Manufacturers from chemicals to metals and machinery curbed production last year in the fallout from Germany’s energy crisis. As the cutbacks linger, it’s a sign that a deeper industrial malaise is setting in.

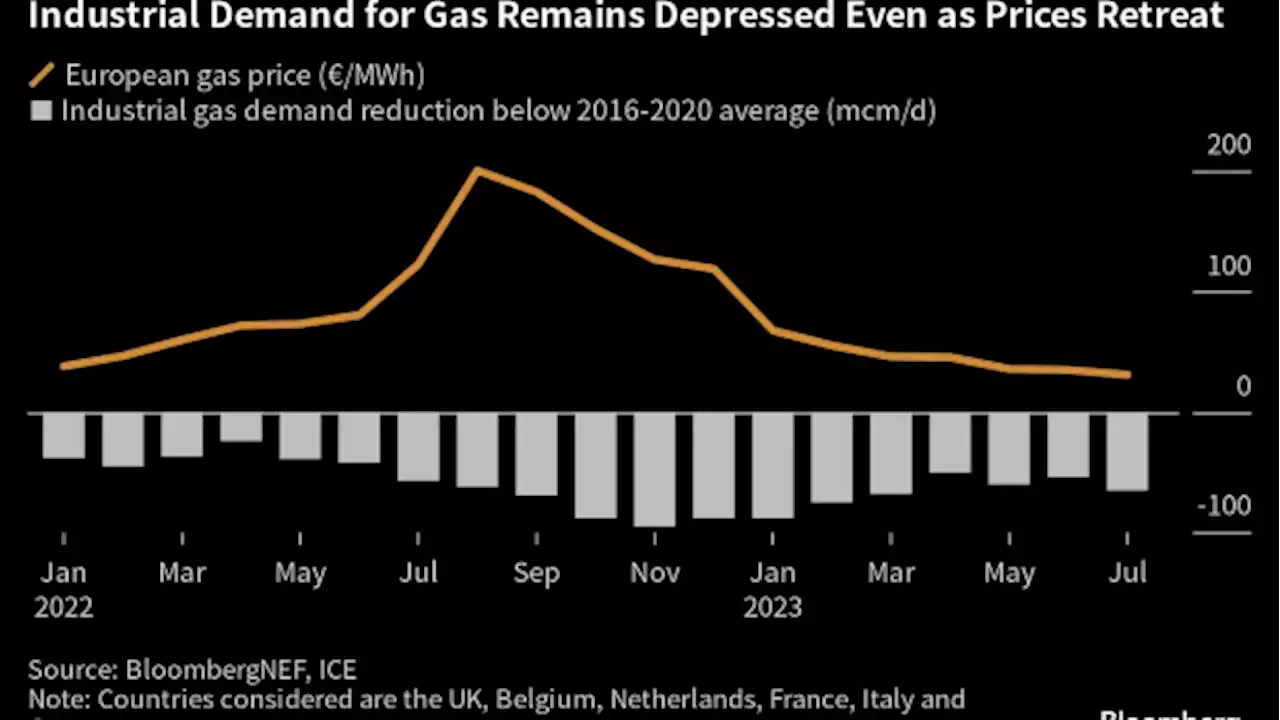

The record-high prices that were triggered by Russia’s squeeze on deliveries last year are now gone, but worsening economic conditions are hitting demand just as hard. Gas usage across Europe’s industrial landscape is projected to remain about 20% below 2021 levels, according to data from S&P Global Commodity Insights.

“There is currently no indication that the situation is improving,” said Tilo Rosenberger-Süß, spokesman for the hub’s operator InfraServ Gendorf, adding that the trend could lead to long-term demand destruction at the facility.Despite an 80% decline from last year’s gas prices — which made some production unprofitable — Germany’s energy-intensive industry is struggling even more than the broader manufacturing sector. That’s especially true for chemicals.

Germany plays a critical role in the industry’s weakness. Europe’s powerhouse economy started the third quarter with the biggest monthly decline in factory orders since the pandemic in 2020. The downturn in the country’s manufacturing core is probably severe enough to lead to a quarterly contraction, just after barely exiting a recession, according to a monthly survey of economists by Bloomberg.

