(Bloomberg) -- Emerging Asia bonds are set to benefit more than their global peers from any rally in Treasuries as the region’s debt enjoys tighter spreads...

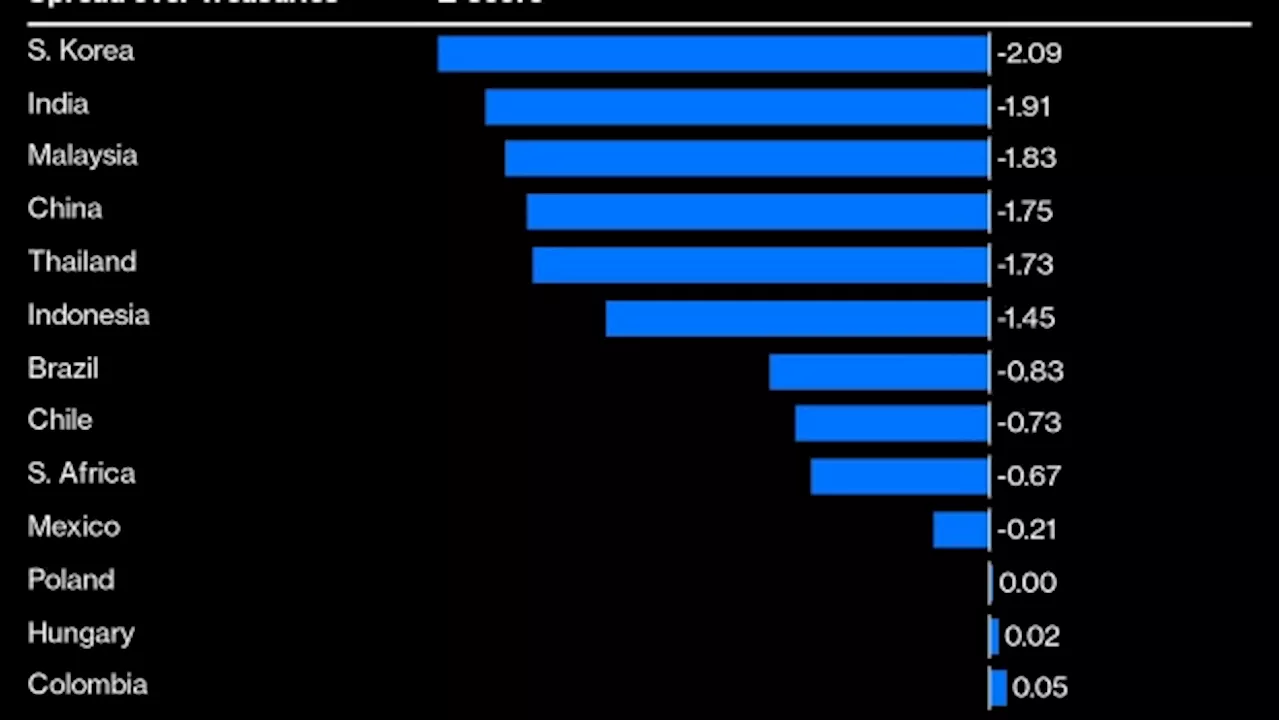

-- Emerging Asia bonds are set to benefit more than their global peers from any rally in Treasuries as the region’s debt enjoys tighter spreads over their US counterparts.South Korean 10-year bonds offer a spread of around 100 basis points below similar-dated Treasuries, which is 2.1 standard deviations below the five-year average, according to analysis by Bloomberg .

Ten-year Treasury yields have fallen seven basis points in May, while an average of the region’s debt of the same tenure has slipped by a mean of 11 basis points, according to data compiled by Bloomberg. By comparison, Europe, Middle East and Africa’s 10-year bond yields declined by only four basis points, while Latin American notes saw a small gain.The drop in US yields, as a proxy for the dollar cost of funding, has made investments into emerging-market assets more alluring.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EM Asian Bonds to Gain More Than Global Peers on Treasury RallyEmerging Asia bonds are set to benefit more than their global peers from any rally in Treasuries as the region’s debt enjoys tighter spreads over their US counterparts.

EM Asian Bonds to Gain More Than Global Peers on Treasury RallyEmerging Asia bonds are set to benefit more than their global peers from any rally in Treasuries as the region’s debt enjoys tighter spreads over their US counterparts.

Read more »

Venezuela Bonds Gain Ahead of JPMorgan Index Phase-in ProcessVenezuelan bonds have risen to the highest levels in three months as JPMorgan Chase & Co. begins to increase the weight of the securities in widely followed emerging-market debt indexes.

Venezuela Bonds Gain Ahead of JPMorgan Index Phase-in ProcessVenezuelan bonds have risen to the highest levels in three months as JPMorgan Chase & Co. begins to increase the weight of the securities in widely followed emerging-market debt indexes.

Read more »

10 Fantastic Asian Canadian Books to Read During Asian Heritage MonthIf you’re looking for your next literary obsession, consider one of these Asian Canadian books worth keeping an eye on.

10 Fantastic Asian Canadian Books to Read During Asian Heritage MonthIf you’re looking for your next literary obsession, consider one of these Asian Canadian books worth keeping an eye on.

Read more »

Markets today: U.S. stocks Join losses in bonds as Fed-cut bets waneStocks and bonds retreated as data showing U.S. business activity accelerated amid a pickup in inflation reinforced speculation the Federal Reserve will remain on hold.

Markets today: U.S. stocks Join losses in bonds as Fed-cut bets waneStocks and bonds retreated as data showing U.S. business activity accelerated amid a pickup in inflation reinforced speculation the Federal Reserve will remain on hold.

Read more »

Markets today: bonds sink as data fuel bets fed in no rush to cutBonds tumbled as U.S. business activity accelerated amid a pickup in inflation that will likely keep the Federal Reserve on hold.

Markets today: bonds sink as data fuel bets fed in no rush to cutBonds tumbled as U.S. business activity accelerated amid a pickup in inflation that will likely keep the Federal Reserve on hold.

Read more »

Losses Pile Up in Top-Rated Bonds Backed by Commercial Real Estate DebtFor the first time since the financial crisis, investors in top-rated bonds backed by commercial real estate debt are getting hit with losses.

Losses Pile Up in Top-Rated Bonds Backed by Commercial Real Estate DebtFor the first time since the financial crisis, investors in top-rated bonds backed by commercial real estate debt are getting hit with losses.

Read more »