The Financial Post reported Scotiabank was fined $22.5M by U.S. regulators as a result of staffers using unapproved communication platforms.

This report raises several interesting employment issues:

There has been much litigation over whether or not financial advisors are independent contractors or employees at the banks. Working with financial professionals for over a decade, I have seen firsthand that advisors are often incentivized by banks to work autonomously to drive growth but often have complicated contractual arrangements that can deprive advisors from employee status.Article contentRECOMMENDED VIDEOSecondly, the large fines hint at the underbelly of remote work.

While I am dubious of ChatGPT’s ability to disrupt employment law, there is no question that it’s power knows no bounds in workplaces everywhere. If regulators are looking to crackdown on employees’ use of non-sanctioned software, the first place to look is AI. Employees are naively feeding these platforms confidential information and company trade secrets in the hopes of wowing their superiors with streamlined reports in a fraction of the time.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

CHAUDHRI: Personal device use by employees lead to large finesThe Financial Post reported Scotiabank was fined $22.5M by U.S. regulators as a result of staffers using unapproved communication platforms.

CHAUDHRI: Personal device use by employees lead to large finesThe Financial Post reported Scotiabank was fined $22.5M by U.S. regulators as a result of staffers using unapproved communication platforms.

Read more »

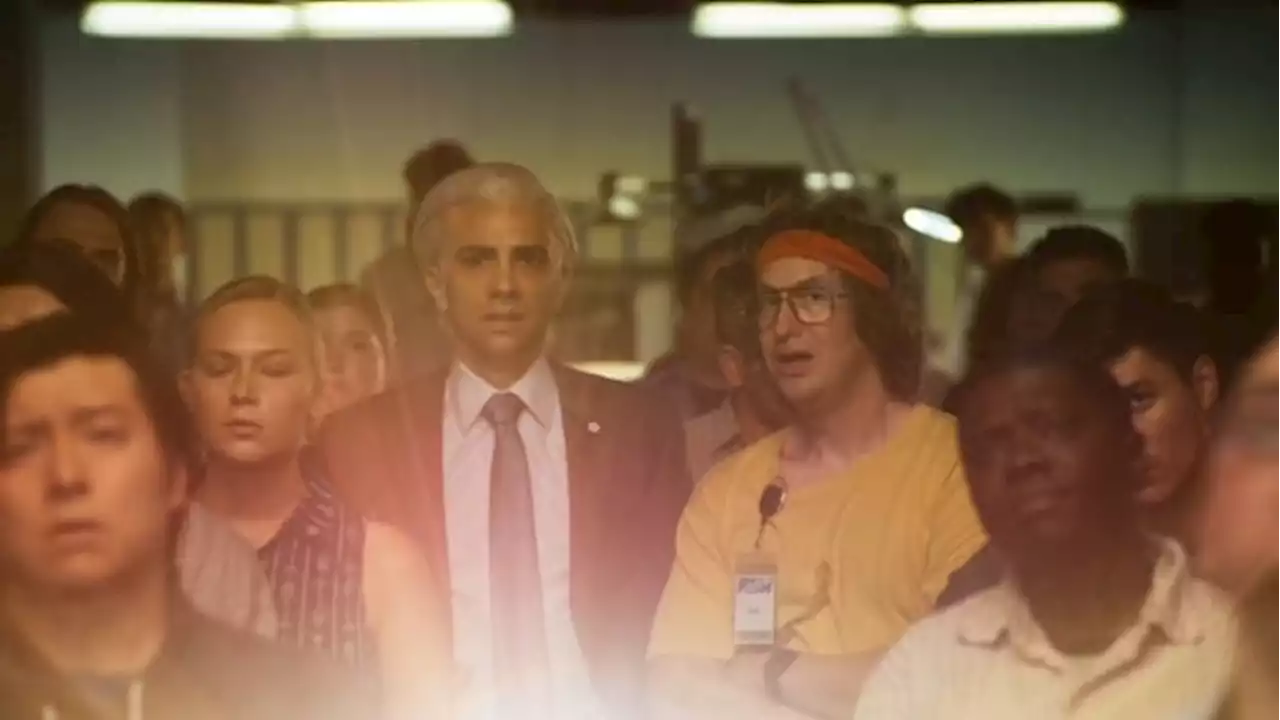

Chaotic, comedic and surprisingly personal — thumbs up for Jay Baruchel's BlackBerry | CBC NewsThe new movie BlackBerry from Canadian director Matt Johnson tracks the rise and fall of Research In Motion and its groundbreaking keyboard phone, and features a surprising turn by actor Jay Baruchel.

Chaotic, comedic and surprisingly personal — thumbs up for Jay Baruchel's BlackBerry | CBC NewsThe new movie BlackBerry from Canadian director Matt Johnson tracks the rise and fall of Research In Motion and its groundbreaking keyboard phone, and features a surprising turn by actor Jay Baruchel.

Read more »

Fairfax Financial more than doubles first-quarter earnings at US$1.3-billionChairman and CEO Prem Watsa said that significantly higher operating income from Fairfax’s property and casualty insurance and reinsurance operations reflected increased interest and dividends

Fairfax Financial more than doubles first-quarter earnings at US$1.3-billionChairman and CEO Prem Watsa said that significantly higher operating income from Fairfax’s property and casualty insurance and reinsurance operations reflected increased interest and dividends

Read more »

CI Financial’s capital infusion comes at high cost for U.S. divisionDebt-heavy CI sold preferred shares that represent a 20-per-cent interest in its U.S. wealth management business to a group of investors that includes Bain Capital, Ares Management and an arm of the Abu Dhabi Investment Authority

CI Financial’s capital infusion comes at high cost for U.S. divisionDebt-heavy CI sold preferred shares that represent a 20-per-cent interest in its U.S. wealth management business to a group of investors that includes Bain Capital, Ares Management and an arm of the Abu Dhabi Investment Authority

Read more »

Transparency International Canada paper outlines hopes for new financial crime agencyAn anti-corruption group says the Trudeau government's plan to create a new federal financial crime agency is positive, but it may be missing an opportunity to tackle corruption and securities fraud.

Transparency International Canada paper outlines hopes for new financial crime agencyAn anti-corruption group says the Trudeau government's plan to create a new federal financial crime agency is positive, but it may be missing an opportunity to tackle corruption and securities fraud.

Read more »

Anti-corruption advocate hopes new financial crime body can start 'scaring bad guys'Anti\u002Dcorruption advocate James Cohen says Canada’s reputation has for years been “hammered” over its weak record of prosecuting financial crimes.

Anti-corruption advocate hopes new financial crime body can start 'scaring bad guys'Anti\u002Dcorruption advocate James Cohen says Canada’s reputation has for years been “hammered” over its weak record of prosecuting financial crimes.

Read more »