrick Harker and his Boston Fed counterpart, Susan Collins, will comment ahead of Chair Jerome Powell’s opening speech Friday.

Read more »

Fed Latest: Thailand Central Bank Wants Tighter Fiscal Stance(Bloomberg) -- Thailand’s central bank wants the new government led by Srettha Thavisin to pursue fiscal consolidation in tandem with monetary policy to avoid fueling inflation in the economy.Most Read from BloombergNYC’s Most Exciting New Fine Dining Restaurant Is in a Subway StationNasdaq 100 Drops 2% as Yields Rise Before Powell: Markets WrapMore People Call in Sick on August 24 Than Any Other DayWagner Chief Prigozhin Listed Aboard Crashed Jet, Reports SayBRICS Bloc Grows Heft With Saudi Ara

Fed Latest: Thailand Central Bank Wants Tighter Fiscal Stance(Bloomberg) -- Thailand’s central bank wants the new government led by Srettha Thavisin to pursue fiscal consolidation in tandem with monetary policy to avoid fueling inflation in the economy.Most Read from BloombergNYC’s Most Exciting New Fine Dining Restaurant Is in a Subway StationNasdaq 100 Drops 2% as Yields Rise Before Powell: Markets WrapMore People Call in Sick on August 24 Than Any Other DayWagner Chief Prigozhin Listed Aboard Crashed Jet, Reports SayBRICS Bloc Grows Heft With Saudi Ara

Read more »