Investors are awaiting earnings reports from consumer discretionary companies

in coming weeks for a read on how the U.S. economy is faring amid persistently high inflation and the Federal Reserve’s most aggressive rate hiking cycle since the 1980s.

Corporate results and outlooks are taking on added importance this earnings season, as investors gauge whether monetary tightening and last month’s banking sector mess are denting overall growth. Part of that expected growth comes from a job market that has remained robust, helping buoy consumer spending, said Jamie Cox, managing partner for Harris Financial Group.

At the same time, the Consumer Discretionary Select SPDR ETF has posted positive inflows in five of the last six weeks as investors sent a net $229.1 million to the fund, its largest six-week net inflow since August, according to Lipper data. Data on Friday showed U.S. retail sales fell more than expected in March as consumers cut back on purchases of motor vehicles and other big-ticket items, suggesting the economy was losing steam at the end of the first quarter. Meanwhile, U.S. consumer sentiment inched up in April, but households expected inflation to rise over the next 12 months.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

When it comes to climate risk, investors prize disclosure, report suggestsA roundup of all the mining news in the precious metals sector with a variety of company news, mining sector analysis, newsletter writer insights and executive interviews.

When it comes to climate risk, investors prize disclosure, report suggestsA roundup of all the mining news in the precious metals sector with a variety of company news, mining sector analysis, newsletter writer insights and executive interviews.

Read more »

Gold can protect investors from the Fed's monetary mayhem - Grant's Interest Rate ObserverKitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

Gold can protect investors from the Fed's monetary mayhem - Grant's Interest Rate ObserverKitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

Read more »

This easy and affordable platform is made for DIY investorsInvest with confidence all on your own

This easy and affordable platform is made for DIY investorsInvest with confidence all on your own

Read more »

Ottawa’s lack of economic clarity drives a growing sense of frustration among investorsThe federal government must replace its obsession with gross domestic product, a broad measure of how much the economy produces in a year, with a focus on GDP per capita

Ottawa’s lack of economic clarity drives a growing sense of frustration among investorsThe federal government must replace its obsession with gross domestic product, a broad measure of how much the economy produces in a year, with a focus on GDP per capita

Read more »

7 world headlines investors should pay attention to, and 1 they can ignoreThese world headlines feel urgent, but not all are important for investors to pay attention to. Find out more.

7 world headlines investors should pay attention to, and 1 they can ignoreThese world headlines feel urgent, but not all are important for investors to pay attention to. Find out more.

Read more »

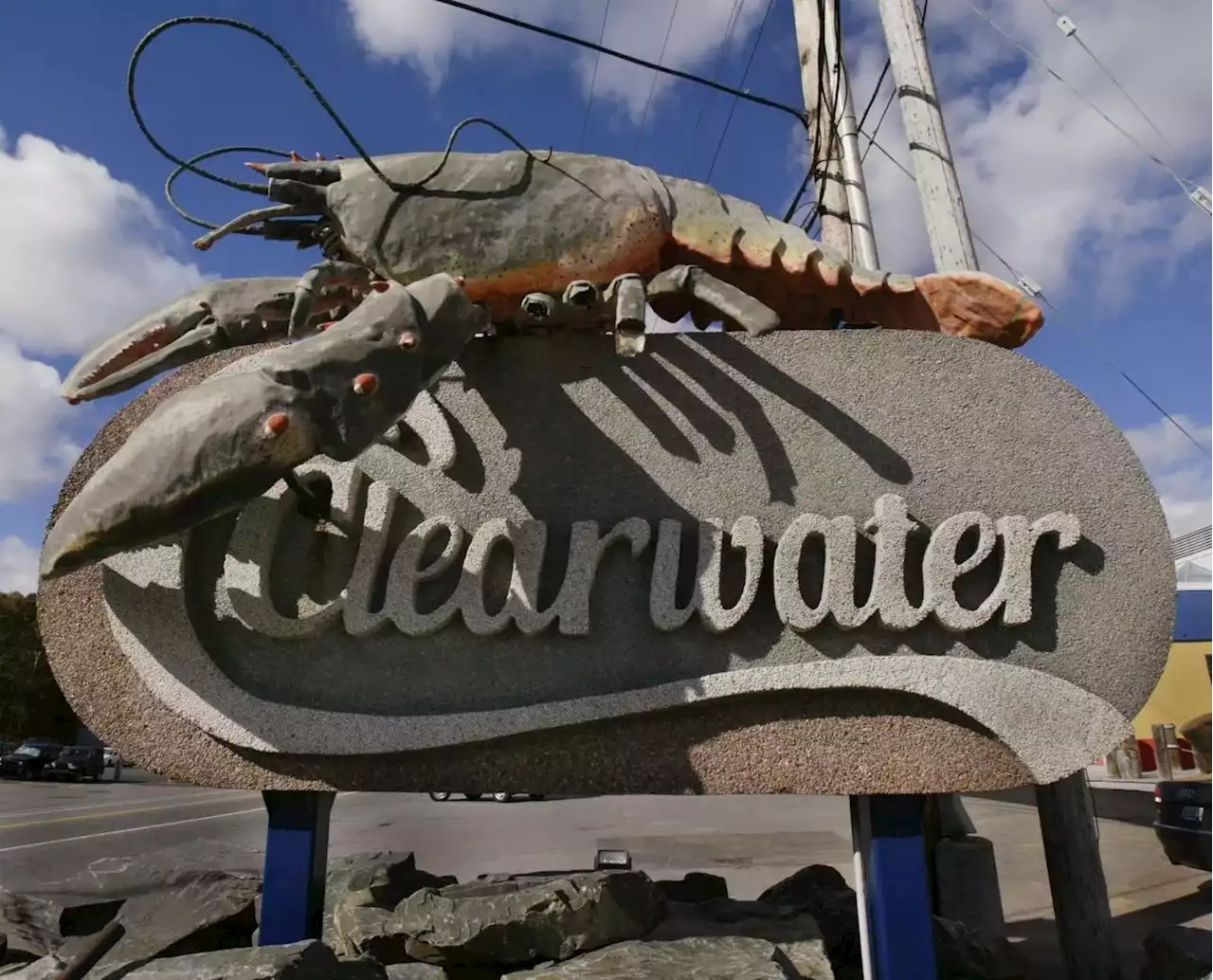

Opinion | Buying back Canada: Indigenous investors are no longer small-time playersOpinion: First Nations, Métis and Inuit people are now players at the table. They are taking back their country—and our country—in a stepwise fashion, using their resources to buy companies, infrastructure, and revenue-producing assets.

Opinion | Buying back Canada: Indigenous investors are no longer small-time playersOpinion: First Nations, Métis and Inuit people are now players at the table. They are taking back their country—and our country—in a stepwise fashion, using their resources to buy companies, infrastructure, and revenue-producing assets.

Read more »