(Bloomberg) -- When the news came, Hisham Nader quickly finished work and went home to deliver a message to his family.Most Read from BloombergUS Homebuyers ...

-- When the news came, Hisham Nader quickly finished work and went home to deliver a message to his family.Gucci’s China Shock Reverberates Across the Luxury Landscape

“We’ve been there before, it’s never good,” Nader said as he pointed to a TV screen broadcasting a government press conference explaining the measures on March 6. “Give me one reason why I should celebrate this.” The minimum wage for state workers is 6,000 Egyptian pounds a month and the majority of the population relies on a subsidy system covering some essential goods. Changes to spending habits, though, are also being forced on Egyptians who would have considered themselves relatively wealthy.

Pulling her empty shopping cart past the carcasses dangling from hooks in the supermarket, Marwa Ahmed stops and points to a sign advertising local beef at 379 pounds a kilo. “We can barely afford lentils and vegetables, so meat is out of question,” said the 42-year-old mother of two. Inflation already had hit a record of over 35% in 2023. Key commodities such as sugar have nearly doubled in price, prompting the authorities to enact measures to avert what they say is price gouging by traders or distributors. The price of onions, whose traditional abundance in kitchens was a symbol of Egyptian culinary culture and an essential ingredient in street food like koshary have risen more than 400% in a year.

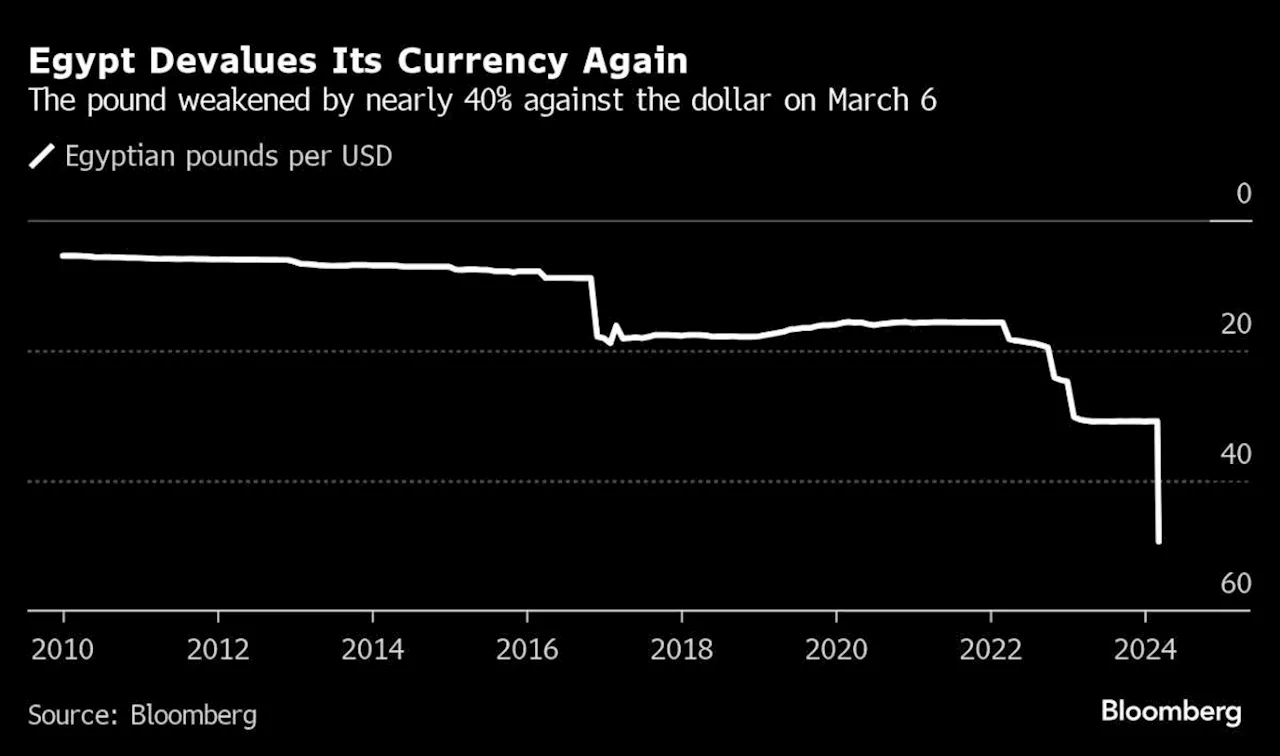

El-Sisi, whose government allows little dissent, blamed the lack of foreign currency on Egypt’s decades-old dependency on imports, which he said required spending $1 billion a month on staples like wheat and vegetable oils and another $1 billion on fuel. The further drop in the value of the currency, though, means higher prices at least in the short term. Indeed, Egyptians know what to expect. The country devalued its currency by 48% and slashed subsidies at the end of 2016 to clinch a $12 billion IMF loan agreement, which helped repair the nation’s finances but spurred inflation.

“I use cheap bones to make large amounts of broth that I can cook with for the rest of the month,” she said. “It’s a struggle, but I have to come up with all kinds of tricks to keep feeding my kids.”Donald Trump lashes out as clock runs down on his $464m bond payment

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Vinci Deal Forges Latin America Megamanager Handling $50 BillionVinci Partners Investments Ltd., a Brazilian alternative asset manager, will acquire Compass Group LLC to expand its footprint across Latin America, creating a combined entity that will manage over $50 billion.

