Office of the Superintendent of Financial Institutions is developing new processes for its expanded mandate, which will include overseeing risks related to non-financial and financial crimes at Canada’s largest lenders

OSFI superintendent Peter Routledge, pictured in Ottawa on Jan. 11, 2023, told a roundtable after an event hosted by the C.D. Howe Institute on May 8 that industry players have opportunities to bolster anti-money-laundering practices as digitalization and geopolitical risks intensify financial crime.The head of Canada ’s banking regulator is comfortable with the ability of the country’s largest banks to curb money laundering crimes, but says that there is room for improvement.

“It is incumbent upon regulators and boards of directors to redouble efforts on surveillance detection and response,” Mr. Routledge said. “I’m confident, but am I satisfied with where we are? No, we have to get better.”government has been bolstering enforcement measures on Canada’s banks, including new tools to address weaknesses in Canada’s anti-money-laundering regime by expanding the powers of OSFI and the Financial Transactions and Reports Analysis Centre of Canada .

TD expects monetary and non-monetary penalties from the current U.S. investigation, and some analysts have estimated that the amount could range as high as US$2-billion. When FinTRAC finds an issue at a financial institution, it will share those details with OSFI to engage with the bank’s senior executives and board of directors to remediate the issue, Mr. Routledge said.

The changes come as regulatory requirements rise in Canada and the United States, more stringent rules prompted in part by the threat of a recession, the banking crisis unleashed in March, 2023, and mounting geopolitical tensions. While those changes are intended to enhance the stability of the financial system, they could also crimp bank profits as higher expenses and slower loan growth weigh on balance sheets.

Canada News Breaking News Video Canadian Breaking News Breaking News Globe And Mail Breaking News Globe And Mail Canada News Photos World News Local News National News Us News Foreign News Sports News Arts News Life News Lifestyle Canada Traffic Canada Weather Trudeau Government Federal Government Canada Sports Canada Sports News Politics Politics News Political News Political Opinion Environment Economy Technology Education Travel Canada Alberta Bc British Columbia Manitoba Ontario Quebec Nova Scotia Pei New Brunswick Newfoundland And Labrador Nunavut Northwest Territories Yukon Globe And Mail

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Anti-money laundering watchdog gives failing grades to banks, real estate companiesAn internal report from Canada’s financial crimes watchdog found that most banking and real estate companies it audited last year are not following the country’s anti-money laundering laws, sparking calls for greater oversight and higher fines. Anne Gaviola has this exclusive story for Global News.

Anti-money laundering watchdog gives failing grades to banks, real estate companiesAn internal report from Canada’s financial crimes watchdog found that most banking and real estate companies it audited last year are not following the country’s anti-money laundering laws, sparking calls for greater oversight and higher fines. Anne Gaviola has this exclusive story for Global News.

Read more »

Anti-money laundering watchdog gives failing grades to banks, real estate companiesAn internal report from Canada’s financial-crimes watchdog found most banking and real estate companies it audited are not following the country’s anti-money laundering laws.

Anti-money laundering watchdog gives failing grades to banks, real estate companiesAn internal report from Canada’s financial-crimes watchdog found most banking and real estate companies it audited are not following the country’s anti-money laundering laws.

Read more »

Banks blame customers for lost money to e-transfer fraudstersDozens of customers are being told by banks that they are to blame for losing thousands of dollars to e-transfer fraudsters. A Manitoba man shares his frustration after TD Bank refused to reimburse him for $3,000 stolen by a fraudster.

Banks blame customers for lost money to e-transfer fraudstersDozens of customers are being told by banks that they are to blame for losing thousands of dollars to e-transfer fraudsters. A Manitoba man shares his frustration after TD Bank refused to reimburse him for $3,000 stolen by a fraudster.

Read more »

Pension funds, big banks to start allocating to Bitcoin via ETFsThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Pension funds, big banks to start allocating to Bitcoin via ETFsThe Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

Read more »

Fed's Cook says households, banks, firms largely in solid financial shapeExplore stories from Atlantic Canada.

Fed's Cook says households, banks, firms largely in solid financial shapeExplore stories from Atlantic Canada.

Read more »

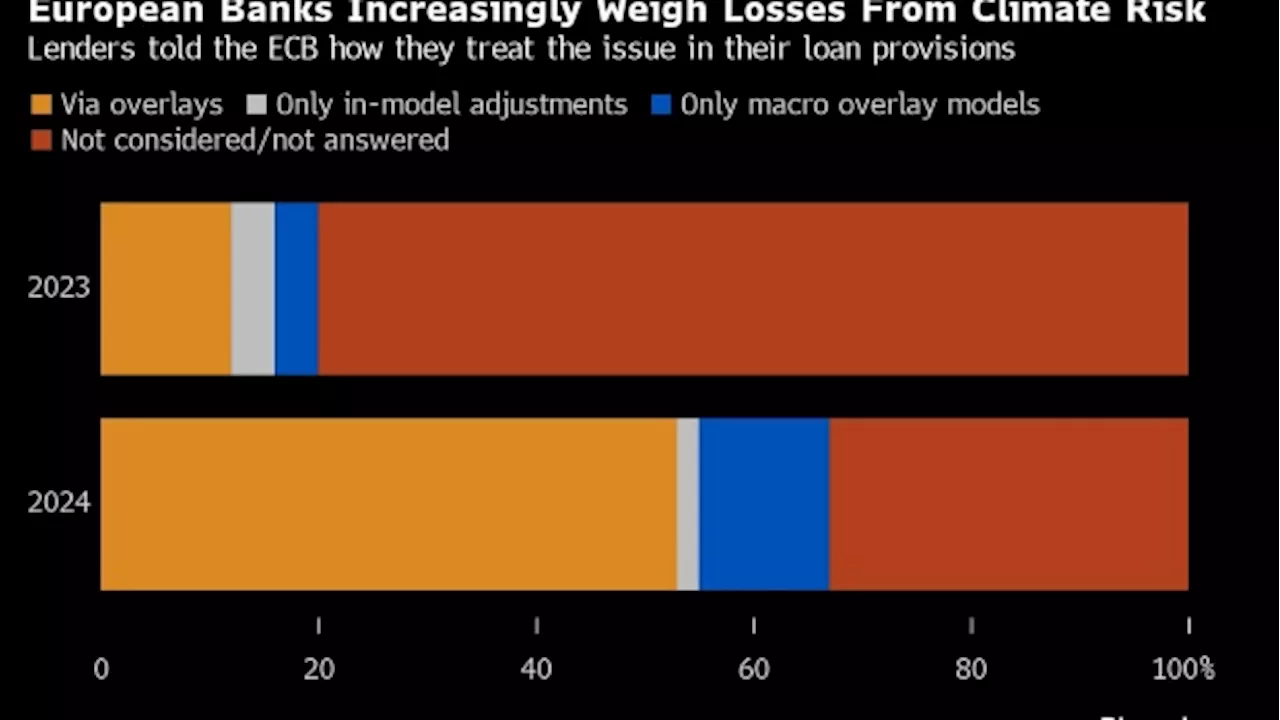

ECB Scores Win in Push to Prepare Banks for Climate Loan LossesThe number of European banks taking account of environmental risks in their reserves for loan losses has more than tripled in a year, signaling an initial win for the regulator in its effort to prepare for climate change.

ECB Scores Win in Push to Prepare Banks for Climate Loan LossesThe number of European banks taking account of environmental risks in their reserves for loan losses has more than tripled in a year, signaling an initial win for the regulator in its effort to prepare for climate change.

Read more »