(Bloomberg) -- Asian equity futures drifted lower as US stocks fell following economic data that exceeded forecasts, bolstering the case for the Federal Reserve to keep interest rates elevated for longer.Most Read from BloombergIndia’s Moment Has Arrived, and Modi Wants a New Global OrderStocks Retreat After Hot ISM Fuels Fed-Hike Wagers: Markets WrapFed Set to Double Its Economic Growth Forecast After Strong US DataSoaring US Dollar Raises Alarm as China, Japan Escalate FX PushbackChina Slowdow

Contracts for share benchmarks in Japan and Australia dropped, while those for Hong Kong equities were flat. The S&P 500 fell 0.7% to close lower for a second day. The tech-heavy Nasdaq 100, which is more sensitive to interest rate expectations, declined 0.9%. US futures were little changed in early Asian trading.

The Institute for Supply Management’s US services index for August reached 54.4, its highest monthly reading since February and one that topped all estimates in a Bloomberg survey of economists. A reading above 50 denotes growth. “The ISM Services Sector report underscores the resilience of the largest portion of the economy,” said Quincy Krosby, chief global strategist at LPL Financial, who pointed to higher prices shown within the data. “This is is certainly not good news for a data-dependent Fed.”

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Asia Stocks Under Pressure, Dollar Strengthens: Markets WrapAsian equity futures drifted lower as US stocks fell following economic data that exceeded forecasts, bolstering the case for the Federal Reserve to keep interest rates elevated for longer.

Asia Stocks Under Pressure, Dollar Strengthens: Markets WrapAsian equity futures drifted lower as US stocks fell following economic data that exceeded forecasts, bolstering the case for the Federal Reserve to keep interest rates elevated for longer.

Read more »

Asia Stocks Fall as China Property Back in Focus: Markets Wrap(Bloomberg) -- Asian stocks edged lower as traders returned their focus to China’s efforts to halt its economic malaise after markets in the US were shut for the US Labor Day holiday.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketStocks Cede China-Led Gains in Thin Holiday Trade: Markets WrapStocks opened lower in South Korea after inflati

Asia Stocks Fall as China Property Back in Focus: Markets Wrap(Bloomberg) -- Asian stocks edged lower as traders returned their focus to China’s efforts to halt its economic malaise after markets in the US were shut for the US Labor Day holiday.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketStocks Cede China-Led Gains in Thin Holiday Trade: Markets WrapStocks opened lower in South Korea after inflati

Read more »