Vinci Deal Forges Latin America Megamanager Handling $50 BillionVinci Partners Investments Ltd., a Brazilian alternative asset manager, will acquire Compass Group LLC to expand its footprint across Latin America, creating a combined entity that will manage over $50 billion.

Read more »

Argentina Swaps $50 Billion of Local Debt to Push Out RepaymentsArgentina successfully swapped about 77% of its peso debt due this year for longer-dated notes in a win for President Javier Milei as he moves aggressively to shore up public finances and stabilize the crisis-prone economy.

Argentina Swaps $50 Billion of Local Debt to Push Out RepaymentsArgentina successfully swapped about 77% of its peso debt due this year for longer-dated notes in a win for President Javier Milei as he moves aggressively to shore up public finances and stabilize the crisis-prone economy.

Read more »

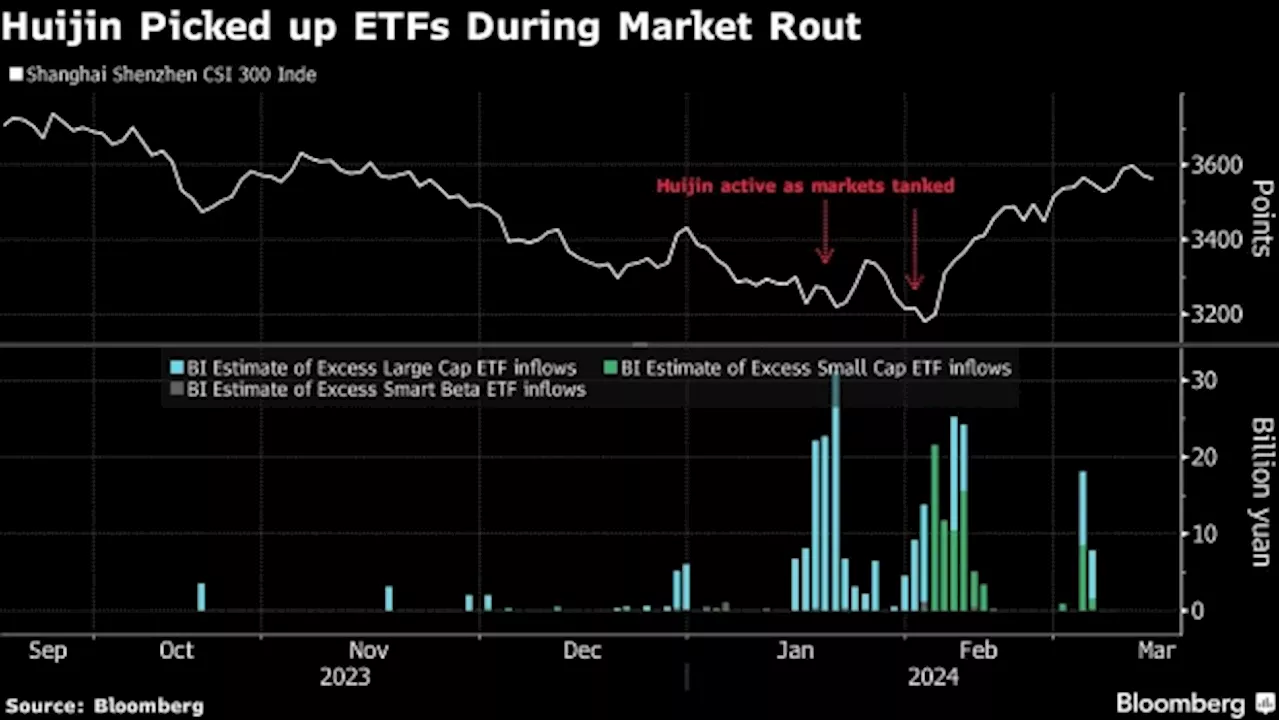

China’s National Team Cools ETF Buying After $50 Billion SpreeChina’s National Team has reduced its buying of ETFs after a $50 billion spending spree. The team had been purchasing ETFs to support the stock market during the pandemic, but has now scaled back its purchases. This move has raised concerns about the sustainability of the recent rally in Chinese stocks.

China’s National Team Cools ETF Buying After $50 Billion SpreeChina’s National Team has reduced its buying of ETFs after a $50 billion spending spree. The team had been purchasing ETFs to support the stock market during the pandemic, but has now scaled back its purchases. This move has raised concerns about the sustainability of the recent rally in Chinese stocks.

Read more »

China’s National Team Cools ETF Buying After $50 Billion SpreeChina’s state funds bought around $50 billion of the nation’s equities over the past five months, with purchases slowing during the annual meeting of the nation’s top legislators, according to an analysis by Bloomberg Intelligence.

China’s National Team Cools ETF Buying After $50 Billion SpreeChina’s state funds bought around $50 billion of the nation’s equities over the past five months, with purchases slowing during the annual meeting of the nation’s top legislators, according to an analysis by Bloomberg Intelligence.

Read more »