The tech giant, which typically only reveals tax payments for certain countries, said that it spent $431-million in payroll and corporate taxes in 2021

In recent years, the Organization for Economic Co-operation and Development has been pushing for the world’s biggest companies to more fairly distribute their corporate tax income to jurisdictions where they operate. Infound that Amazon had for years structured its Canadian retail business in such a way that certain profits could be booked in the United States.

That strategy required many senior retail employees to conduct minimal business in Canada, as they limited the amount of their time spent north of the border and signed any documents back on American soil. Amazon told The Globe last year that it no longer employed the exact strategy its reporters had found in an internal playbook, but did not clarify how its approach to profit and taxation in its retail division had changed.

It also does not break down the taxes that were attributable to its different divisions, meaning it is impossible to separate how much was incurred by the retail operations versus the Amazon Web Services cloud segment – which in fiscal 2021 was responsible for US$18.5-billion or 74 per cent of the parent company’s global operating profit.

The Globe investigation found, as recently as in the past six years, the tech giant’s warehouse network in Canada was run by a B.C.-registered company called Amazon Canada Fulfillment Services while retail operations were led separately through a subsidiary at the head office in Seattle. Nothing The Globe uncovered suggested illegal practices, such as tax evasion, but the strategy could effectively shield one of Canada’s largest merchants from having retail profits taxed by Ottawa.

Philippines Latest News, Philippines Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

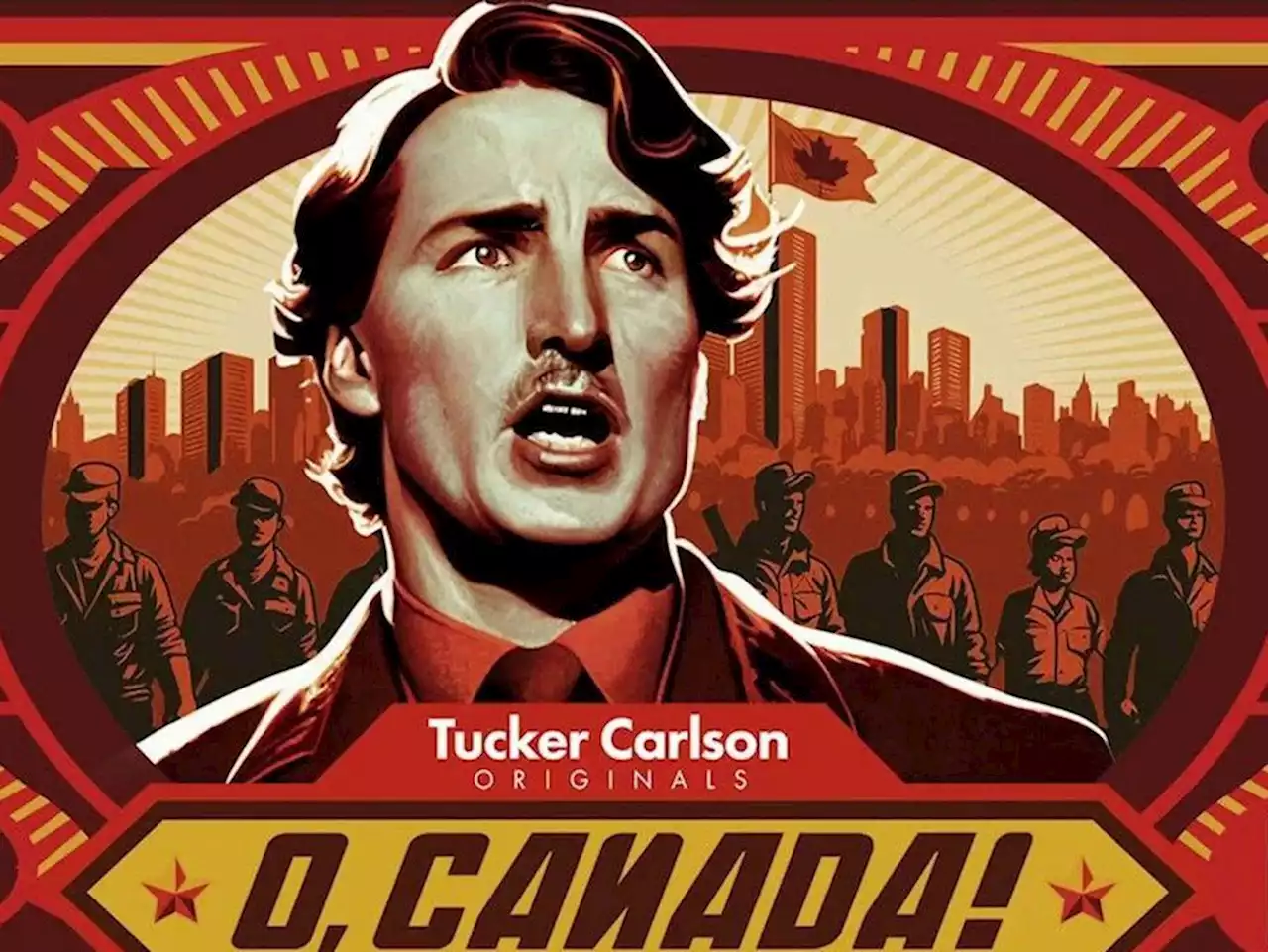

FIRST READING: Why Canadian PMs are the closest thing the democratic world has to a dictatorAn NDPer is launching a Quixotic bid to rein in prime ministerial power, but he certainly has a point

FIRST READING: Why Canadian PMs are the closest thing the democratic world has to a dictatorAn NDPer is launching a Quixotic bid to rein in prime ministerial power, but he certainly has a point

Read more »

FIRST READING: Why Canadian PMs are the closest thing the democratic world has to a dictatorAn NDPer is launching a Quixotic bid to rein in prime ministerial power, but he certainly has a point

FIRST READING: Why Canadian PMs are the closest thing the democratic world has to a dictatorAn NDPer is launching a Quixotic bid to rein in prime ministerial power, but he certainly has a point

Read more »

Before the Bell: What every Canadian investor needs to know todayA look at Tuesday morning’s market action

Before the Bell: What every Canadian investor needs to know todayA look at Tuesday morning’s market action

Read more »

Spotlight: A TRUE Northern mining showcase coming June 7 & 8The Canadian Mining Expo in Timmins, 'Where the World Comes to Explore'

Spotlight: A TRUE Northern mining showcase coming June 7 & 8The Canadian Mining Expo in Timmins, 'Where the World Comes to Explore'

Read more »

Private investment needed to ramp up climate adaptations in infrastructure, report saysThe report by the Canadian Climate Institute says public funding isn’t enough to meet the investment needs for adapting Canadian infrastructure to climate change

Private investment needed to ramp up climate adaptations in infrastructure, report saysThe report by the Canadian Climate Institute says public funding isn’t enough to meet the investment needs for adapting Canadian infrastructure to climate change

Read more »

Binance's exit and Bank of Canada's digital loonie discussions: How they impact Canadian cryptoBinance is leaving and the Bank of Canada is exploring a digital Canadian dollar. Read on for what that means for the crypto industry.

Binance's exit and Bank of Canada's digital loonie discussions: How they impact Canadian cryptoBinance is leaving and the Bank of Canada is exploring a digital Canadian dollar. Read on for what that means for the crypto industry.

Read more »