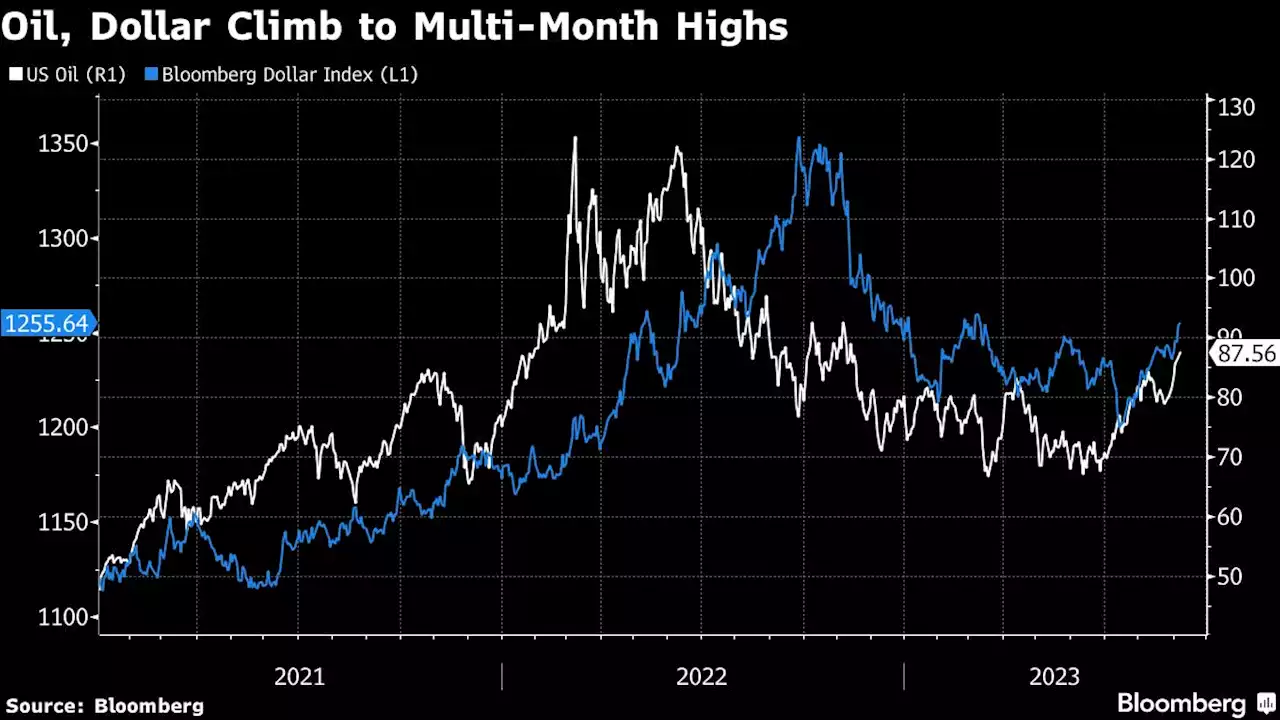

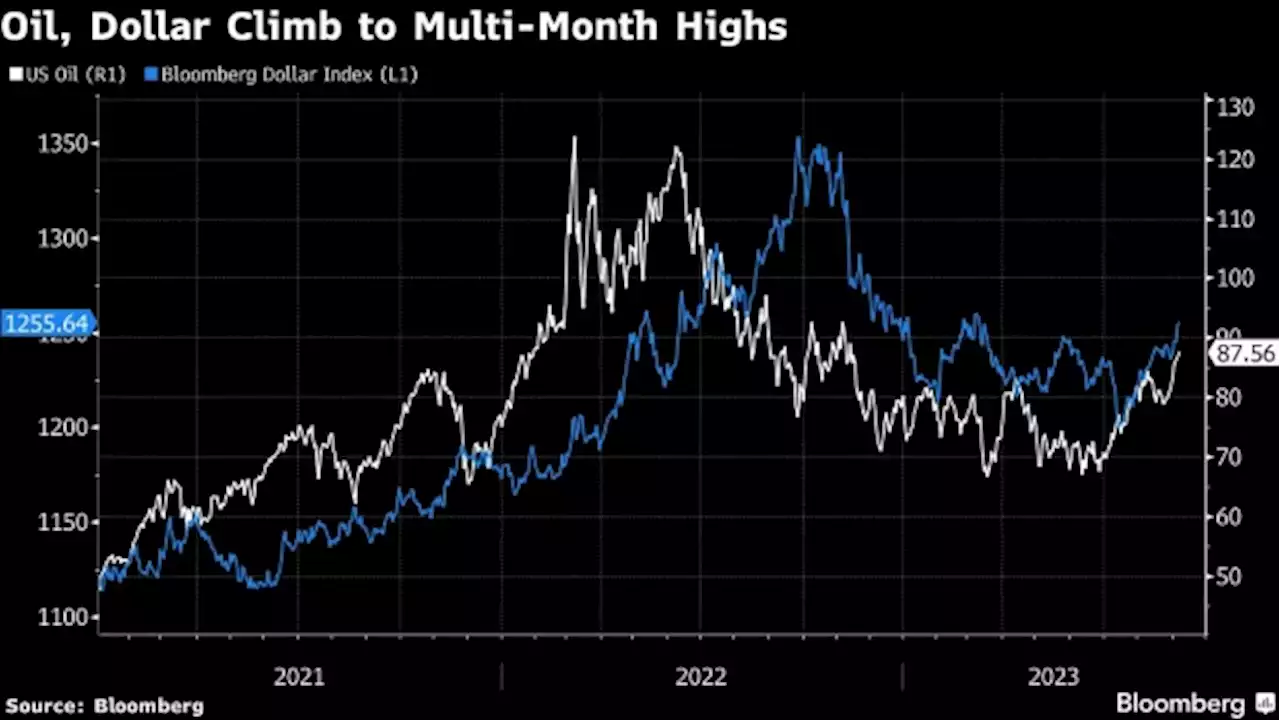

Emerging Markets Set for ‘Wild Ride’ on Moves in Dollar and OilDeveloping-world currencies and stocks weakened as renewed dollar strength and elevated oil prices hurt sentiment for riskier emerging assets, prompting Barclays PLC to predict a “wild ride” across local markets.

Emerging Markets Set for ‘Wild Ride’ on Moves in Dollar and OilDeveloping-world currencies and stocks weakened as renewed dollar strength and elevated oil prices hurt sentiment for riskier emerging assets, prompting Barclays PLC to predict a “wild ride” across local markets.

Read more »

Asian banks tap US dollar bond markets for $4.75 blnMarket News

Asian banks tap US dollar bond markets for $4.75 blnMarket News

Read more »

Dollar firm on growth worries, fragile yen draws warningThe dollar perched near a six-month peak on Wednesday as jitters over China and global growth dragged on risk sentiment, while the yen was close to a 10-month low, drawing the strongest warning since mid-August from Japan's top currency diplomat. The yen was at 147.66 per dollar in early Asian hours, just shy of 147.8 per dollar, the lowest since Nov. 4 it touched overnight. The Asian currency has hovered around the key 145 per dollar level for the past few weeks, leading traders to keep a wary eye on signs of an intervention.

Dollar firm on growth worries, fragile yen draws warningThe dollar perched near a six-month peak on Wednesday as jitters over China and global growth dragged on risk sentiment, while the yen was close to a 10-month low, drawing the strongest warning since mid-August from Japan's top currency diplomat. The yen was at 147.66 per dollar in early Asian hours, just shy of 147.8 per dollar, the lowest since Nov. 4 it touched overnight. The Asian currency has hovered around the key 145 per dollar level for the past few weeks, leading traders to keep a wary eye on signs of an intervention.

Read more »

S&P/TSX composite posts loss Tuesday ahead of rate decision, U.S. markets also lowerTORONTO — Canada's main stock index moved lower as investors await an interest rate decision from the Bank of Canada Wednesday, while U.S. stock markets also posted losses. The S&P/TSX composite index was down 131.60 points at 20,413.76.

Read more »