Hellma Materials, a Jena-based manufacturer of crystalline and optical components, has invested €20 million in a facility in Trollhattan, Sweden. The new site fulfills Hellma’s complex requirements with regard to electricity supply and industrial cooling water, Chief Executive Officer Thomas Töpfer said in a statement.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Marketmind: China's weak property stocks set the paceA look at the day ahead in European and global markets from Kevin Buckland A light calendar for Europe today means markets are likely to take their cues ...

Marketmind: China's weak property stocks set the paceA look at the day ahead in European and global markets from Kevin Buckland A light calendar for Europe today means markets are likely to take their cues ...

Read more »

Marketmind: China's weak property stocks set the paceA light calendar for Europe today means markets are likely to take their cues from Asia, and there's a lot going on - particularly in China. Property shares are taking a beating after weekend data showed new home sales in China's biggest cities slumped by half in the first week of this month. Country Garden, China's biggest private developer, added to pressure on the sector at the centre of the country's economic woes as it faces a new round of voting by creditors - the third this month - to avert default, in this case by extending debt repayments to onshore creditors by three years.

Marketmind: China's weak property stocks set the paceA light calendar for Europe today means markets are likely to take their cues from Asia, and there's a lot going on - particularly in China. Property shares are taking a beating after weekend data showed new home sales in China's biggest cities slumped by half in the first week of this month. Country Garden, China's biggest private developer, added to pressure on the sector at the centre of the country's economic woes as it faces a new round of voting by creditors - the third this month - to avert default, in this case by extending debt repayments to onshore creditors by three years.

Read more »

Evaluating Ethereum’s network and ETH’s current demand levelsThere are some areas in ETH’s journey this year that inspire confidence. Ethereum’s total value locked in ETH deposit contracts just achieved a new historic peak at over 28.7 million ETH.

Evaluating Ethereum’s network and ETH’s current demand levelsThere are some areas in ETH’s journey this year that inspire confidence. Ethereum’s total value locked in ETH deposit contracts just achieved a new historic peak at over 28.7 million ETH.

Read more »

China’s Housing Measures Fall Short of Stimulating Steel DemandChina’s measures to arrest its housing crisis are no panacea for the steel markets that rely on real estate for demand.

China’s Housing Measures Fall Short of Stimulating Steel DemandChina’s measures to arrest its housing crisis are no panacea for the steel markets that rely on real estate for demand.

Read more »

China’s Housing Measures Fall Short of Stimulating Steel Demand(Bloomberg) -- China’s measures to arrest its housing crisis are no panacea for the steel markets that rely on real estate for demand. Most Read from BloombergTrudeau Is Stuck in India With Faulty Aircraft After Hearing Criticism From ModiIndia’s G-20 Win Shows US Learning How to Counter China RiseMeloni Tells China That Italy Plans to Exit Belt and RoadBiden Doubts China Able to Invade Taiwan Amid Economic WoesBoss of Failed Crypto Exchange Gets 11,000-Year SentenceWhile property accounts for a

China’s Housing Measures Fall Short of Stimulating Steel Demand(Bloomberg) -- China’s measures to arrest its housing crisis are no panacea for the steel markets that rely on real estate for demand. Most Read from BloombergTrudeau Is Stuck in India With Faulty Aircraft After Hearing Criticism From ModiIndia’s G-20 Win Shows US Learning How to Counter China RiseMeloni Tells China That Italy Plans to Exit Belt and RoadBiden Doubts China Able to Invade Taiwan Amid Economic WoesBoss of Failed Crypto Exchange Gets 11,000-Year SentenceWhile property accounts for a

Read more »

More Chinese cities lift home-buying curbs to revive demandBEIJING (Reuters) - Two major cities in eastern China lifted all curbs on home purchases and selling on Monday, joining several other cities in ...

More Chinese cities lift home-buying curbs to revive demandBEIJING (Reuters) - Two major cities in eastern China lifted all curbs on home purchases and selling on Monday, joining several other cities in ...

Read more »