The Bank of Japan is widely expected to keep its monetary stimulus unchanged Friday, with traders focusing on any remarks Governor Kazuo Ueda might make on negative interest rates or the correlation between currencies and policy as the yen trades near a 10-month low.

All 46 economists surveyed by Bloomberg predict no adjustments to the interest rate or yield curve control after the bank tweaked its YCC settings at the last gathering in July.

Traders will look for the governor to clarify his comments or discuss the market’s reaction to them. Ueda usually holds a press conference at 3:30 p.m. after the bank releases its policy statement around noon. Friday marks the one-year anniversary since Japan’s first yen-buying intervention in 24 years. A year ago, then-BOJ chief Haruhiko Kuroda pledged after a board meeting to continue with easing. That helped fuel a further slide in the yen that prompted the government to buy the currency.

At the same time, if Ueda sends strong signals on normalizing policy, yields on 10-year government bonds could hover closer to the bank’s de-facto ceiling at 1%, a development that would likely force the BOJ to buy more bonds, exacerbating the side effects of yield control. The 10-year yield touched a fresh nine-year high of 0.725% on Wednesday.

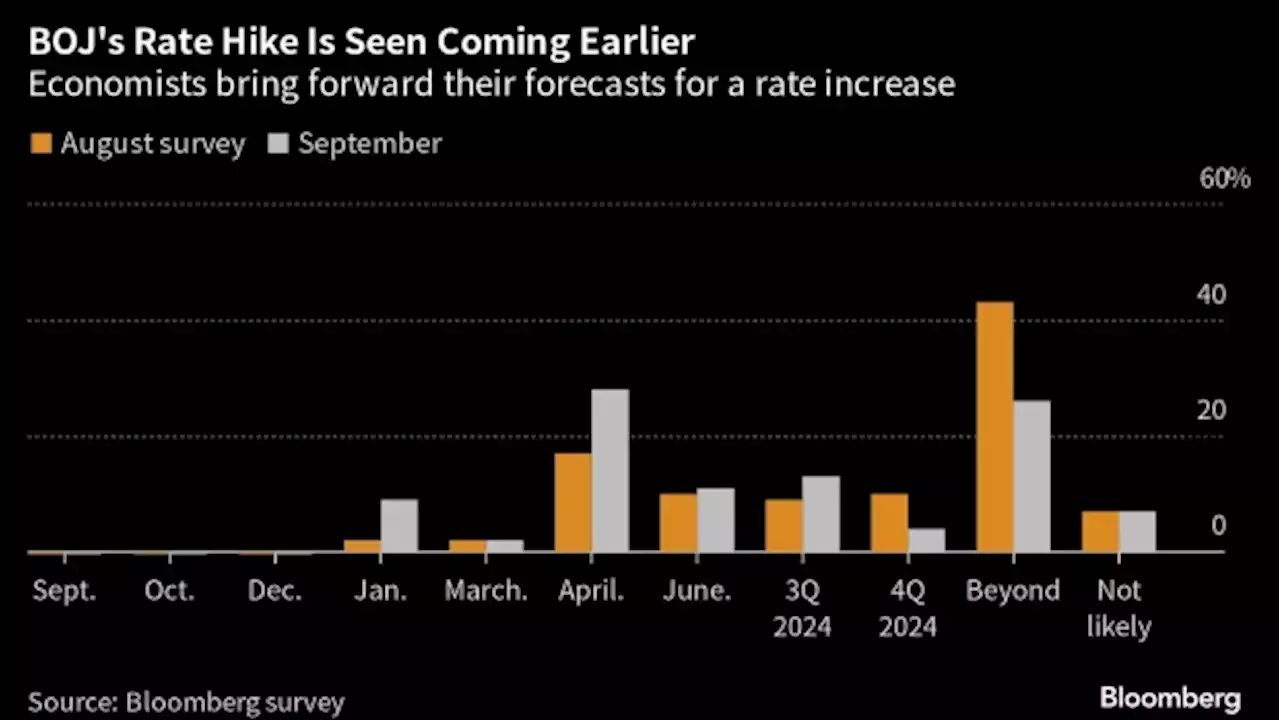

How Ueda characterizes the chances of a rate hike in early 2024 will be under close scrutiny. While he is likely to cite the possibilities of moving both early or late, traders will look for any emphasis in either direction.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Japan may intervene on yen again, BOJ should ditch easy policyBy Tetsushi Kajimoto TOKYO (Reuters) - Japan could intervene again to support the yen if it declines further, former top currency diplomat Takehiko ...

Japan may intervene on yen again, BOJ should ditch easy policyBy Tetsushi Kajimoto TOKYO (Reuters) - Japan could intervene again to support the yen if it declines further, former top currency diplomat Takehiko ...

Read more »

Japan industry minister: BOJ's policy aimed at 'buying time' will eventually endTOKYO (Reuters) - The Bank of Japan's ultra-loose monetary policy, which was aimed at

Japan industry minister: BOJ's policy aimed at 'buying time' will eventually endTOKYO (Reuters) - The Bank of Japan's ultra-loose monetary policy, which was aimed at

Read more »

Euro gains; yen flounders ahead of central bank bonanzaBy Rae Wee SINGAPORE (Reuters) - The euro clung to gains on Tuesday following hawkish comments from European Central Bank (ECB) policymakers, while the ...

Euro gains; yen flounders ahead of central bank bonanzaBy Rae Wee SINGAPORE (Reuters) - The euro clung to gains on Tuesday following hawkish comments from European Central Bank (ECB) policymakers, while the ...

Read more »

Euro gains; yen flounders ahead of central bank bonanzaCurrency moves were subdued in early Asia trade as markets stayed on guard ahead of this week's slew of central bank meetings, with the Federal Reserve taking centre stage and the BOJ grabbing the spotlight in Asia. The euro eked out a slight gain to trade at $1.0695, having risen 0.3% in the previous session as ECB officials suggested further rate increases were on the cards - comments which boosted euro zone government bond yields. 'With ECB speak noting how inflation is not expected to come down anytime soon... we should all be gearing to this idea that the cash rate will remain elevated for an extended period of time, and potentially a very long period of time,' said Rodrigo Catril, senior FX strategist at National Australia Bank.

Euro gains; yen flounders ahead of central bank bonanzaCurrency moves were subdued in early Asia trade as markets stayed on guard ahead of this week's slew of central bank meetings, with the Federal Reserve taking centre stage and the BOJ grabbing the spotlight in Asia. The euro eked out a slight gain to trade at $1.0695, having risen 0.3% in the previous session as ECB officials suggested further rate increases were on the cards - comments which boosted euro zone government bond yields. 'With ECB speak noting how inflation is not expected to come down anytime soon... we should all be gearing to this idea that the cash rate will remain elevated for an extended period of time, and potentially a very long period of time,' said Rodrigo Catril, senior FX strategist at National Australia Bank.

Read more »

Euro gains, yen struggles in central bank-packed weekMarket News

Euro gains, yen struggles in central bank-packed weekMarket News

Read more »

Yellen Says Yen Intervention Understandable If Due to VolatilityUS Treasury Secretary Janet Yellen said any intervention by Japan to prop up the yen would be understandable if it were aimed at smoothing out volatility — not at affecting the level of the exchange rate.

Yellen Says Yen Intervention Understandable If Due to VolatilityUS Treasury Secretary Janet Yellen said any intervention by Japan to prop up the yen would be understandable if it were aimed at smoothing out volatility — not at affecting the level of the exchange rate.

Read more »